The price of Bitcoin (BTC) saw a 19% drop in August, marking its biggest dip for 2024 and its sharpest monthly drop since June 2022.

Bitcoin (BTC) dropped below $50,000 after the Bank of Japan said it would raise its interest rate from 0% to 0.25%.

The decision to hike rates directly affected the US stock market, as the traders were borrowing Japanese Yen at low interest rates to purchase assets in the US market. This paradigm shift directly affected risk assets, with Bitcoin recording deeper corrections.

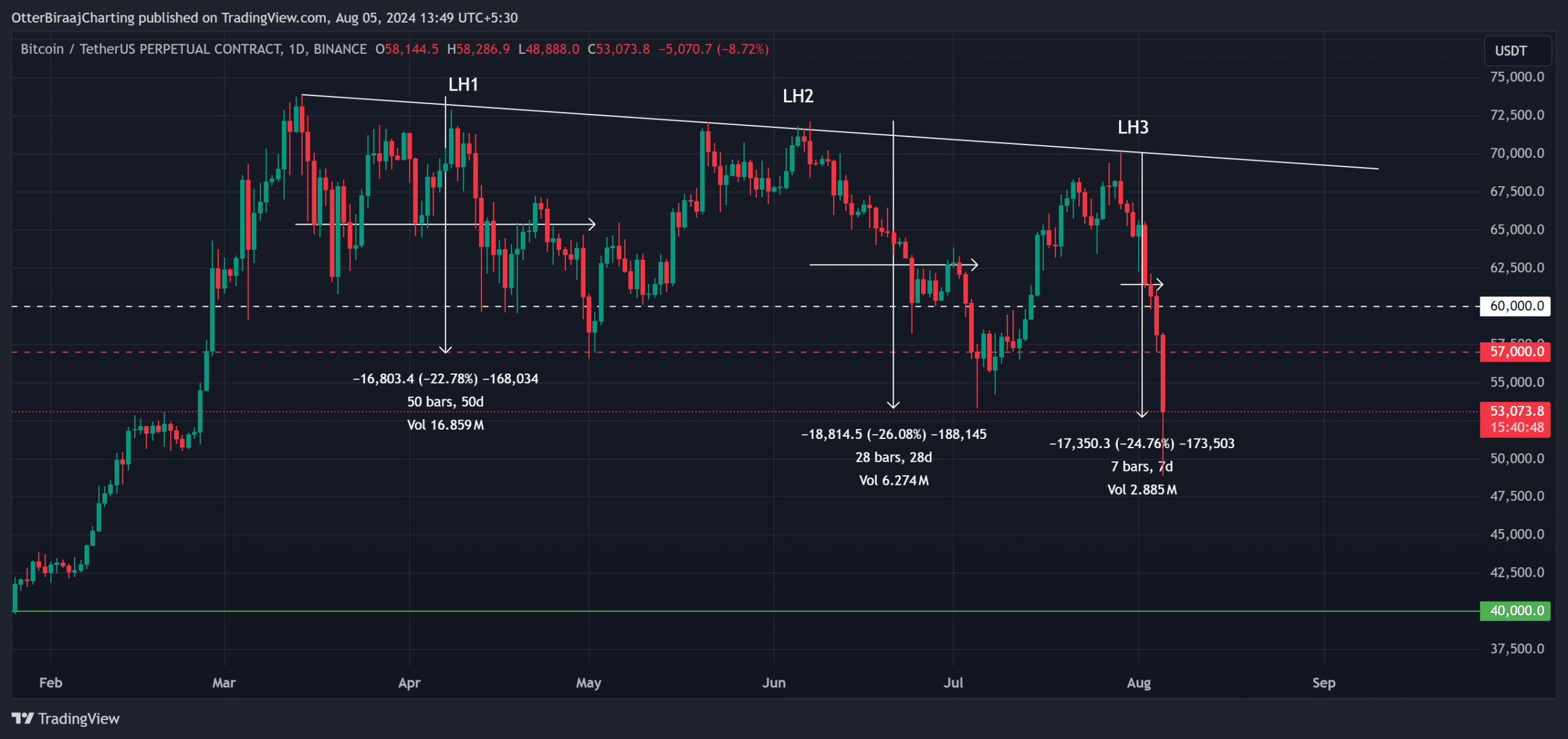

Bitcoin Repeats ‘Lower High’ Trend From Q2

Bitcoin recorded a third lower high (LH3) on July 29, when it hit $70,000 briefly. This specific pattern has signaled a major bearish reversal every time in 2024, with BTC currently down 25% since LH3. In the past, the lower highs seen in April and June 2024 resulted in notable corrections of 23% and 26%, respectively.

