Investors can breathe a sigh of relief as Securitize Inc. is developing a distributed ledger technology (DLT) platform that allows them to invest in various closely held assets, including closely-held companies.

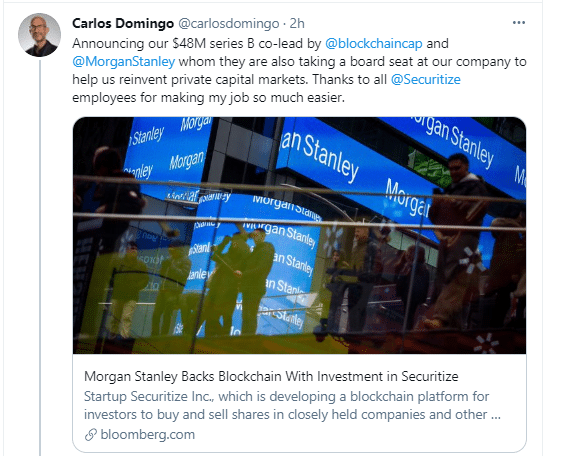

Bloomberg reports that the digital security firm recently realized over $50 million in a Series B fundraising round with Blockchain Capital fund and Morgan Stanley among the top investors. Carlos Domingo, Securitize’s CEO, and founder shared the outcome of the fundraising event on a 4-part thread on Twitter.

Carlos Domingo Tweet. Source: Twitter

Domingo remarked that this is Morgan Stanley’s first shot at investing in the blockchain industry, which is good for the company and serves as an excellent validation for the whole crypto industry. He also revealed that a top-level member of Blockchain Capital would also be among Securitize’s board of directors.

Wall Street Keeps Embraces the Blockchain Industry

Morgan Stanley’s investor department revealed the good news this morning. It also revealed that Pedro Teixeria would become one of the Securitize board of directors and one top-level executive from Blockchain Capital, as disclosed above. Teixeria currently co-heads the bank’s tactical value investing department.

According to Bloomberg, neither Morgan Stanley nor Blockchain Capital has publicly revealed their investment amount into Securitize. The original press release from Securitize disclosed that Sumitomo Mitsui trust bank, NTT data, Migration Capital, and IDC ventures also invested in the company.

Stanley’s investment in this DLT startup proves that wall street will invest in any blockchain-related financial technology (FinTech) company; this includes companies utilizing or intending to utilize digital tokens for their assets such as stocks and real estate. Consequently, Securitize can be likened to the Robinhood of publicly traded firms.

As of this writing, over 310,000 investors have opened accounts with Securitize to invest in stocks, and over 105 companies are seeking funds via the Securitize platform.

Signature Bank’s Blockchain Payment Platform Now Accepts Trueusd Stablecoin

As more companies invest in blockchain-related products and services, most banks are especially fascinated with stablecoins because of these coins’ speed and reliability.

Consequently, Signature Bank is now the first American financial institution to accept stablecoins as a means of payment. Signature’s signet platform (its digital payment platform) has collaborated with Trueusd to incorporate multichain stablecoin (TUSD) payments in its services.

Hence, Signet can now redeem and mint TUSD in real-time. Signature bank’s customers can also invest in the stablecoin as it is supported in a ratio of 1:1 based on the U.S. dollar reserves. Also, its on-chain proof-of-reserves and the services of an independent accounting firm make it regularly verifiable. A side benefit for signet customers is that they can convert their TUSD in real-time and send the U.S. Dollar equivalent anywhere and anytime.

Joseph J. DePaolo excitedly shared the news saying that “our new offering is proof of our desire to offer advanced services to all our clients. Thus, strengthening our position as one of the leading banks in the cryptocurrency space.”

Jennifer Jiang, Chairperson for Trueusd, also said, “Trueusd’s collaboration with Signet is of outstanding significance to our growth as a proven virtual asset. Through this partnership, our customers can perform their transactions in real-time regardless of their location.”

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.