LDO, the governance token of the well-known Ethereum staking service Lido Finance, recently suffered a steep decline. The token’s value decreased by nearly 8.7% within the last 24 hours and 26.6% throughout the previous week.

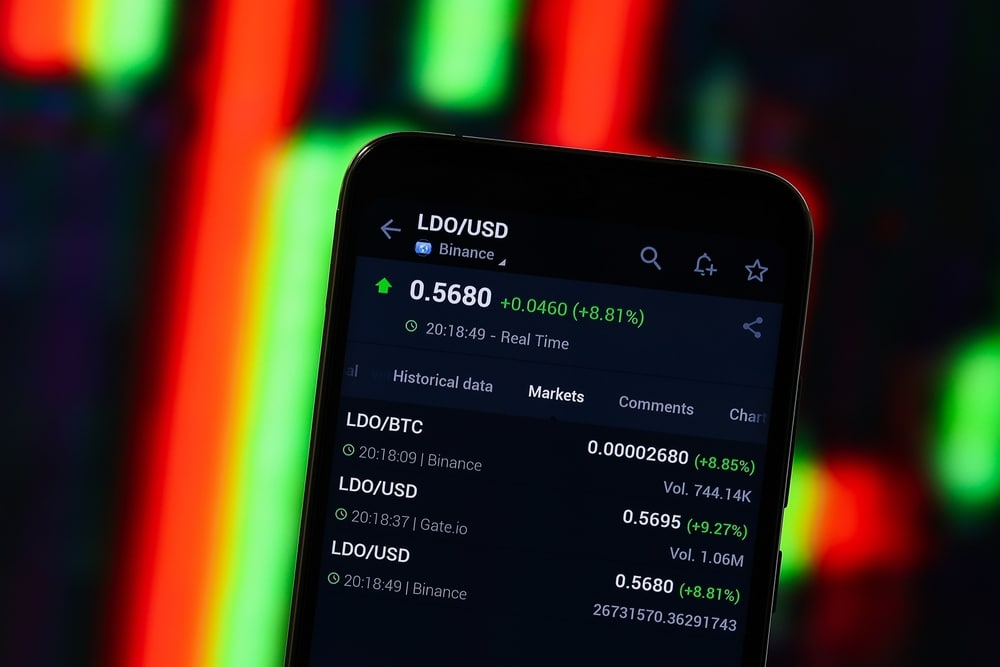

Currently, LDO is trading at $2.06, according to Coingecko data. The values of the leading market tokens have decreased within the previous day.

The market is declining and grappling with its support and resistance thresholds.

The Possible Reasons For LDO’s Price Decline

The sharp decrease in LDO’s price may be due to a partner company’s decision to discontinue liquid staking on Kusama and Polkadot. MixBytes — Lido’s partner company in development for staking on Kusama and Polkadot, has declared that it will no longer back the network.

Mixbytes’ decision partly explains the significant drop in LDO’s price this past week. Another possible reason is that the Securities and Exchange Commission in the U.S. has issued Lido, along with a couple of other cryptocurrency initiatives, a Wells Notice each. The disclosure of this information was initially made public by David Hoffman from Bankless, though he later withdrew the statement.

There has yet to be an official verification of this notice. MixBytes recently revealed that by August 1, 2023, its team would no longer work or support Lido on these two networks.

Beginning on March 15, users can no longer stake deposits into Lido for the Kusama and Polkadot protocols. The official statement indicated that the community intends to establish a UI alternative host by August 1.

Nevertheless, MixBytes seeks to raise $100K from VCs to sustain its technical upkeep efforts over the next five months.

Lido To Permit Withdrawals Of Ethereum

The decline in LDO’s value remains a huge surprise to many, given the surge in the popularity of liquid staking within the last 12 months. Staking activities have overtaken DeFi lending and rank as the second-largest segment in DeFi.

Among the various DeFi staking protocols, Lido stands out as the most famous. In February, Lido experienced an unprecedented 150,000 ETH inflow for staking, and there were speculations that Justin Sun—the TRON founder, owned the assets.

Additionally, Lido intends to enable Ethereum withdrawals, but this feature will only be available after Ethereum’s Shanghai upgrade.

Editorial credit: photo_gonzo / Shutterstock.com

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.