Where Is Bitcoin’s Next Major Support Zone?

Bitcoin’s flash crash caught everyone off-guard. The price of Bitcoin failed to hold its previous support levels at $60,000 and $57,000, eventually dipping below $50,000.

As Bitcoin’s market structure develops a new lower-low pattern, Axel Adler Jr, CryptoQuant contributing analyst, highlighted that the price of Bitcoin has recorded a fifth occurrence where:

“The price has fallen below the moderate risk lower boundary of 9% from the average purchase price of active investors. The support level for this cohort is $48K.”

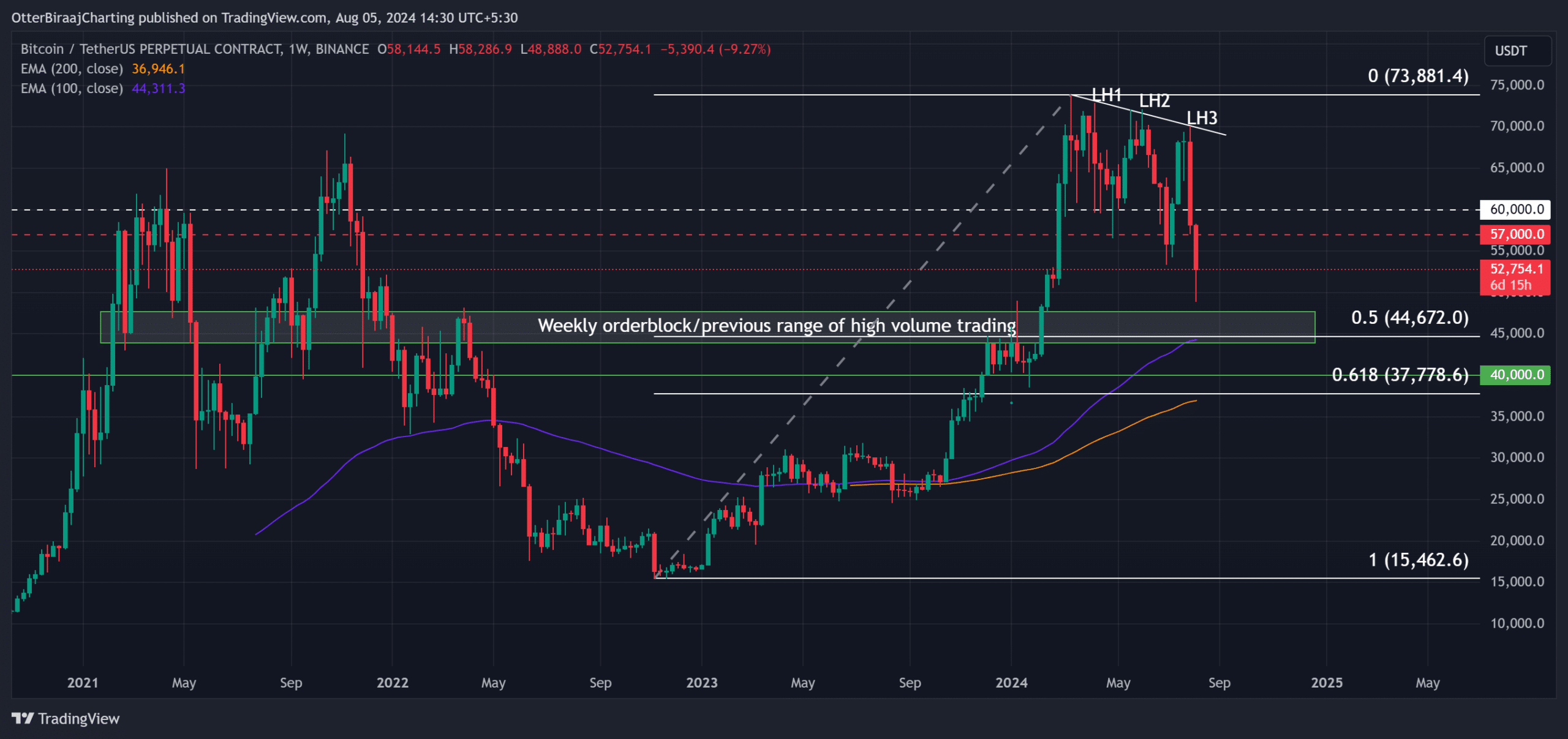

Moreover, the founder of the Capriole Fund, Charles Edwards, thinks that Bitcoin needs to start retracing at its current range of nearly $52,000. Nonetheless, if Bitcoin fails to hold its position above $50,000, its next key support is found near $44,000.

The low $40K-levels served as the consolidation zone between December 2023 and February 2024.

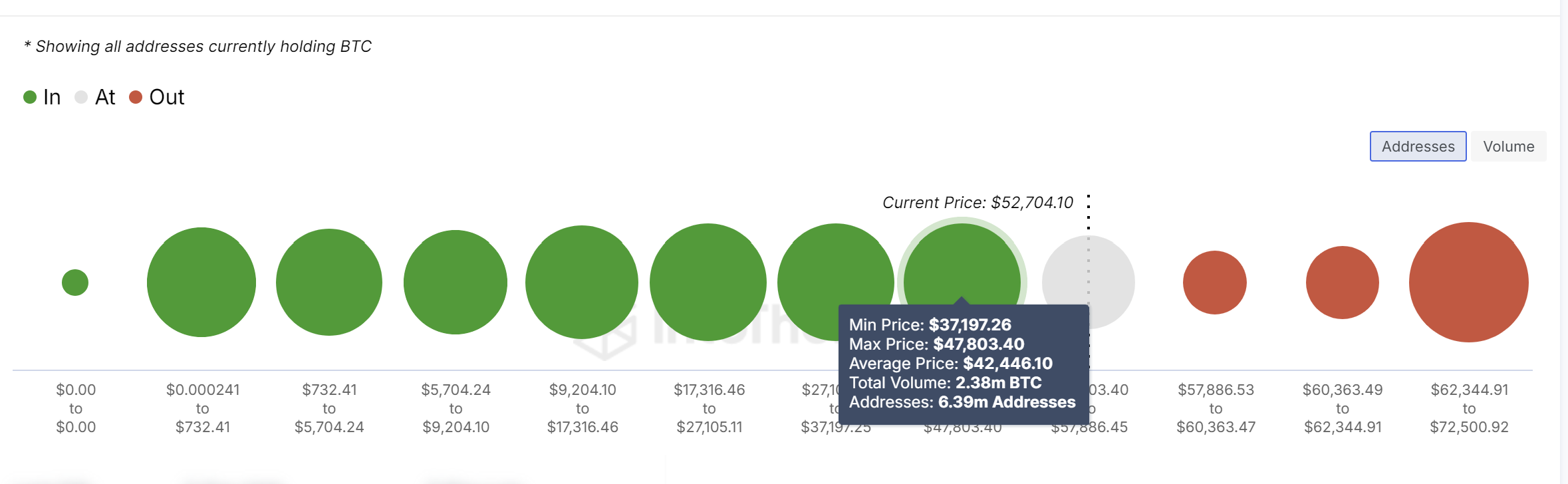

6.39M Addresses Defending Bitcoin At $42K

While popular proponents implied that Bitcoin needs to bounce at $48,000 or $44,000, Intotheblock data shows that the whales’ cohort remains further down.

Nearly 6.39 million addresses now hold 2.38 million BTC at an average value of $42,446. A retest of $42,466 will introduce another 18% correction from its current market value. That might eventually create more panic and extensively affect buyer confidence.

From a technical point of view, a bidding range between $44,000 and $48,000 makes sense since there is a weekly order block formation in this range, which confluences with two more indicators.

Therefore, Bitcoin’s price has a great opportunity of retesting the weekly 100-exponential moving average (100-EMA) at this range — and the 0.5 Fibonacci level is almost the same level at $44,672.

Despite the gloomy outlook, Bitcoin might prevent more downside pressure if it closes the day above the $51,000 level.

