Over the last few hours, the crypto market has lost nearly $250B worth of digital assets following a steep market correction.

BTC Price On A 5-Month Low

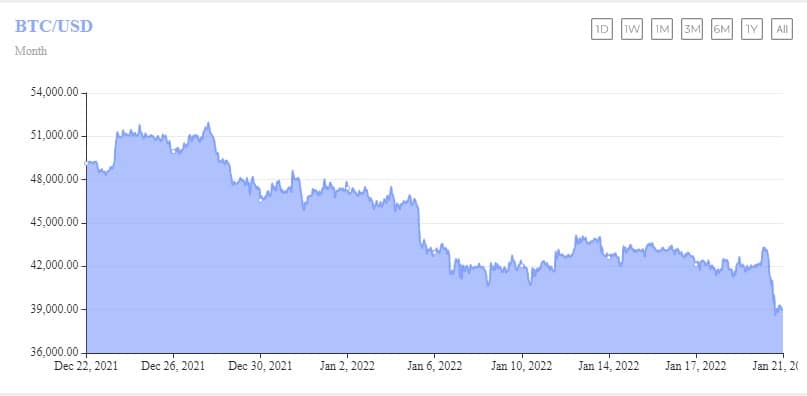

The largest digital asset (BTC) lost 7.5% during this period, which saw a dip to a 5-month low and now trades at sub-$39K levels. According to a Santiment tweet, it is the first time BTC would trade at sub-$39K levels since August 5, 2021.

Santiment Tweet. Source: Twitter.

Most traders agree that this market correction has resulted from the prevailing economic situation globally, especially in the US. For instance, the current high inflation in the country has forced the fed to announce an increase in interest rates this year. Thus, leading to a dovish stance by wall street and strong price correction on volatile assets such as virtual currencies and equities.

However, a tighter monetary policy would stabilize the US Dollar index (DXY); it is nearly 96 as of this writing. Part of the latest report by Fundstrat digital assets to its investors states that macro variables play a huge role in determining the crypto market conditions, including BTC price.

The report also claimed that crypto whales might have a hand in the current market correction but failed to specify how they reached that conclusion. A Coinglass report states that more than $600m liquidations have occurred over the last 12 hours.

30-day BTC price movement. Source: TradingView

Not A New Experience

It is not new that BTC is experiencing a severe price correction; it has declined by 40% or more several times. However, BTC now trades at a price below its crucial support with this latest decline. Famous BTC analyst peter Schiff claims that BTC might still trade at sub-$30K levels.

He also stated that “BTC has dipped below the neckline of the head-and-shoulder top. This move implies that BTC might eventually trade at sub-$30K levels. If BTC trades at this level, it would mean the completion of a strong double top where a further decline cannot be ruled out.”

BTC Network Difficulty Is Still Waxing Strong

BTC mining difficulty (BMD) continues to move from strength to strength despite the substantial decline in BTC price. The BMD rose by nearly 9.5% over the past 24 hours, its most significant rise in five months. The BMD changes once in two weeks at a 10-minute average blocK time depending on the fluctuation in the hash rate.

After China’s blanket ban on cryptocurrencies last May, the BMD and the hash rate dipped by over 50% that month, but, as of this writing, both have recovered this loss. The recovery comes from miners’ successful settling down in other crypto-friendly regions.

The United States has overtaken China as the largest BTC mining hub globally. More importantly, most BTC miners have adopted clean energy (which doesn’t pollute the environment) for their crypto mining operations. Thus, it is no wonder that leading mining firms have been expanding their mining operations by increasing the number of their mining tools.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.