With more negative bitcoin reports from China, the leading cryptocurrency has declined to a new 2-week low of a little more than $32,500. The latest bad news is that China’s third-largest bank (the Agricultural Bank of China) has banned its customers from trading in any virtual assets.

Agricultural Bank of China Restricts Crypto Transaction

Per a press release issued today (June 21, 2021) by the Agricultural Bank of China, their clients will no longer be allowed to transact any business involving digital currencies. If the bank should discover any customers involved in any cryptocurrency transaction, their accounts will be terminated immediately.

Also, the bank has warned that it would report such transactions to the appropriate government agency instantly. This move shows that China is yet to relent in stopping anything that has to do with cryptocurrency in the country. You would recall that China stepped up its crypto crackdown efforts by prohibiting the operations of bitcoin miners in most provinces of the country.

Crypto advocates opined that China’s more aggressive crypto crackdown efforts would pave the way for the incoming digital yuan, which is entirely independent of bitcoin’s or cryptocurrency’s decentralized nature. It should be noted that this bank has been involved in all digital yuan trials organized by China’s central bank. Hence, it is fully invested in China’s central bank digital currency.

Cryptocurrencies Price Declines Amidst News

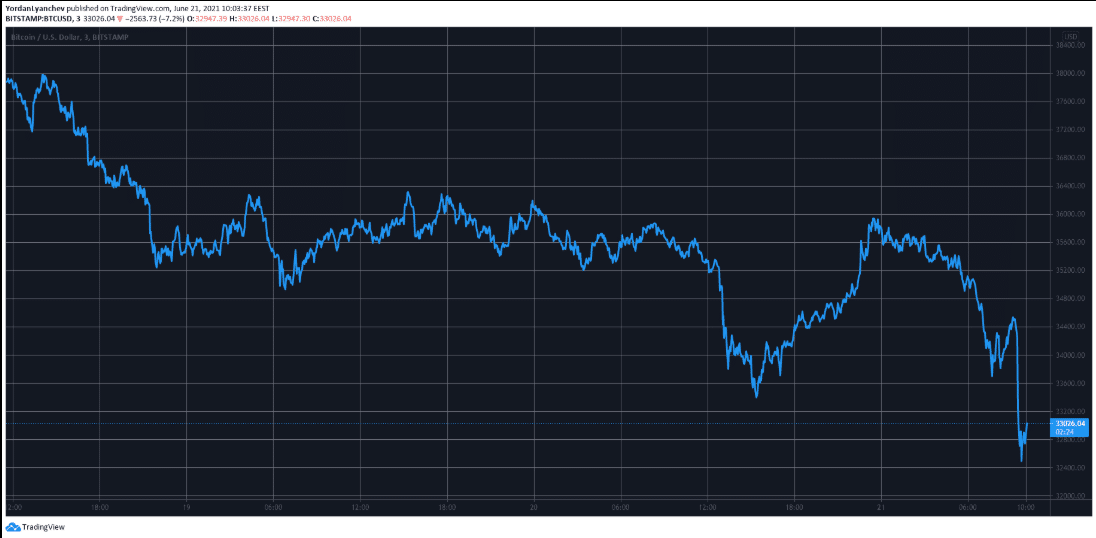

Unfortunately, this news from the Agricultural Bank of China has affected the crypto market negatively. Within hours after the news was released, bitcoin declined by over $2,000 to a 14-day low of $32,500. This translates to a loss of almost $4,300 within 24 hours.

Bitcoin price slump. Source: TradingView

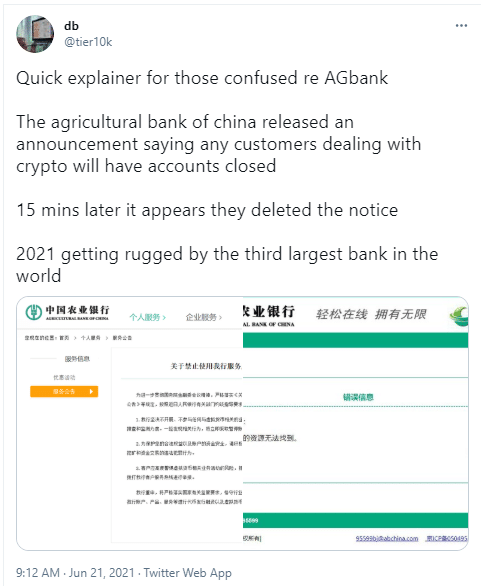

Altcoins were even more affected. Most of them recorded a double-digit price decrease within that same period. However, a Twitter user with the handle @tier10k has revealed that the bank deleted the tweet 15 minutes after releasing it in a twist of events.

Tier10k Tweet. Source: Twitter

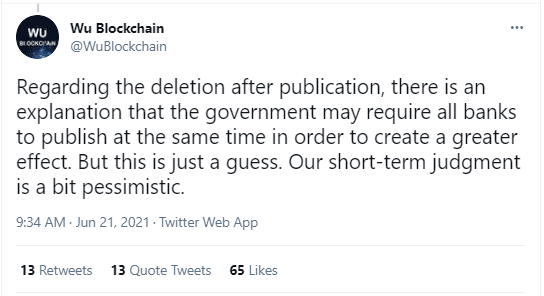

Respected China crypto journalist, collins wu confirmed the tweet from tier10k and also gave a possible reason for the bank’s action stating that Chinese authorities may have instructed banks to release the notice at the same time.

Collins Wu tweet. Source: Twitter

Bitcoin’s Bullish Run Reduces

The combination of relentless severe pressure on bitcoin miners in various Chinese provinces and the “death cross” on bitcoin’s 24-hour and 1-hour charts cause a decline in bitcoin price. The bitcoin price might likely keep swinging back and forth in the coming days, but this would suit expert intraday traders as they can make profits in either direction of the price swing.

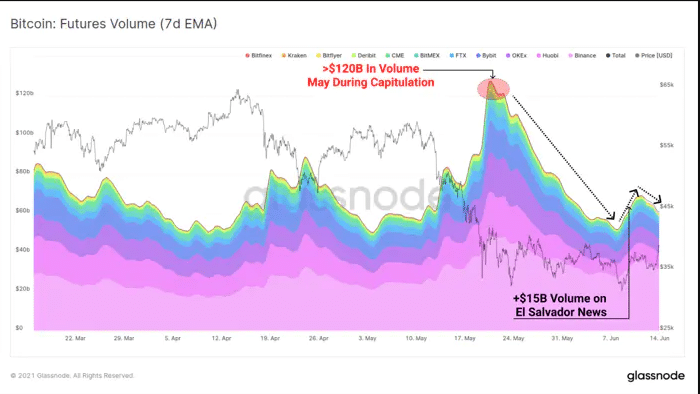

This increased trade activity by retail investors can cause high fluctuations in the bitcoin market even though long-term investors continue to hold on. Also, a Glassnode data survey reveals a drastic drop in trade activity involving bitcoin futures compared to last month’s trade activity.

Bitcoin futures trade activity. Source: Glassnode

Possible reasons could be the confusing signals as several investors and crypto traders are unsure of the long-term market direction of bitcoin derivatives. Thus, leverage levels are low.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.