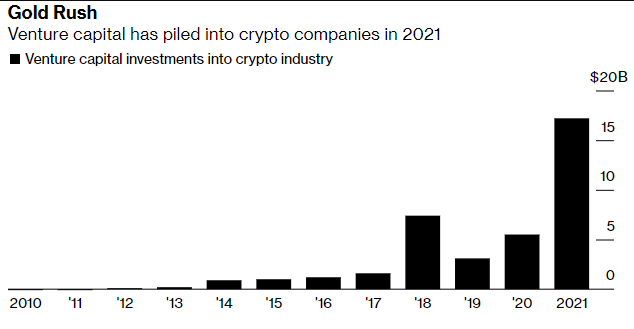

New evidence by PitchBook (a private market data firm) reveals that venture capital firms have been very active in investing in the crypto space.

Pitchbook discovered that venture capital firms have already invested about $18B into the crypto market this year alone. For perspective, the previous year’s record was 2018, when venture capital (VC) firms invested about $7.5 billion into the crypto market.

With the year 2021 just a little over halfway, the combined investments from VC firms have surpassed the total amount they invested over the past eleven years.

Venture capital Crypto investments since 2010. Source: Bloomberg

2021 VC Crypto Transactions

Block one’s $11b investment into bullish global, a crypto exchange firm, is the largest recorded deal this year.

This deal represents the largest VC crypto deal ever. 10THoldings’ $390 million investment in a ledger crypto wallet company comes a distant second.

10THoldings is a mid to late-stage growth equity fund with several divestments into digital asset firms. Ledger’s CEO, Ian Rodgers, said, “I am strongly convinced that everyone will eventually own crypto. It is only a matter of each person owning it at different prices. There are still greater things that will happen beyond this protocol phase that we are in at the moment. While we at ledger may not have the complete picture of what’s to come, we are sure we’ve not attained the level of selling an iPod at Target yet.”

Other crypto deals worthy of mention include an investment of:

- $310 million in each of Paxos and Blockchain.com.

- $360 million in each of Blockfi and Dapper Labs

- $260 million in Bitso, a Mexican crypto exchange.

More VC Crypto Investments Still to Come

Companies looking to increase their exposure to the crypto market have seen them increase their investment in the crypto space this year. However, VC firms aren’t stopping yet; Andreessen Horowitz, one of the top American venture capital firms, has revealed another $1 billion that it wants to invest in the crypto space despite recently investing some huge funds into Coinbase.

Earlier in the year, Galaxy Digital also makes giant strides in its efforts to own Bitgo completely by investing about $1.3B. Bitgo is a top institutional digital asset custodian.

Also, Goldman Sachs announced that its collaboration with Galaxy Digital and acquisition of controlling shares there. Goldman Sachs will also offer bitcoin futures trading using Galaxy Digital’s platform.

Will VC Crypto Investments Reduce Volatility in The Industry?

After completing the partnership process between Galaxy Digital and Goldman Sachs, Damien Vanderwilt, Galaxy Digital’s co-president, has opined that as more VCs invest in the crypto market, the market will become less volatile.

Vanderwilt further said, “this is a shift of market participants with huge leverage into a community with a deeper understanding of risk, asset-liability mismatch, and leverage. The greater the number of participants, the lesser the volatility of the community.”

There are reports that Galaxy Digital has tabled a proposed bitcoin exchange-traded fund with the security and exchange commission (SEC).

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.