Key Insights:

- Cardano’s network records highest new address growth since mid-2023, reflecting rising adoption globally.

- Whales acquire 130M ADA at $0.30, strengthening support and aiding rebound to near $0.99.

- Sustained network activity and smaller wallet growth signal grassroots expansion amid market volatility.

Cardano’s blockchain network is seeing a surge in activity, reaching its highest new address creation rate since mid-2023. Recent data reveals strong network adoption, even as the cryptocurrency faces market volatility, with prices currently trading near $0.91 after a brief rally above the $1 mark.

New Address Creation Hits 18-Month High

Data from market intelligence platform IntoTheBlock shows that Cardano has achieved its fastest growth in daily new address creation since June 2023. This metric, which tracks the number of wallets participating in their first transactions, indicates a rise in user engagement with the network.

The growth in new addresses points to multiple factors, including new investors entering the ecosystem and previous users reactivating their wallets. The increase in participation reflects broader adoption and interest in Cardano, beyond speculative trading.

Unlike earlier periods of growth, where address creation closely followed price movements, the recent surge in activity has continued even during market fluctuations. This suggests that the network’s growth may be driven by long-term interest in the platform’s capabilities and use cases.

Whale Accumulation Supports Price Stability

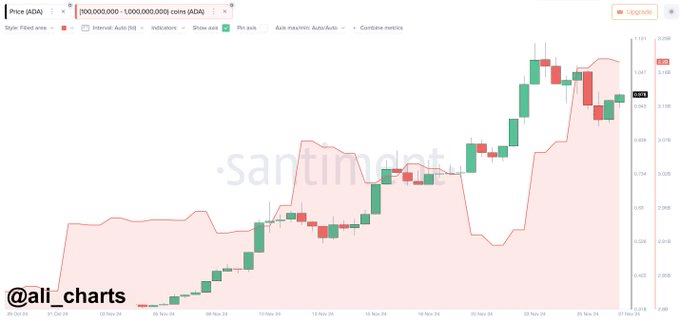

Large investors, often referred to as “whales,” have played a role in Cardano’s price stability. Blockchain data reveals that whales holding between 100 million and 1 billion ADA tokens recently acquired over 130 million tokens during a market dip when the price dropped to $0.30.

This accumulation has helped strengthen $0.30 as a key support level, contributing to a rebound in ADA’s price. Following the buying activity, the cryptocurrency climbed back near $0.99. Analysts view whale activity during downturns as a potential indicator of confidence in the asset’s long-term value.

Crypto analyst Ali noted,

“The large-scale acquisitions during the price drop demonstrate the growing confidence among major investors.”

Source: X

Such moves can also signal optimism for retail investors, as whale behavior often reflects a long-term investment outlook.

Sustained Network Adoption Amid Market Volatility

Despite the recent price pullback from the $1 mark, Cardano has managed to maintain 24% weekly gains. This resilience, even as the broader cryptocurrency market faced pressure, underscores the continued network adoption and activity.

On-chain metrics reveal consistent daily transactions and increased utilization of Cardano’s blockchain. This operational stability is accompanied by robust trading volume across major exchanges, reflecting steady user engagement.

Unlike short-term price-driven spikes in activity seen in the past, the current growth in address creation appears more sustainable. Wallet data indicates that many of the new addresses are associated with smaller holdings, pointing to a grassroots expansion of the network.

Geographical data also shows diverse adoption across multiple regions, further supporting Cardano’s growth as a global blockchain platform. This widespread participation may enhance the network’s long-term resilience.

Technical and Network Insights

Technical analysis highlights that Cardano’s new address creation rate has surpassed previous growth cycles in both daily numbers and duration. This momentum, combined with consistent trading activity, sets the current trend apart from earlier fluctuations.

Exchange data reveals that while some profit-taking occurred during the recent price correction, overall network metrics have remained robust. The rise in new address creation continued even during the pullback, suggesting that many new participants are maintaining their positions rather than exiting the market.

Cardano’s network has also shown consistent capacity utilization, with steady transaction volumes supporting its operational stability. These indicators align with the broader trend of network expansion, positioning Cardano as one of the more active blockchains in the current market.

As of press time, Cardano’s price was trading at $0.91, maintaining its 20.97% weekly gains despite market volatility. The network’s sustained growth in new addresses provides a strong foundation for its ongoing adoption and potential for future development.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.