Key Insights:

- Changpeng Zhao pleads guilty to lax AML controls and accepts a four-month prison sentence and hefty fines as the crypto industry faces strict oversight.

- Zhao’s sentencing by the U.S. court emphasizes growing regulatory scrutiny and compliance demands within the global cryptocurrency market.

- Legal experts see Zhao’s case as a warning to other crypto firms to prioritize anti-money laundering measures and regulatory compliance.

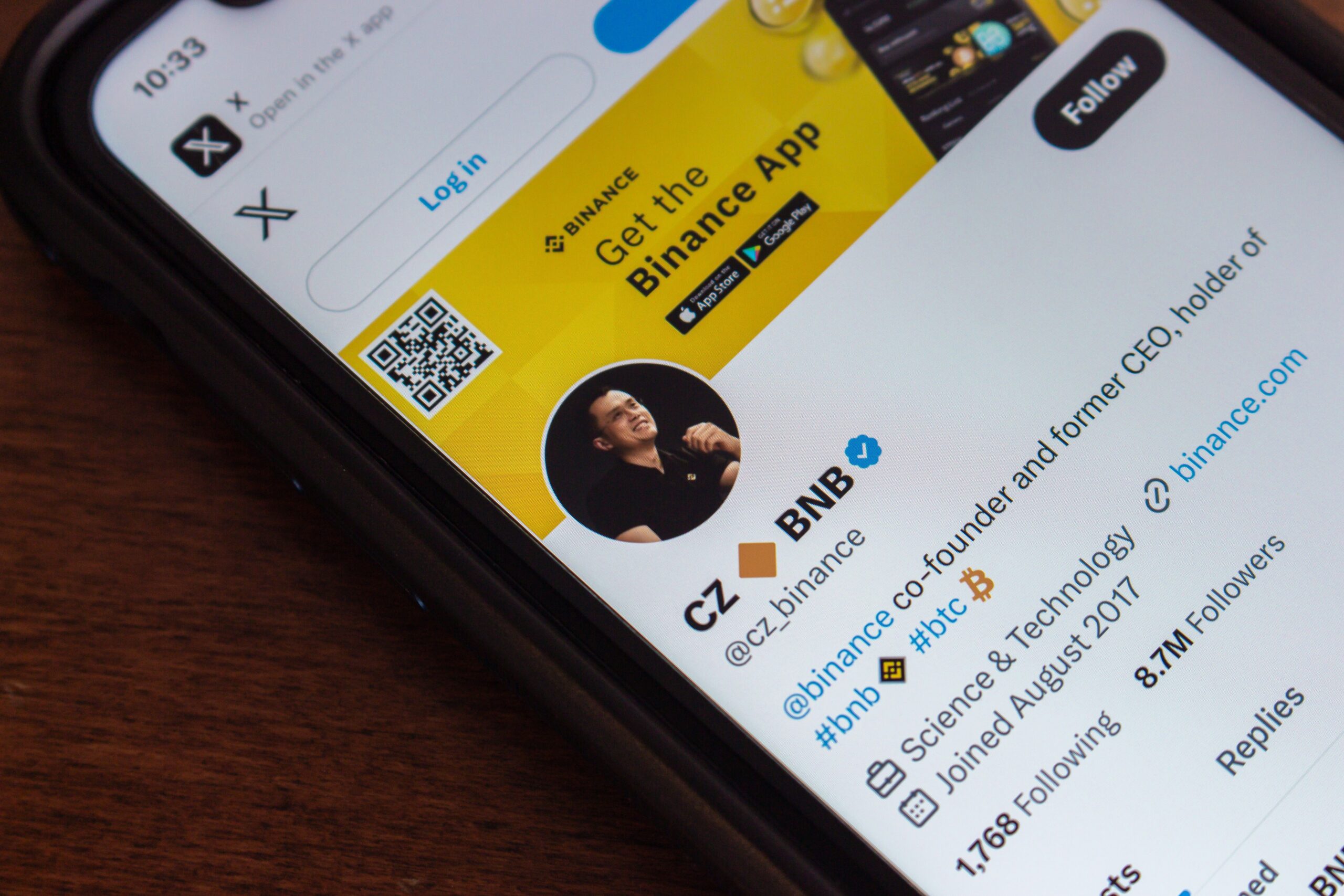

Changpeng Zhao, the founder of Binance, has been sentenced to four months in prison for charges related to money laundering. This sentencing occurred in a Seattle courtroom, where Zhao was confronted with his failure to maintain an effective Anti-Money Laundering (AML) program. Legal experts believe that the judge’s decision serves as a general deterrence, stressing the importance of regulatory compliance in the rapidly evolving crypto industry.

Dr. Aaron Lane, a senior law lecturer at RMIT Blockchain Innovation Hub, emphasized that the sentence was not merely about penalizing Zhao but was intended to send a broader message to the entire cryptocurrency sector. Compliance with AML regulations, according to Lane, must be prioritized by all players in the industry.

Zhao’s Guilty Plea and Legal Proceedings

Zhao’s legal troubles stemmed from accusations that under his leadership, Binance failed to implement necessary controls to prevent money laundering. This lack of compliance allegedly allowed the platform to become a conduit for illicit financial activities involving various criminal elements. The U.S. Department of Justice claimed that Binance did not report over 100,000 suspicious transactions, some of which were linked to terrorist groups.

In response to these charges, Zhao pleaded guilty and agreed to a plea deal that included a significant financial penalty and his resignation as CEO of Binance. The plea agreement stipulated that Zhao would not appeal any sentence under 18 months, granting the judge considerable leeway in determining the final sentence.

Ultimately, the court decided on a four-month term, acknowledging Zhao’s cooperation with law enforcement and his steps towards remediation, including paying a $50 million fine personally and Binance being fined $4.3 billion.

Industry Reactions and Future Compliance

The sentence has sparked discussions across the financial and technology sectors about the future of regulatory compliance in cryptocurrency. David Chung, founding director of law firm Creo Legal, remarked that the sentence clearly signals that the period of minimal oversight in the crypto world has ended. While acknowledging Zhao’s non-compliance, Chung also noted that a substantial fine coupled with Zhao’s resignation might have been an adequate response, suggesting that the actual prison sentence might be seen as overly punitive by some.

Despite the controversy, Zhao has accepted his sentence with a forward-looking attitude, expressing his intent to focus on future projects, including an education initiative related to blockchain and cryptocurrency. His case and the resultant sentence underscore a growing trend towards stringent regulatory oversight in the crypto industry, an aspect Zhao himself conceded as being of paramount importance moving forward.

Legal and Industry Implications

Zhao’s sentencing is part of a broader crackdown on regulatory lapses in the cryptocurrency industry. It serves as a stark reminder to other firms in the space about the serious consequences of failing to comply with legal standards, particularly those designed to prevent financial crimes. As the industry continues to mature, the expectation for compliance will likely increase, with regulatory frameworks becoming more defined and vigorously enforced.

This case also highlights the shifting landscape of the cryptocurrency market, where major players like Binance must navigate not only market dynamics but also increasingly complex legal environments across multiple jurisdictions. Zhao’s case’s outcome could lead to more compliance-focused business models in the industry, prioritizing transparency and regulatory adherence.

Editorial credit: Koshiro K / Shutterstock.com

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.