The second-largest cryptocurrency is hitting the digital asset industry as it corrects some value against the USD. Following the $1,633 price high, Ethereum continues to push the importance of its token to new heights as it continues its bullish rally.

The price move is partly triggered by the upcoming merge scheduled for September and Bitcoin’s price slide. When writing, the token aims for an upward price move to above $1,700.

ETH Set Sights on More Price Uptrend

Ethereum continued its rally above the $1,450 and $1,500 price levels for the week. In addition, the token has managed to clear the $1,550 barrier to continue its move into the green zone.

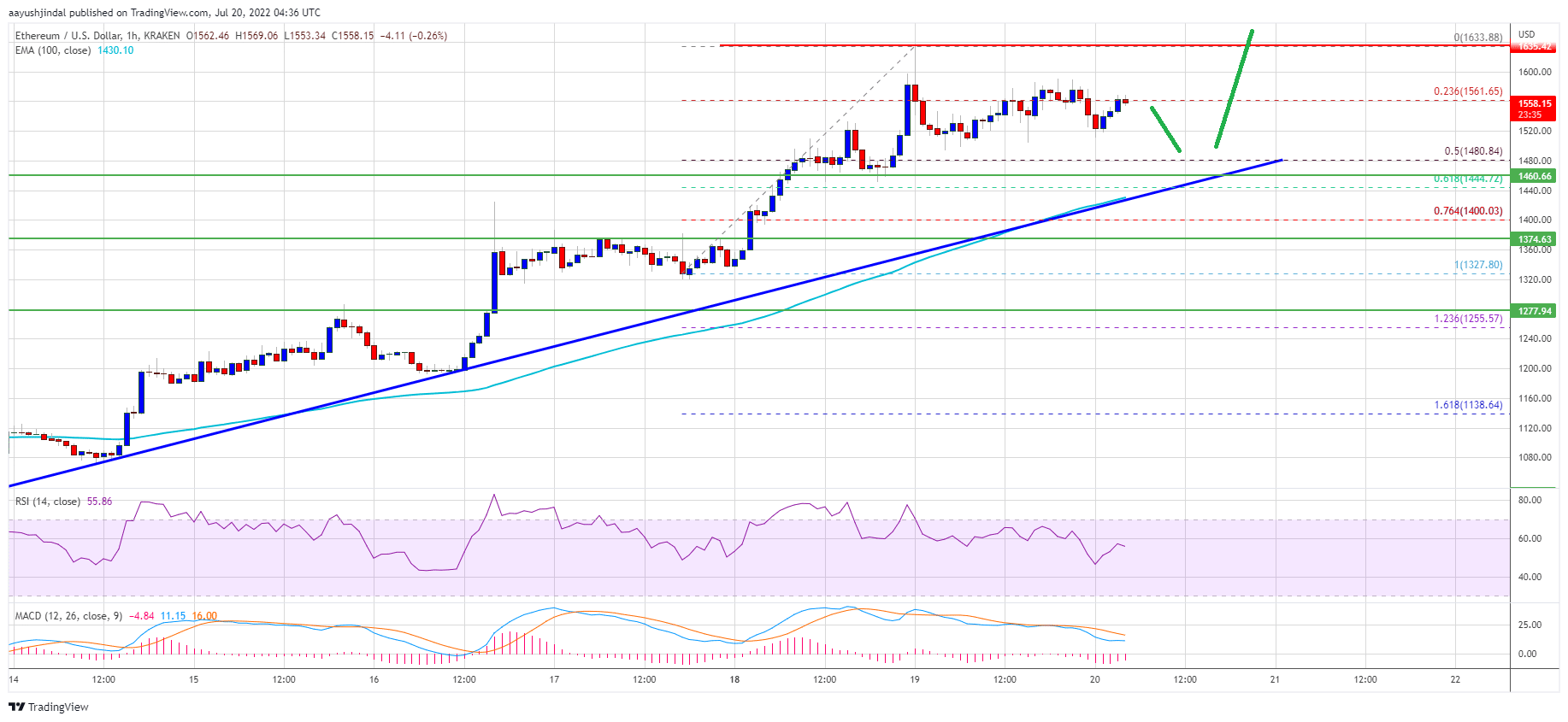

Moreover, the price surpassed the $1,609 resistance and currently sits comfortably above the 100-hourly simple moving average (SMA). The cost of Ethereum briefly traded at $1,633 before a market correction wiped out the price level. However, no move below the support zone at $1,540 has occurred.

As the price declined further, ETH pushed the 23.6% Fibonacci retracement level sideways. With the price swinging low from $1,325 to a high of $1,633, the bears are looking to spring a comeback. However, the bulls are pretty active at the $1,500 support zone, thus keeping the bears at arm’s length.

Furthermore, a significant bearish rally is mounting near the $1,480 support, as shown in the ETH/USD hourly chart. Accordingly, the trend line has shifted close to the 50% Fibonacci retracement level of the upward price movement.

The token will find immediate price resistance on the upside close to the $1,600 price mark.

(ETH/USD chart. Source: TradingView)

Ethereum’s price at this stage might gain momentum and rise above the resistance zone of $1,800 in the coming days.

Is There Support for the Price Dip?

The general view is that Ethereum’s resistance hurdle, given the current price action, is $1,600. If it failed to move to pass the current resistance zone, it could kickstart a downward trend for the token.

Meanwhile, the initial support for the upcoming downtrend is close to $1,520, which the token is expected to get by.

Further analysis indicates that for both the trend line and the significant support, the price mark of $1,480 is set if the price bounces back.

However, further losses in value will push the price of ETH below the support zone at $2,450, which will prove harmful to the upcoming price action. In this case, the cost would drop in the 100-hourly simple moving average (SMA).

Ethereum’s upward movement will be halted by the competing price metrics, which will slow down the modest gains recorded. As the broader crypto market correction is not yet over, consistent performance of the ETH is critical.

If another significant dip in price occurs, the token may not be able to maintain the recent gains for some time. The bears are ever ready to come back once the opportunity presents itself.

However, the good news is that Ethereum’s technical indications show bullish momentum for the time being.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.