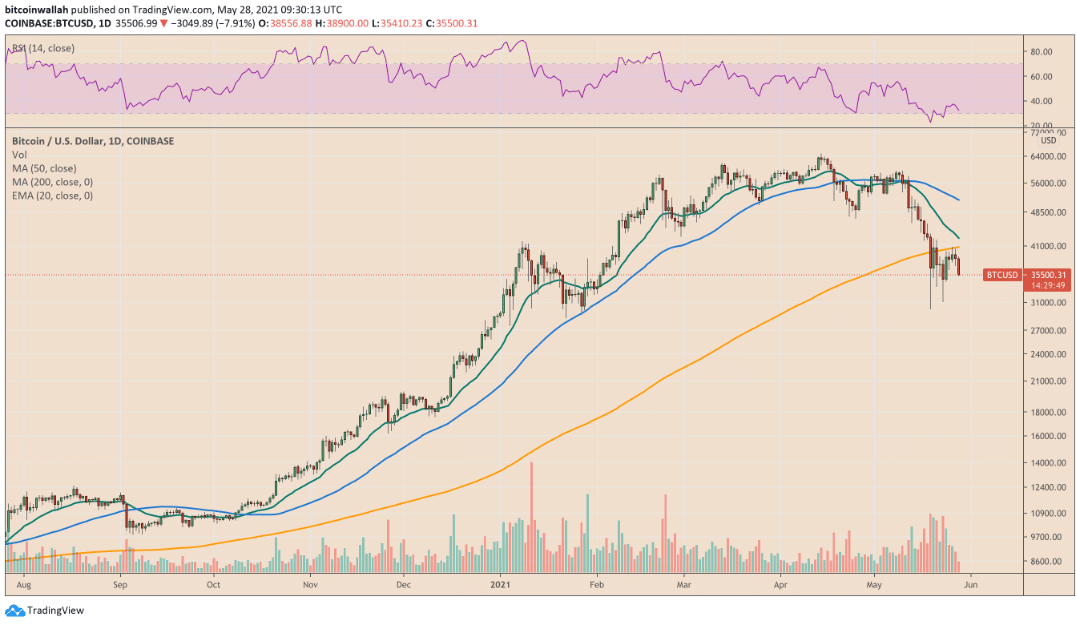

The 200-day moving average chart of the leading cryptocurrency is showing signs of a higher profit-taking sentiment. With traders choosing to earn short-term profits, Bitcoin price rise above $40K was short-lived as its price tumbled midway into yesterday’s early New York trading session. Despite reaching almost $40,500 on Coinbase yesterday, Bitcoin declined by 12.1%. Before the London opening bell today, it had declined to a new intraday low of about $36,000 – a sign of upward resilience near the $40,000 mark.

Bitcoin’s brief touch of its 200-day simple moving average. Source: TradingView

Stricter Crypto Market Regulations

Worries regarding soon-to-be-released virtual currency market regulations have caused a slight reversal for a gradual Bitcoin price rally. For perspective’s sake, the news of china’s prohibition on virtual currency transactions caused a crash to the BTC/USD exchange rate to about $30,500 9 days ago. Unfortunately, the united states government also mandated financial institutions to report any crypto trade deals above $10,000 to the internal revenue service during the same week. Hence, there was more pressure on all digital assets, including Bitcoin.

Nick Thissen tweet. Source: Twitter

However, Bitcoin could not test more downside prices as most investors were concerned about a higher inflation rate if the flagship currency were to do so. According to economic analysts, current inflation rates is within the 4.3% range, which exceeds the federal reserve’s expectations by over 2%.

Even though these figures should have given the U.S. Central bank reason not to implement the current expansionary policies, officials from the country’s apex banks seem convinced that these high inflation rates are transient. The inconsistencies in the fundamental signals have caused a frequent fluctuation in Bitcoin prices. Currently, its temporary support stands at about $34,500, while its temporary resistances stand at about $39,500.

Wood Pushes The Bullish Narrative

In the meantime, Cathie Wood, CEO of ark investment, has attempted to quieten the fears about the upcoming crypto regulations. During a consensus symposium during the week, wood insisted that no one can shut down digital currencies, saying that authorities would eventually learn how to live with them.

In a recent interview, wood said, “the global competitive dynamic is a positive influence for the united states…” When she was asked about the reduction in traditional investments in the digital currency space, wood remarked that these investors’ doubts regarding the crypto space have caused a pause in their foray into cryptocurrency investments. This was the same issue Elon Musk raised when he revealed that Tesla would no longer be accepting Bitcoin payments for their electric cars. Contrastingly, musk supported a group of North American crypto miners who are making giant strides on how carbon emissions from crypto mining can be reduced. During her consensus address, wood said, “understanding the problem is 50% of the solution.”

Analyzing what American miners and their counterparts intend to do to reduce electricity consumption for crypto mining will provide a massive relief for all investors and even cause a fast rise in the adoption of renewables for crypto mining activities which would have taken a longer period to become a reality. She further said that as trading on these virtual assets becomes greener, there would be more interest in them from institutional investors. Last, ark investment bought more than 220,000 Coinbase shares which caused Coinbase’s net exposure to exceed $1 billion.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.