- Miners forced to liquidate newly mined BTC amid narrowed profit margins.

- Latest reports reveal declined margins in recent weeks.

- Bitcoin price experiences selling momentum below $28K.

Matrixport’s Friday report indicated that Bitcoin miners could be responsible for the selling momentum the leading crypto experiences. Mining machines manufactured before 2022 struggle to attain profits as the industry becomes more competitive. That has forced crypto miners to liquidate newly minted assets, translating to bearish sentiments.

According to a report by Matrixport, bitcoin miners are being forced to liquidate newly mined coins due to compressed profit margins. This competitive landscape has made it challenging for machines produced before 2022 to be profitable. #Bitcoin #Miners #btc

@PlatterFi

Matrixport, a crypto service provider, revealed that compressed profit margins (over the past weeks) forced miners to sell any newly mined asset. The report stated that the continued BTC miner difficulty increase has made mining competitive and unprofitable.

Mining difficulty measures how miners can easily mine new Bitcoins. The metric touched an ATH earlier this week. Meanwhile, Matrixport added that machines manufactured before 2022 seem unprofitable at current input and potential revenue output anticipations.

Mining Profitability Deteriorates

Mining profitability has recorded a massive slump over the past year. Hashrate Index shows plunged by a significant 82% since the crypto market peak of late 2021. Nonetheless, some mining firms appear bold enough to keep investing in the mining business. CleanSpark took advantage of the current discounts to acquire new mining equipment.

Overcoming Mining Challenges

Despite noteworthy profitability declines over the past twelve months, mining companies continue to expand their businesses. An American-based BTC mining company CleanSpark has recently purchased 12,500 Bitmain machines.

The firm purchased the equipment to attain its year-end goal and expand its mining capacity. Moreover, the move comes as BTC’s difficulty touched record highs, pressuring miners. Besides capitalizing on discounts to get the units, the company likely sees profitable opportunities in the upcoming sessions.

Reduced profitability forces miners to liquidate their holdings at current levels – not waiting for prices to soar. Consequently, that has triggered bearish sentiment around Bitcoin. The leading crypto continued to battle unknowns below the $28K value area. It traded at $27,163.89 during this publication (Coinmarketcap data).

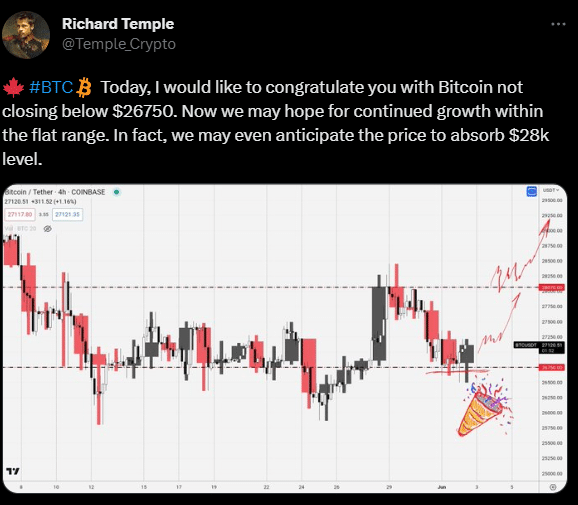

While various factors continue to hinder Bitcoin’s uptrends, crypto fans hope for impressive upticks. For instance, Crypto Temple tweeted that Bitcoin can see continued growth as it prevented a closing beneath the crucial $26,750. The analyst believes the leading asset can overcome the $28K hurdle.

🍁 #BTC Today, I would like to congratulate you with Bitcoin not closing below $26750. Now we may hope for continued growth within the flat range. In fact, we may even anticipate the price to absorb $28k level.

@Temple_Crypto

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.