Top crypto analytics firm, Santiment, has revealed that the supply of cryptocurrencies (particularly, Ethereum) at crypto exchanges is now at a two-and-half-year low.

Santiment Ethereum revelation. Source: Santiment

However, the firm affirms that the decline is a bullish sign for Ethereum. “a less than 17% decline for the first time in about two and half years reduces the possibilities of a significant sell-off.”

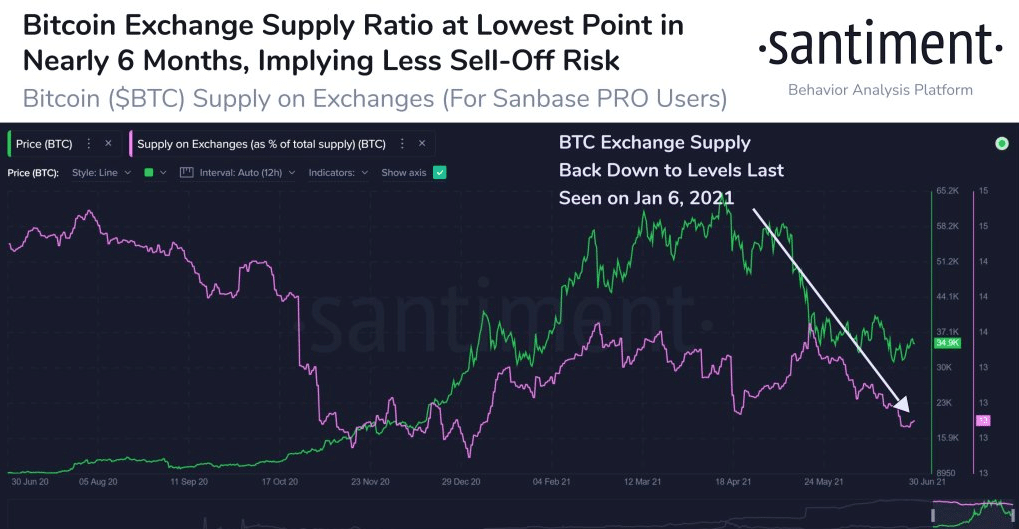

Santiment further added that bitcoin also has a similar experience, but it’s across a shorter period. “After bitcoin’s dip mid last month, there has been a steady decline in the BTC supply at the exchanges. HODLers (hold on for dear life) seems to lock them away for keeps.” It is also another positive for the bulls because HODLers would be less inclined to sell it than when exchanges are holding it.

Santiment bitcoin revelation. Source: Santiment

The analytics firm further reveals that the Ethereum supply in investors’ hands is now at a 4-year high. “Our metrics reveal that Ethereum addresses with over 10k coins is now over 75% of the currency’s supply for the first time in about four years.”

Santiment Ethereum whale analysis. Source: Santiment

Santiment also revealed that Ethereum’s price has rebounded from its march levels and has surpassed that of bitcoin for the first time in history. “Ethereum’s address activity has exceeded bitcoin’s activity addresses for the first time with prices now over $2k.”

The crypto metrics and market insights firm also believe that the rise in Ethereum’s address activities is the cause of a significant rise the altcoin prices recently. “In the last two days, altcoin prices have been on the rise, but the main cause is the massive increase in the Ethereum activities which has made it surpass that of bitcoin.”

Jack Dorsey Rejects Ethereum

Meanwhile, Twitter and Square CEO (Jack Dorsey) has rejected Ethereum as a viable digital asset. The popular bitcoin advocate remains convinced that the leading cryptocurrency is still the only dependable virtual asset.

Interestingly, twitter’s recent release of 140 NFTs was done using an Ethereum-built platform. For this reason, a Twitter user suggested that Dorsey would soon invest in other altcoins, especially Ethereum.

But the social media mogul replied to the tweet with a firm ‘no.’ It is strange that the Twitter founder doesn’t believe Ethereum is a viable investment even though Ethereum remains the second-largest digital currency by market cap.

Jack Picks Hamstercoin Over Dogecoin

Lots of meme coins have been flooding the market recently, and Hamstercoin is one of them. Dorsey also disagreed with another tweet that suggested that Dogecoin is Ethereum’s main competition. Dorsey responded that Hamstercoin would soon be Ethereum’s main competition.

Within hours of Dorsey’s tweet response, the meme coin price rose by an astonishing 260%. Dorsey’s action and consequent rise in Hamstercoin price are no different from Elon Musk’s comments about Dogecoin, which often coincides with the increase in its price. It is now a trend for influencers to comment in support of meme coins, and such currencies will rise in price pretty fast.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.