U.S. based crypto custodian company Prime trust has agreed to pay the sum of $17 million to troubled crypto lender Celsius. The company inappropriately withheld the funds since June 2021.

Court To Give Orders On Distribution Process

At a recent bankruptcy court hearing, Prime Trust affirmed to return approximately $17 million in crypto tokens to Celsius. This comes after Celsius sued Prime Trust in August this year alleging that the crypto custodian failed to return some of its tokens when they terminated their contract in June 2021.

The tokens comprises 2.2 million USDC, 398 BTC, 196,268 CEL tokens, 3,740 ETH and 2.2 million USDC and is valued at about $17 million. The assets are linked to Celsius’ yield product clients in Washington State and New York.

According to Prime Trust, the assets will be sent to an assigned Celsius wallet, and Celsius will wait for instructions from the court on how to go about distribution.

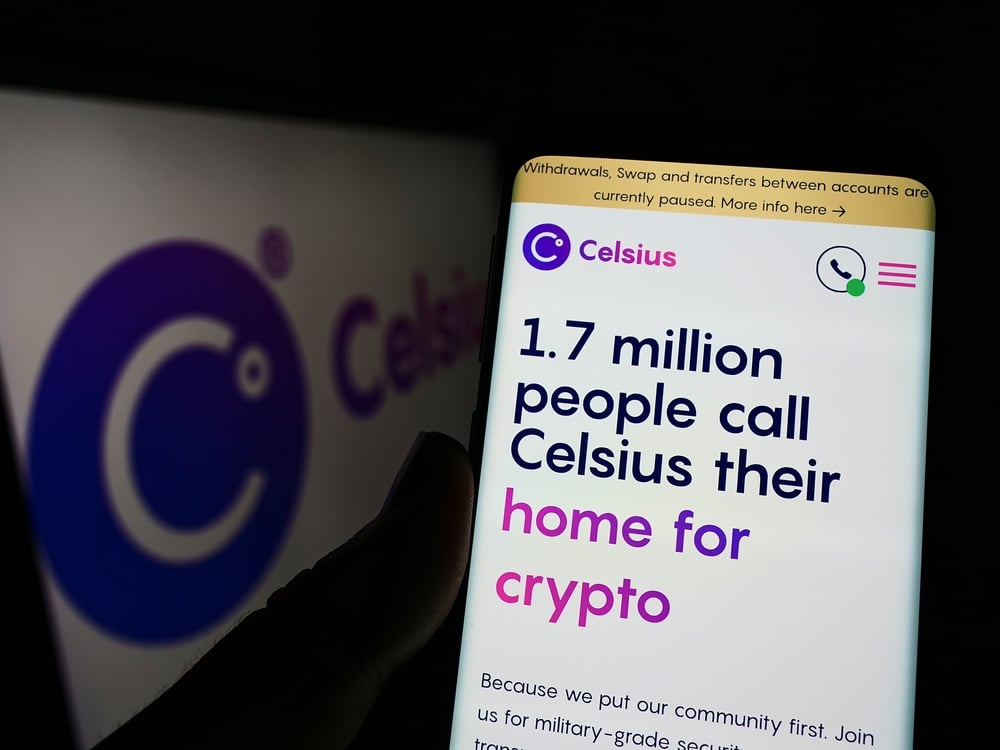

Prime Trust had in its care $119 million of Celsius’ assets at the time the contract was terminated. Celsius is one of the crypto companies that caught the contagion this year. As cryptocurrency prices crashed down in June, the crypto lender got into a liquidity crisis, and announced that it was freezing withdrawals due to harsh market conditions.

The announcement sent Celsius crashing down alongside its native token CEL, and within a few weeks, the company filed for chapter 11 bankruptcy protections.

Celsius Bankruptcy Proceedings Progresses

Celsius is looking to finish up sale of its assets before the end of the year. At a recent hearing, Chief Bankruptcy Judge, Martin Glenn heard arguments for the sale of the assets, which includes date for a possible auction among other factors.

Also, a new fee examiner has been appointed for the case. Judge Christopher Sontchi who formerly served as a bankruptcy judge in the district of Delaware has been appointed for the role.

The high cost of bankruptcy processes has also been factored in and all parties are striving to preserve what is left of the company after the auction.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.