Currency.com Review

There are several challenges that besiege cryptocurrency holders these days: one of these is their inability to gain access to regulated financial markets.

This challenge is a major reason why crypto investors can’t trade in the commodities market. If this had been your situation thus far, you have nothing to worry at all. This is where currency.com comes into play.

Currency.com supports regulated exchange and has a well-made and intuitive platform with splendid UX.

In addition, it is the only legislated platform with the ability to trade crypto and fiat, where margin trading is available.

In this article, we’re going to review and analyze how Currency.com, the first regulated crypto exchange of tokenized assets in the CIS, works.

This review is going to tell you everything you need to understand currency.com.

General info

| Location | Minsk, Belarus |

| Mobile App | Yes |

| Parent Company | Currency Com BCL LLC |

| Transfer types | Bank transfer, Credit card, debit card, Crypto transfer |

| Supported Fiat | USD,RUB,EUR,BNY |

All you need to know about currency.com

Currency.com is a platform of tokenized security designed to make complex trading fast and easy. It is special in that you don’t have to convert to fiat money before you trade directly in crypto and earn in crypto.

Currency.com is licensed, authorized and regulated by the High Technology Park of Belarus under Decree No. 8 ‘On the Development of a Digital Economy’.

In 2018, its mobile app won the award for the most transparent service provider in Europe and most innovative broker worldwide.

With 1,300+ tokenized assets presently available and about 10,000 assets set as a future goal and approximately 37000 mobile app installs in 2019. Not forgetting, 100+ employees with key members such as:

- Project CEO – Ivan Gowan

- General manager – Alexander Shevchenko

- Head of project management – Victor Pergament

- Head of Compliance – Nigel Crome

- Head of Development – Dmitry Ogievic.

Ivan Gowan, CEO of Currency.com, said:

“The arrival of tokenized securities will completely change how investors can use their cryptocurrencies. Linking crypto to the price of stocks and shares provides a tangible way for holders of bitcoin and ethereum to access traditional financial markets.”

Viktor Prokopenya, Founder and CEO of VP Capital, said:

“Currency.com will disrupt and revolutionize financial technology on a large scale. Access to global financial markets has historically been available through one primary medium the stock exchange but Currency.com leverages groundbreaking cryptocurrency technology to create opportunities for investors who might not have access to traditional stock markets otherwise. All this was made possible by the progressive Decree No. 8 ‘On the Development of a Digital Economy’ that was passed in Belarus. Belarus has become one of the most forward-looking countries when it comes to blockchain technologies and the first country in the world to create a dedicated legislative framework tailored to cryptocurrencies and their industry.”

Finally, with a trade matching speed of 50 Million/sec, you are perfectly safe using currency.com.

Currency.com offers top class auditing from a top accountancy firm, a tried-and-tested sealable matching engine, strong and effective know your customer compliance and anti-money laundering service, physical and virtual security and finally, a purpose-built regulation.

What unique features do you stand to gain from currency.com?

Wide Range Of Deposit Methods

This trading platform accepts deposits from both credit cards (Master Card, VISA) and wire transfer. The minimum deposit for all credit cards is 100 EUR, 100 USD, 7000 EUR or 250 BUN.

Currency.com also accepts deposit of fiat currency and the good news is, either you want to deposit fiat or crypto (from the Cryptocurrency wallet belonging to you), the minimum deposit is 0.01 BTC or 0.1 ETH.

This is therefore a huge boost for crypto investors and crypto enthusiasts, as the amount required to trade is quite affordable.

Currency.com charges deposit and withdrawal fees. This depends, to a large extent, on the type of payment method its customers as shown in the figure below:

| Payment Method | VISA | Mastercard | Bank Transfer (International) | Bank Transfer (Belarus Resident) |

| Maximum Deposit | 100USD/EUR | 100USD/EUR | 50USD/EUR | 50USD/EUR |

| Minimum withdrawal | 3.5% | 3.5% | Free | Free |

| Deposit Fee | 24000 USD or individual | 24000 USD or individual | 24000 USD or individual | 24000 USD or individual |

| Withdrawal fee | 100USD/EUR | 100USD/EUR | 50USD/EUR | 50USD/EUR |

With a highly competitive rate of fiat deposit fees on currency.com, it makes complete sense to use this platform as a fiat-to-crypto gateway

For instance, if you were to buy crypto with a Mastercard or VISA on Coinbase, it could cost you up to 4% depending on your location. This makes crypto purchases on currency.com cheaper in some situations.

Fractions of payment of the amount for withdrawal is made although, cryptocurrency deposits are free by default on currency.com.

| Cryptocurrency | Min.

Deposit | Max. Deposit | Min.

