Over the past seven days, Grayscale capital has been increasing its Litecoin holdings buying over 16,000 Litecoins within that period. On Wednesday, the wealth asset management firm revealed that it had increased its Litecoin investment by about 9,000.

Grayscale’s Bullish Litecoin Moves

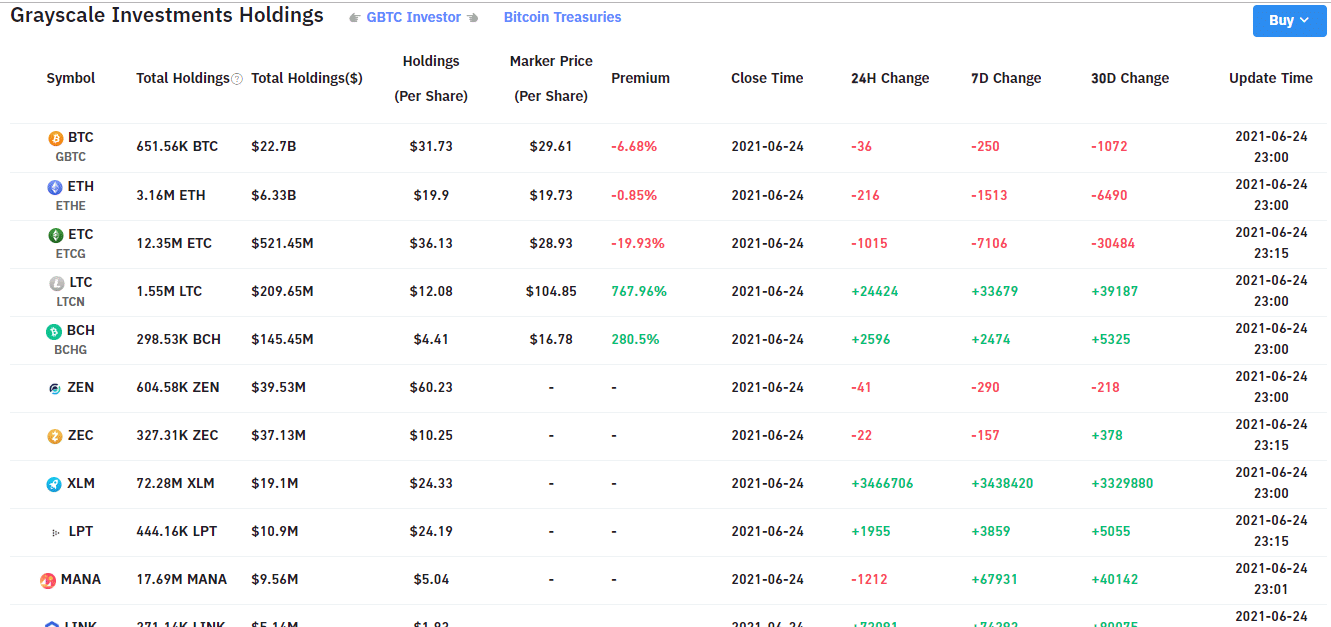

Its total Litecoin holdings in the last 30 days would amount to about 41,000 Litecoins. During that same time, the company was selling off vast amounts of its other cryptocurrencies. The company has sold the following virtual assets within the past day, 4,715 XLM (stellar lumens), 217 ETH, and 35 BTC.

The Grayscale holdings chart below shows that the company keeps increasing its Litecoin portfolio while going bearish for other crypto assets.

Grayscale Chart Holdings. Source: ByBt

No one will ever understand whale-like moves like this, which often differs from any move made by smaller investment firms or crypto wallet addresses in their effect on the market. However, the massive volume of Litecoin purchases that Grayscale has made over the last 30 days proves that the firm is incredibly confident that Litecoin would remain pacesetters for modern blockchain technology.

The truth is, crypto whale holders never make these kinds of moves in the market unless they’ve done their homework in the right way. Grayscale shows other crypto investors its analysis of the current market conditions and the path it thinks the market will follow in the medium-term.

While crypto investors can also be bullish like Grayscale, they should never be bearish on other digital currencies like them. Large investors like Grayscale often make such moves to influence the market in their favor. If they think their bullish moves with Litecoin can earn them some huge cash, they will do it. However, the remaining part of the market will keep moving as a decentralized network and still reward long-term investors.

Why Is Grayscale Loading Up On Bitcoin?

Various factors can cause a whale-like Grayscale to keep loading up on Litecoin while instantly dumping the majority of the other virtual assets. One possible reason is that they want to be bullish on Litecoin and its direction without being overexposed to the risk of investing in other crypto assets.

The Grayscale team may have felt they are holding an excess of some virtual assets, which might further increase their risk, especially with rapid changes happening in the crypto asset market and blockchain technology.

Hence, they started liquidating other cryptocurrencies that they are no longer buying actively but have to reduce their risk in a specific crypto asset. As one of the top investment firms in the crypto world, Grayscale wouldn’t want to overly expose itself to enormous risk by keeping a surplus of its investment in one crypto asset.

Bear in mind that their combined holdings in other digital currencies run into billions. Their purchase of Litecoin is proof that they are positive about the returns they would earn from investing in the asset and its benefit to the crypto world in the medium and long term. Only time will tell whether Grayscale is right about their decision.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.