Crypto analysts insist that the latest Bitcoin sell-off might result in lower lows, possibly threatening a drop toward $40,000. The flagship crypto dropped to levels last seen in February 2024 below $50,000. According to Alex Kuptsikevich, senior market analyst at FXPro, Bitcoin could drop lower in the coming weeks.

The analyst told reporters:

“At its lowest point, Bitcoin dipped below its 50-week moving average. Without strong buyer support right now, it goes even lower, and it would trigger an even more active sell-off as it did in late 2021 and early 2022. If it doesn’t hold either, it’s worth preparing for a failure towards $42K.”

$42,000 is an integral zone for crypto investors and the price action at these levels might determine Bitcoin’s momentum in the near term.

Can Bitcoin Remain Above $45,000?

Despite the recent downward pressure, Bitcoin might still stage a recovery and avoid printing lower lows. Nevertheless, Bitcoin must decisively reclaim the $51,000 mark to avoid more downside, based on pseudonymous crypto analyst the Moon, who wrote an August 5 X post:

“BTC must get back above the support, otherwise we might dump to $45,000.”

Bitcoin’s more than 20% drop is in line with previous bull cycle retracements and was originally triggered by a failed attempt to conquer the $70,000 mark, as highlighted by Kuptsikevich. He added:

“Active pressure on the first cryptocurrency started after a failed attempt to go above $70K and overcome the resistance of the descending channel seven days ago.”

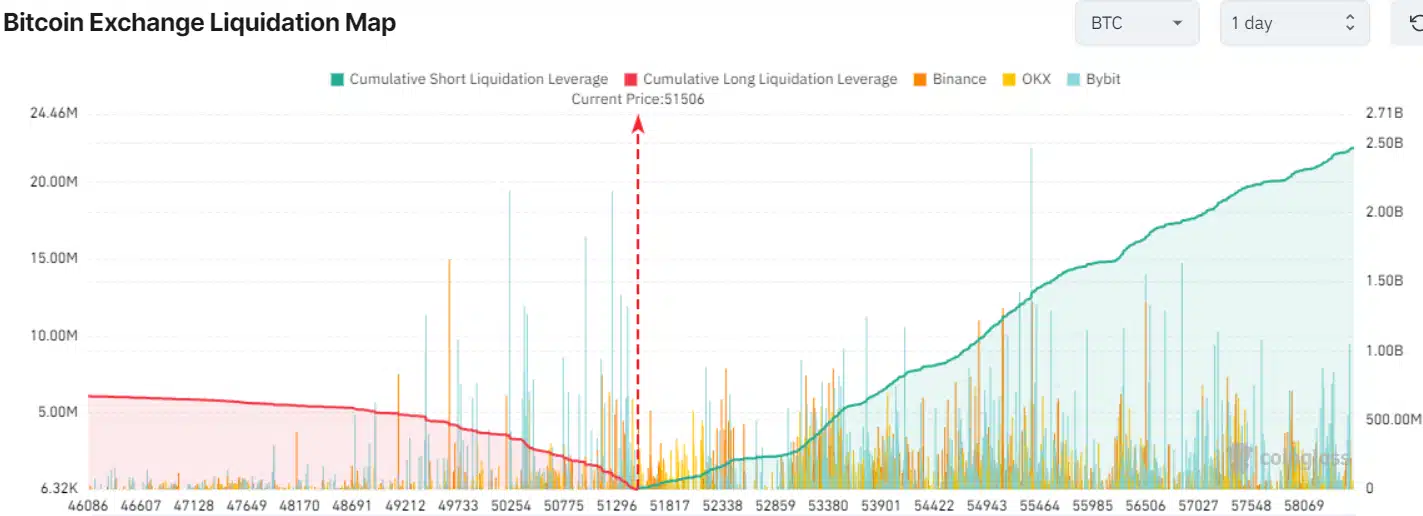

Bitcoin Has Major Support At $50,000

Despite the gloomy market outlook, Bitcoin’s value has a considerable support zone at the $50,000 psychological zone. More than $400 million worth of cumulative leveraged short positions would get liquidated if BTC possibly dropped below the $50,000 zone, as highlighted by Coinglass data.

Short Bitcoin liquidations might surpass $520 million across all exchanges in case the price of Bitcoin drops below the $49,400 level.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.