Withdrawal | Withdrawal Fee | Confirmations |

| Bitcoin | 0.002 BTC | 24000 USD

(Unverified accounts) | 0.005 BTC | 0.005 BTC | 2 |

| Etherium | 0.1 ETH | 24000 USD

(Unverified accounts) | 0.5 ETH | 0.02 ETH | 12 |

| Litecoin | 0.2 LTC | 24000 USD

(Unverified accounts) | 0.1 LTC | 0.04 LTC | _ |

| Bitcoin cash | 0.05 BCH | 24000 USD

(Unverified accounts) | 0.05 BCH | 0.015 BCH | _ |

| Tokenized

security | 100 USD | 24000 USD

(Unverified accounts) | 100 USD | 1.5% Or Min. 0.02 | _ |

Leveraged Trading

At currency.com, you can trade with leverage. In case you are wondering what leverage means, It involves trading with positions that you would otherwise not be able to take. For example, if what you have is 5000 USD and you trade with, let’s say 10X leverage, it means you can simply place 5000 on something.

On this platform, you can trade with the following leverage levels below:

- Tokenized stocks: up to 20x

- Crypto: up to 10x

- Tokenized commodities: up to 100x

- Tokenized Indices: up to 100x

NOTE: As much as leverage trading can lead to huge returns, it can as well lead to huge losses.

Fees

Currency.com charges two types of fees; withdrawal-related charges and platform fees (deposit).

Trading fees include exchange fees, funding fees, margin trading costs and fees for assets under management.

The table below shows the competitive fees which currency.com offers when it comes to both margin trading and tokenized securities;

| Platform Function | Fee Type | % |

| Leverage (margin) trading fees | Crypto’s taker fee | 0.075% |

| – | Crypto’s maker fee | -0.25% (rebate) |

| – | Tokenized assets (shares, ETF’s, indices, commodities) | 0.0125% |

| – | Tokenized currencies | 0.002% |

| Exchange Fees | Cryptocurrencies | 0.2% |

| – | Tokenized assets (shares, ETF’s, Indices, Commodities) | 0.05% |

| – | Tokenized bonds | 0.03% |

| – | Tokenized currencies | 1% |

| – | Companies tokens (buy) | 0% |

| – | Companies tokens (sell) | 1.5% |

| Other Fees | Assets under management fee | 50 BPS per annum (0.5%) |

| – | Funding fee | Varies based on the market rate |

Withdrawal fees

All the fees at currency.com are generally good in that it charges a withdrawal fee amounting to 0.0005 BTC for each BTC withdrawal.

This value (0.0005 BTC) is substantially less than the industry average of 0.000812 BTC per BTC withdrawal. Thus, making this exchange’s withdrawal fees 40% less than the industry average.

Top-notch Security

Currency.com has servers located on the territory of LD4 data center. This LD4 center is protected by armed guards and equipped with a video surveillance system. LD4 services are used by several of the world leading trading platforms, including Nasdaq, Dow Jones as well as London and Frankfurt exchanges.

According to currency.com’s website, the following security regulations were stated;

- It stores user data in military-grade protected servers by using physical security measures;

- PGP (pretty good privacy) and GPG (GNU privacy guard) are used for verification of Emails, this discrete system is used for secure document upload. It is also the highest level of global encryption;

- It has highly vetted workers and every decision made concerning sensitive data passes through a strict approval protocol;

- It is subject to strictest inspection from the high technology park of Belarus;

- Your funds are stored in a bank account entirely different from currency.com’s operations account and cannot be borrowed even for margin trading.

Quick One: The currency.com team is already planning to become fully decentralized by 2023.

Huge Profit For An Investor

Currency.com provided its users with 1,358 tools in September 2019 and this number is likely to increase to 10,000+ in the coming years. These include; tokenized stocks, exchange indexes, cryptocurrencies, materials and many others.

All markets are real tokens, issued out on Ethereum blockchain. As a result, they can be withdrawn and stored in the user’s personal Ethereum wallet. Users, therefore, are given several opportunities to trade on the cryptocurrency exchange. Such opportunities include;

- Trading with or without leverage;

- Traditional tokenized assets with leverage up to 1:100;

- Crypto assets with leverage up to 1:20;

- Use of professional tools to reduce trading risks;

- Direction of fiat/crypto and crypto/crypto;

- Use of any currency, with the basic asset traded.

Margin Trading

Currency.com offers margin trading. With a leverage up to 100X on certain pairs, users can trade crypto currencies. These crypto currencies which can be traded with leverage are; Ethereum, Bitcoin and Litecoin.

They can be traded against US dollar, Belarusian ruble (BYN), Euro and Russian ruble (RUB). They can also be traded against each other, For instance, LTC/BTC and ETH/BTC trading pairs.

