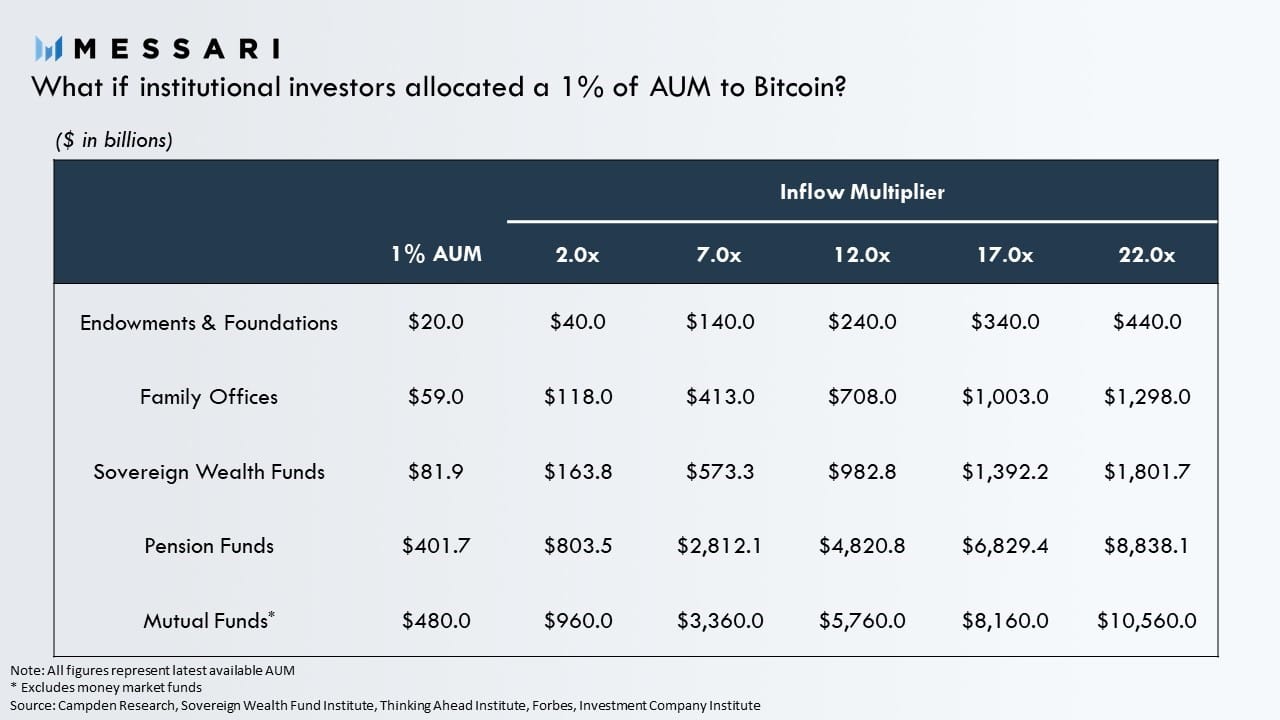

Crypto data firm Messari claimed in its latest Pro-based research analysis that Bitcoin may hit $50,000 if institutional investors dedicate 1% of their portfolios for Bitcoin and its market cap will reach above $1 trillion.

Messari Analysis

Ryan Watkins, research at Messari, explained what will happen if institutional investors gain exposure to the top leading asset. His prediction will come true if the Bitcoin market receives capital inflows from endowments and foundations, sovereign wealth funds, mutual funds, family offices, and pension funds.

Watkins said:

“Depending on your assumptions, an aggregate 1% institutional allocation to Bitcoin can easily bring Bitcoin’s market cap above $1 trillion…This is why enthusiasts get so excited about the prospect of institutional inflows. 1% is a lot when everyone does it.”

Source: Messari

Due to economic pressure and COVID-19, some investors attract to digital assets to hedge their funds. The slight upside move shows the number of investors is few, and it requires more institutional interest to reach a $1 trillion crypto market.

Watkins also noted that institutions and assets management firms behave on their clients’ will who want high profit but with minimum risk.

But Bitcoin wrapped in a volatility and high risk is attached as many regulatory bodies of the world have not recognized it as an asset.

“[Investors] simply cannot bear risk like retail investors can without taking the necessary time and effort to get comfortable.”

Watkins quoted the example of a veteran hedge fund manager who is an exception. In May, Paul Tudor Jones allocated 1-3 % of his portfolio worth $22 billion for Bitcoin futures.

He went to explain that the amount invests in the BTC market are hedge fund:

“Among the most likely to invest in Bitcoin are hedge funds, which have some of the most flexible investment mandates… Hedge funds can virtually invest in any asset class and financial instrument they agree to with their [limited partnerships].”

Messari pro-based research analysis mentions the factors which can inspire institutional investors to invest in Bitcoin. On top of these factors, the trust is declining on federal institutions as the Fed responds to the pandemic by printing money.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.