South Korean exchanges have expressed their concerns over the de-pegging of two stablecoins – the USDD and USDN. Part of the Upbit’s warning notice reads, “we have received various messages that there isn’t an ideal maintenance of the peggings of the USDN and USDD.”

It adds, “hence, it is likely that the price of these stablecoins and their associated native tokens may vary wildly. Hence, we urge our users to perform their due diligence before investing in either of these tokens.” Tron’s algorithmic stablecoin, USDD, is linked with its native token, TRX. Similarly, neutrino’s USDN algorithmic stablecoin is linked with its native token, WAVES.

The prices of these two stablecoins are no longer stable. Each of them has lost their pegs. The recent Coingecko data shows that the USDD has lost 1.5% over the past 24 hours. The same data revealed that the USDN had lost 1% of its value within the same period.

Tron’s Downward Spiral Continues

Tron’s price has been declining in the last 30 days. Many analysts claim the de-pegging of the USDD is the cause of the consistent decline in Tron’s value. There are various claims by other stablecoin players that the USDD is an over-collateralized stablecoin.

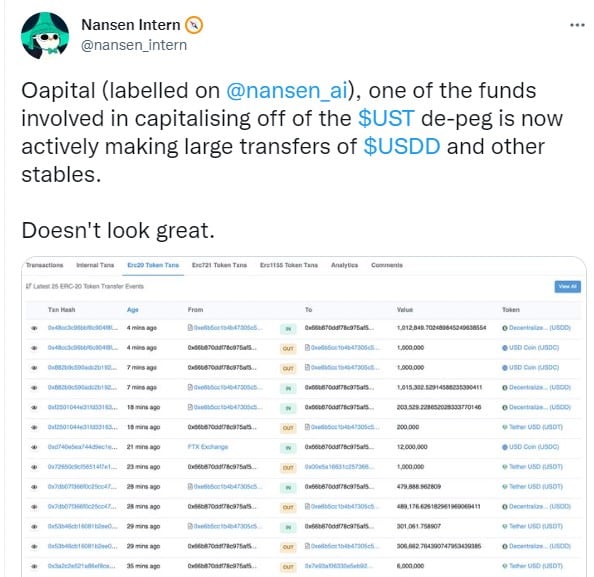

Recently, Nansen (a platform that tracks blockchain transactions) revealed that one of the funds that benefitted from the UST de-peg has been moving several volumes of USDD and other stablecoins.

Nansen tweet. Source: Twitter.

South Korea Now Has A Digital Asset Board

Following the crash of the terra network, South Korean authorities launched a board to oversee crypto activities. South Korean authorities constituted the board in the first week of this month.

Last week, South Korean exchanges announced the delisting of LTC from their platforms. The delisting came as a result of the launch of a new privacy feature by Litecoin developers. The exchanges stated that the new feature would make them violate anti-money laundering policies. Thus, they can’t guarantee investor protection when they make Litecoin-related transactions.

The exchanges’ consistent decision proves that the new digital asset board is working hard to ensure the regulation of all activities in the country’s crypto sector. Recently, lee bok-Hyun, head of South Korea’s financial supervisory board, made some remarks regarding tighter crypto policies.

He said, “the committee involved in the development and interpretation of crypto policies have background knowledge in finance. Hence, we would take a proper look at important aspects of the policy.”

Intense Selloffs Continue In The Crypto Market

The intense selloffs across financial markets are keeping BTC below $22K. BTC trades at $21,418.67, according to the latest Coinmarketcap data.

The selloff in the crypto market has been so steep that the market’s cap declined by more than $1 trillion in 60 days. Coinmarketcap data shows that the entire crypto market is now valued at $983.72b. A sharp contrast to a $2.9 trillion evaluation last November.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.