The popular digital currency investment firm, Grayscale, has revealed that it will be investing in other digital assets with a large focus on the Defi space like Polygon (MATIC).

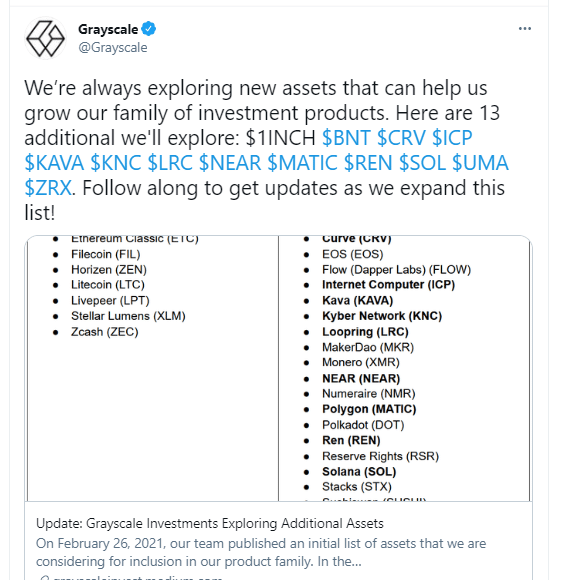

Grayscale Already Considering 13 Virtual Assets

Other digital assets Grayscale hopes to explore include 0x, Universal Market Access, Solana, Ren, Near, Loopring, Kyber Network, Kava, Internet Computer, Curve, Bancor, and 1inch. They will also look to invest in Tezos, Polkadot, and Cardano.

Grayscale announcement. Source: Twitter

Thus, the total number of assets Grayscale is now considering is 31. Grayscale enables investors to own digital assets via public and private funds. Already, there are 13 assets under its management. They are Zcash (ZEC), Stellar Lumens (XLM), Livepeer (LPT), Litecoin (LTC), Horizon (ZEN), Filecoin (FIL), Ethereum Classic (ETC), Ethereum (ETH), Decentraland (MANA), Chainlink (LINK), Bitcoin Cash (BCH), Bitcoin (BTC) And Basic Attention Token (BAT) in no particular order.

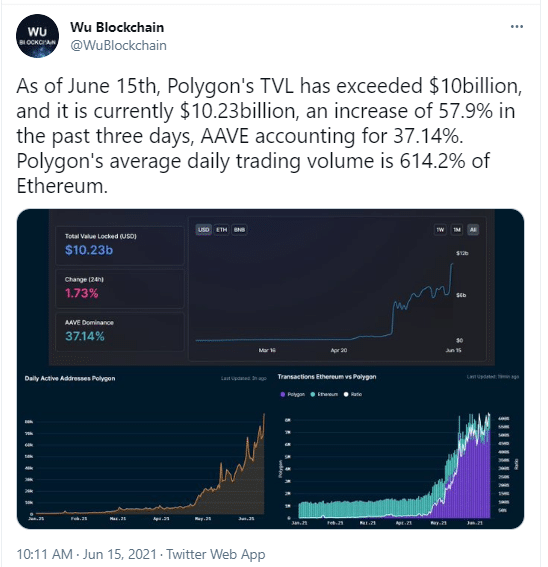

Keep in mind that most of the assets under consideration by Grayscale have been experiencing phenomenal growth. For example, polygon’s total value locked (TVL) is now well over $11 billion. A fact substantiated by respected crypto-journalist Collins Wu.

Wu Blockchain Polygon Tweet. Source: Twitter

There have been times this year that polygon has exceeded Ethereum and Binance Smart Chain (BSC)’s daily active wallets. Also, in recent months, MATIC (polygon’s native token) has been experiencing substantial growth.

However, Grayscale has clarified via a blog post that “it won’t invest in all the assets under consideration.”

Grayscale Bitcoin and Ethereum Trusts Account for $35 Billion Assets Under Management

As of yesterday, the value of assets under Grayscale management is about $35 billion. Digital asset investment firm, Coinshares, estimated that Grayscale’s investment products are about 74% of assets among institutional cryptocurrency investment products. Grayscale’s announcement indicates that more investors are willing to explore digital asset investment vehicles apart from bitcoin like decentralized finance Defi) and Ethereum.

So far this year, cash flow into Grayscale’s bitcoin and Ethereum trusts have exceeded $2.5 billion. However, Grayscale‘s bitcoin trust (GBTC) remains its largest investment product with over $26 billion worth of assets under its management.

The Ethereum trust rounds up the top two trusts, and it accounts for about 23% of the total asset under management market. The remaining trusts account for only 3% of the total asset under management.

Micheal Sonnenschein, Grayscale’s CEO, recently revealed in an interview with CNBC that most investors now consider crypto as a genuine asset class. He opined that investors’ confidence is due to the interest of the government in regulating the industry.

Sonnenschein also encouraged investors to use the current pullback in the market to increase their investment portfolio before the market goes on another bullish run.

Unfortunately, GBTC has been trading at a discount for over four months now. That is, the net asset value of GBTC shares is far greater than its market price. As of this writing, the GBTC discount is about – 15%. Analysts cite fresh competition and selling pressure from current clients as factors for this GBTC price slump.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.