According to Similar Web, last month marks the first time that Ethereum mining revenue will be up to $1.37 billion. That figure represents an almost 65% increase in revenue from that of January. Eth miners earned just below $830 million in revenue in January 2021.

Source: Similar Web

However, a little over $720 million of the income were from transaction charges. The rest (about $645 million) were block subsidies. The continuous growth in the network’s hash rate has caused its mining operations to increase by 16%. As of this writing, Etherscan reports that there are over 420,000 gigahashes per second (GH/s). Similarly, there has also been an increase in mining difficulty. The previous peak was set on the first day of last month and it was over 4,500 tetrahashes per second (TH/s). However, it is currently close to 5,500 TH/s and it shows no sign of reducing in growth.

Increase in ETH mining income

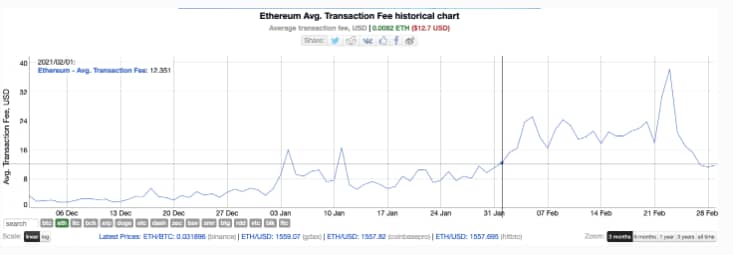

At the beginning of this year, almost 30% of ETH income was earned through network fees. It is on record that there was a 217% increase in Ethereum transaction fees – it was $12 in February but rose to $38 five days to the end of last month.

Source: bitinfocharts

Hence, it is no wonder that there is an increase in growth fee revenue. Miners may have been forced to sell ether and earn more gains due to the increase in transaction fees. But gas fees were back at less than $12 and the cause might be the announcement of the Ethereum improvement proposal (EIP-3298) by Vitalik Buterin on Github.

Buterin’s GitHub post suggests that the London upgrade will see a removal of the gas refunds linked with the “SELFDESCTRUCT” function. Hence, there would be a decrease in the in the purchase of gas tokens.

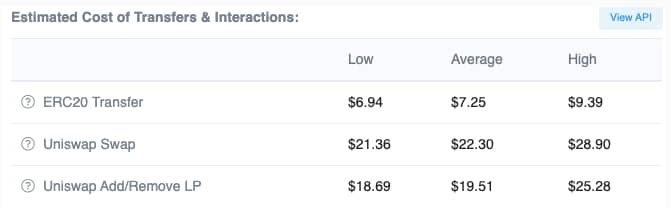

After the first EIP-3298 announcement on February 26, there has a gradual reduction in gas fees. At the moment, it would cost almost $7.27 per transaction to transfer one ERC-20 on Ethereum.

Source: Etherscan.io

Possible Causes of Reduction ETH Mining Revenue

The EIP-1559 is an additional ETH improvement development that can lessen miner’s gains from trade deals. It was first released three years ago and the rising gas fees have made its upgrade to be highly anticipated. With the upgrade, the significant reduction in ETH fees will be more profitable to ETH holders than miners. Also, this proposal will ensure that there is less volatility in the network’s gas fees compared to that which was experienced last month.

Hence, miners will lose one of the main revenue streams – transaction fees. There are several contradictory views on the effects of the upgrade on the evolution of Ethereum. For instance, F2pool is in support of the upgrade because they believe it can have a significant improvement on the whole ETH network. F2pool constitutes almost 11% of ETH’s hash rate and currently occupies the top three spot in the Ethereum pool.

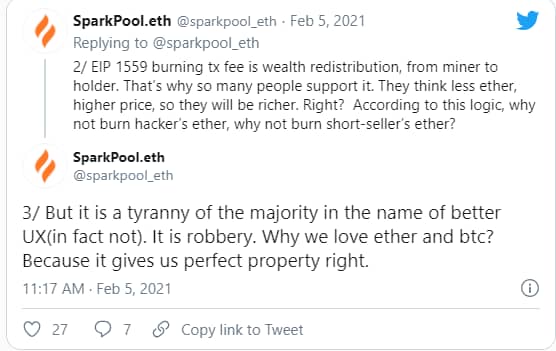

Curiously, Sparkpool opposed the EIP-1559 upgrade citing it as a robbery intended to redistribute potential wealth. Sparkpool constitutes 24% of ETH’s hash rate and they’re the largest mining pool on the ETH network.

Sparkpool’s Tweet. Source: Twitter

The effect of this proposal on miners will be known in due time. The launch of the EIP-1559 proposal will take place in July same as the ETH’s London hard fork. As gas fees decrease, there has been a slight recovery in Ethereum prices. This proves that transaction fees are hugely important in its prices.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.