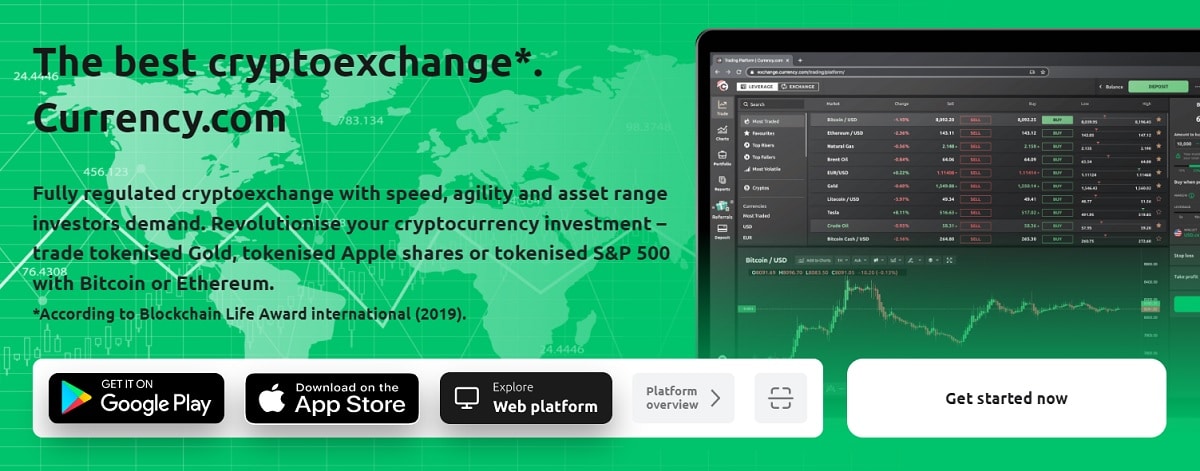

Design and Usability

This platform is well designed and equally easy to navigate with no unnecessary distractions, be sure that windows will work smoothly without any lags. If you aren’t new to a trading platform, then you will find this one relatively easy to control. For the newbies, you have absolutely nothing to be worried about because its intuitive interface is so easy to master.

Tools are grouped and located in convenient places, you can control everything within one window.

In addition to the web version, the platform has its own convenient and fast application, which is available on both Android and IOS. With same functions and the support of several languages, the ability of quick and convenient verification, push-notifications of price changes, built-in chat with support centre, rate charts, shown in a landscape format and lots more.

Effective Customer Support

Another unique feature of currency.com is its 24/7 customer support. They are reachable at any given time via a variety of channels such as;

- Email – support@currency.com

- Phone – +375293757075

- Facebook messenger

- Viber

- Telegram

- Live chat

In my recent attempt to contact their customer support via WhatsApp, I got a reply in less than 15 minutes which is a good response time.

Deposits and Withdrawal methods

Deposits and withdrawal on this platform are processed within a day but may take several days for a fiat withdrawal to get to your bank account.

Below are some currencies which this platform supports;

- U.S Dollars (USD)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Ethereum (ETH)

- Tokenized securities

- Russian Rubles (RUB)

- Belarusian Rubles (BYN)

- Euros (EUR)

For extensive details on Deposits and withdrawals, visit (https://exchange.currency.com/deposits-withdrawals)

A Win-Win referral program

Along with all these unique features, do you know that you can get a two-way bonus from currency.com just by referring a friend?

You earn 50% trading commissions paid by your referrals for you as well as 10% discount on trading commissions for your friends. Isn’t that massive?

Yeah, you might be wondering how you can qualify to take part in this referral scheme. Here’s a step by step guide to this program;

- Sign up via a referral link and get a 10% discount on trading commissions for the next 3 months.

- Share your referral link with a friend and earn 50% commission off their trading fees for the first 6 months of their trading.

For details on how to register, visit this link (https://exchange.currency.com/affiliate-programme)

How To Get A Referral Link

- Download the app (available on android and IOS)

- Login to currency.com

- Go to the ‘Referrals’

- Get your referral link!

Why is Currency.com the right choice to trade BTC?

Below is a table that shows how currency.com compares with other currency exchange platforms, take all the time you need to compare;

| Key Features | Currency.com | Other Exchanges |

| Regulation | YES.

Currency.com is the first truly regulated tokenized securities exchange, which makes it a safe choice. | NO.

They are not often licensed |

| Leverage | YES.

Currency.com offers leverage from 1:2 up to 1:100. | NO.

Usually do not offer any leverage. |

| KYC and AML | YES.

Currency.com adheres to the world’s most stringent industry standards and rigorous AML and KYC rules | YES/NO.

A limited number of crypto exchanges comply with all AML and KYC procedures. |

| Number of Tokens | 1,300+ (up to 10,000 eventually)

A wide range of assets to trade places Currency.com above rival platforms. | 0-200

Limited number of tokens to trade. |

| Tokenized Assets | YES.

