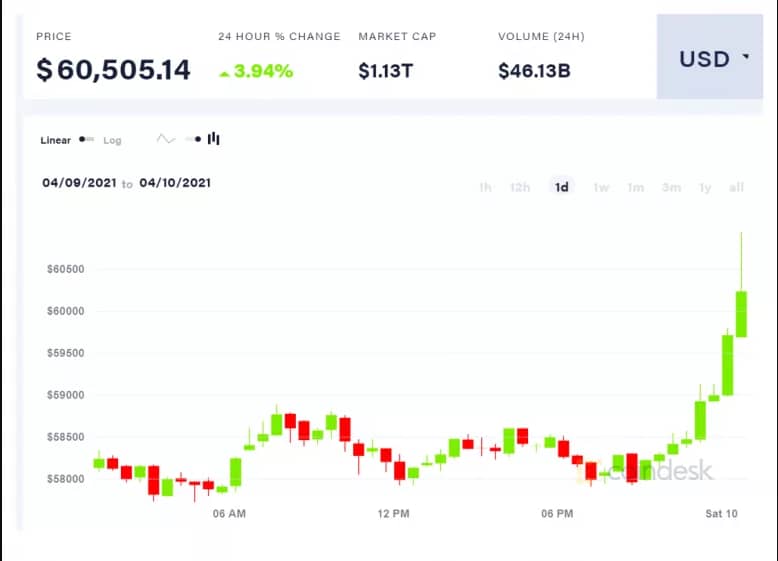

After some period of trading within the $50K range, the king coin now trades at about $60K. As of this moment, bitcoin has declined slightly after attaining $60.9K but it is still within the psychological marker. It would be recalled that the leading cryptocurrency reached a new peak price mid-last-month. A previous attack on the $60K resistance couldn’t be sustained.

Bitcoin price index chart. Source: Coindesk

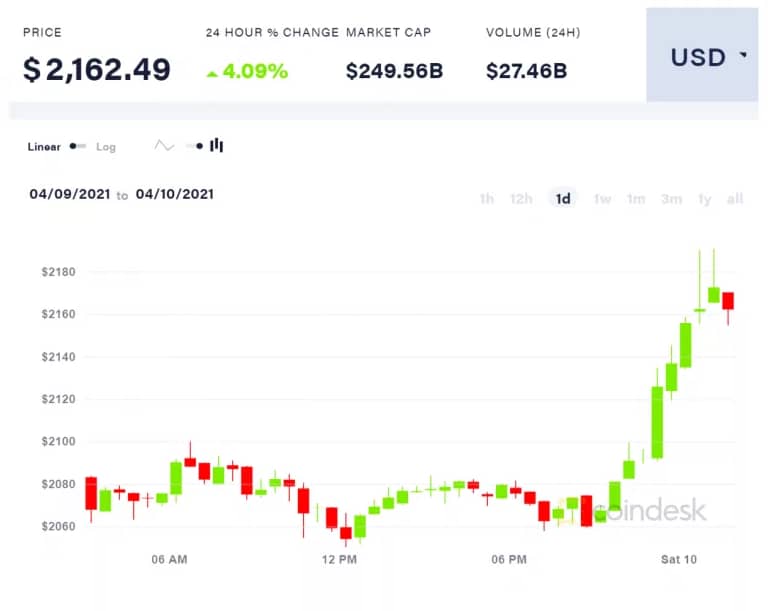

In the same vein, Ethereum is closing in on a new all-time high of $2.2K. This comes days after it exceeded $2.1K for the first time. The second-largest digital asset based on market cap has risen by over 170% since January of this year and that represents an increase of about 1,200% in the last year alone – absolutely mind-blowing. It should be noted that apart from Ethereum, most other altcoins (such as Bitcoin Cash and Litecoin) are also benefitting from this sideways consolidation of BTC price. Analysts are predicting that eth might attain a new peak price this weekend (with another target set at $2,280) provided the hype and optimism can be sustained till Coinbase’s listing mid-next-week. But if there is a correlation in the wider market, ethereum might decline to the $2K price range and even test a previous price of $1,940 or another low of about $1,888.

Ethereum price index chart. Source: Coindesk

What Might Be the Cause of the Price Surges?

While the cause for these price surges remains unclear and it is even unclear whether this price rise will be sustained, they are happening few days before Coinbase becomes a listed company on the NASDAQ stock exchange. Coinbase is a top U.S. Coin exchange and its listing would be a novel idea in the crypto industry. Apart from being a long-awaited event, this listing would give wall street traders a sign of the industry’s growth rate.

Traditional Investors Now Hodling

Some traditional investors are making all efforts to accumulate more of these coins. Yesterday, the CEO of ThirdPoint, Daniel Loeb, announced in a brief online interview that he was already hodling. Apart from him, there has been an influx of institutional funds into the industry in recent weeks. It is even possible that their entry might be the reason for the uptrend in cryptocurrency prices that we have witnessed so far this year.

SEC’s ETF Approval Gives Rising Hope to BTC Bulls

There was jubilation among BTC bulls when the sec confirmed that WisdomTree’s ETF approval application is under review and the approval might be granted before this year ends. Also, the review of VanEok’s ETF application has started last month, and six other firms have indicated an interest in launching a regulated BTC investment platform by picking up their initial registration forms. There has been a massive influx of industry participants and investors into the entire virtual currency industry in recent months. Most of them are investing massively in altcoins such as doge, NFTs, and decentralized finance tools. You’d recall that Doge recently octupled its value in early February before attaining a peak of almost $0.09 in the same month.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.