Apart from BTC trading, Currency.com supports top-traded equities, commodities, indices and plans to include bonds and other assets. | NO.

Often provide only one single asset class. |

| Matching speed per second | 50 M/sec

Currency.com has an unparalleled matching engine, which ensures a split-second order execution. | Limited

by the speed of a blockchain, which makes them more prone to risk. |

Is Currency.com A Scam?

This platform was launched in April 2019 so it is definitely not too early to tell if it is a scam or not. However, they have been authorized to perform crypto trading activities based on Decree of President of The Republic of Belarus No.8, on Development of Digital Economy far back as 21st December 2017.

They are transparent about their name, address and it’s hard to find an exchange with full, proper regulation, given the nature of cryptocurrencies. What is clear so far is that we haven’t heard of any scam allegations YET.

User Friendliness.

The website is translated into 10 different languages, making information easily accessible.

Currency.com has a nice balance between functionality and ease including the use of a Demo account.

Available Markets.

Currency.com offers a wide range of financial instruments that traders can use to leverage their crypto possession on traditional markets. These markets are summarised below;

- Tokenized Indices

Stock indices otherwise called indexes forms a fundamental part of the traditional financial markets. Some notable ones include the Dow Jones, NASDAQ, FTSE 100, and the S & P 500. A stock index measures the price-performance of a group of shares from a particular exchange.

- Tokenized Shares

One of the most interesting markets to measure and engage in is the stock market. Traders use it to speculate on stock prices of the largest companies.

This platform offers tokenized shares of companies such as Uber, Fiverr, NVIDIA, AT & T, Visa, Netflix, Tesla, Apple, Slack Technologies and many others.

- Tokenized Commodities

Currency.com enables traders to use their cryptocurrency to engage with some of the world’s largest markets. Users can speculate on the price of gold, natural gas, crude oil, palladium, silver and lots more.

- Tokenized Government Bonds

These are well-known debt instruments issued by the government of a country so as to finance both short-term and long-term spending.

What Are Tokenized Securities?

Tokenized securities are tokens that represent the price of assets such as commodities, securities, or bonds. Tokenized securities are analogous to financial instruments (bonds, commodities, equities etc) whether the outcome of an investor is a profit or loss.

The platform is poised to issue over 10,000 tokens which are pegged to the market prices of various asset classes. They will include companies such as Coca-Cola, Amazon, and Apple; indices such as the Dow Jones 30, Nasdaq 100, and the S&P 500; as well as commodities such as Brent Crude oil, gold, and silver.

When a client places a trade, a token is received, this token tracks the price of the selected instrument allowing investors to diversify their portfolios without having to convert their crypto to fiat.

The prices are transparent and accessible via blockchain-based technology in order to guarantee the best possible prices.

What Tools Does This Platform Offer?

Tools

There are a large number of technical analysis tools available on this platform, but these are the summaries of the most important ones that you need to know.

- Price Movement Channel

The Price movement channel allows you to create a zone of fluctuations in the asset value during a specific period of time.

- Head and Shoulders Pattern

Head and shoulders pattern is a reversal chart, and it can be used to enter the bearish position after the bullish trend.

This pattern is created from different lines on other platforms, but you can use the whole of it on Currency.com.

- Triangle Pattern

Triangle pattern is two merging trend lines, where the price fluctuates from one to another.

- Gann Fans

Gann Fans include a progression of straight lines, drawn at various angles with the pivot point basis. When prices approach it, each of these lines indicates possible support or resistance levels.

- Fibonacci retracement

This is when you can define possible aims, which the market price can reach, with the help of Fibonacci retracement levels. The system consists of two fields: corrective and objective.

Indicators

Varieties of indicators are available on this platform, they can help both novice traders and professionals to guide them with the choice of a trading strategy. We are going to take a look at the most popular ones.

- MACD

MACD is used to check the strength and path of the tren and also used to determine pivot points.

- Accumulation/Distribution

Accumulation / Distribution compares the closing price with the middle of the trading range.

- Moving Average

Moving Average is useful in that it helps to determine the direction of the asset or market price movement and identify the current trend.

- Price Volume Trend

Price Volume Trend provides a price and volume change percentage, which confirms the strength or divergence of the price trend, and also warns about the price movement weakness.

Conclusion

This platform is well-made and enables crypto-currency users to be exposed to the price movements of various cryptocurrencies and traditional assets. This allows clients to engage in those markets without converting their cryptocurrency, and also ensures that they are able to receive their profits directly in Crypto.

For individuals who love taking risks, it offers margin trading opportunities.

Also, with a wide range of tools available, currency.com has established itself as one of the best exchange platforms coupled with its easy to navigate interface. I would strongly recommend that you start using currency.com.

Happy trading.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.