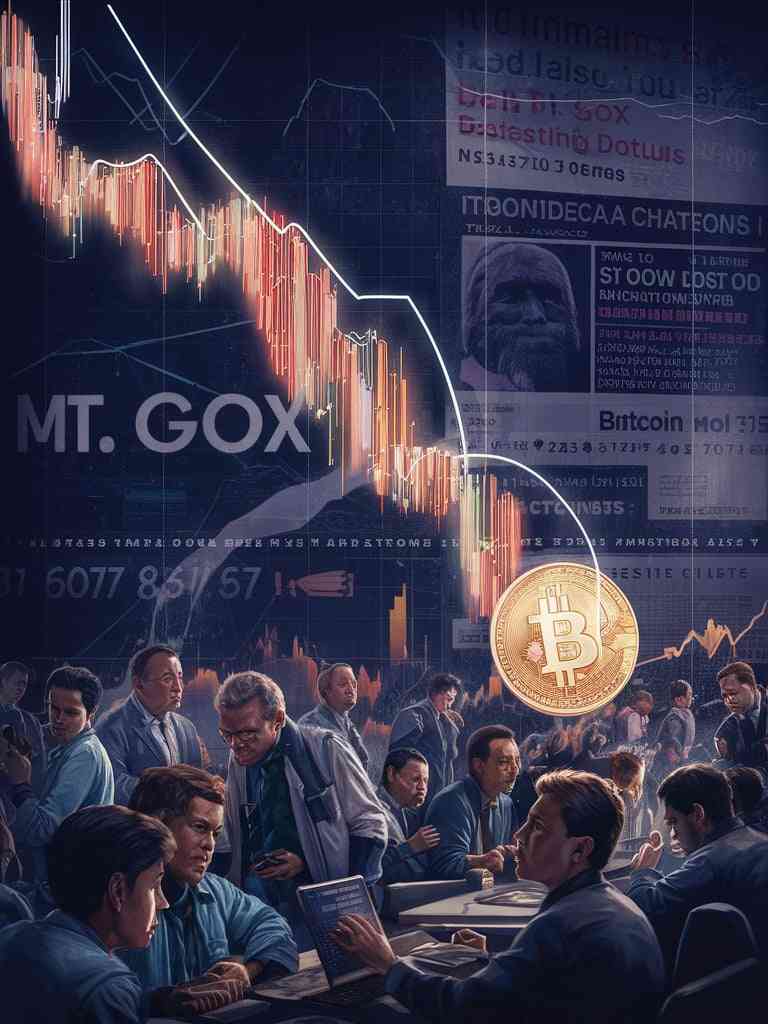

The price of Bitcoin has dropped by 3%, causing major market volatility. This was mostly caused by huge transfers associated with the defunct Mt. Gox exchange. Investors and market analysts are concerned about the sudden movement of Bitcoin out of the wallets of the now-defunct exchange, which has heightened volatility and uncertainty.

Mt. Gox declared bankruptcy in 2014 following the loss of 850,000 Bitcoins in a significant hack. The cryptocurrency community has been intently monitoring the recovery and allocation of the remaining assets since it announced its refunding process.

The current market volatility has been intensified by the transfer of Bitcoins associated with Mt. Gox. The possibility of significant sell-offs has further shaken investor sentiment, which was already shaky owing to pressure from regulations and concerns in the global economy.

Experts Advise Investors to Expect Fluctuations in the Price

According to Bitcoin researcher Jane Simmons, “Any movement from Mt. Gox wallets are seen as an event that will usher in significant market activity.” Financial strategist Michael Carter stated, “Investors should be ready for large and abrupt fluctuations in price, particularly when handling legacy problems such as the Mt. Gox case.”

Data from Lookonchain revealed that Mt. Gox, on Tuesday, moved 44,527 BTC, which is equivalent to $2.84 billion, to an unknown wallet address. This movement is suspected to be funds used in readiness for the repayment to affected creditors.

Mt. Gox holdings are currently 138,985 BTC and valued at $8.87 billion. The total loss suffered by Mt. Gox customers are estimated at $9 billion. However, the recent movement of funds is expected to trigger a Fear, Uncertainty, Doubt (FUD) situation, which also played out in a 3% drop in the price of Bitcoin on Tuesday.

Blackrock CEO Speaks, Admits Bitcoin’s Domination of Global Economy

According to some analysts, the market might stabilize and gain from greater openness once the seized assets are dispersed in full and the confusion is cleared up. Simmons also added that the market’s maturity and resilience will ultimately be determined by its capacity to absorb these assets without suffering significant disruptions.

The influence of Micheal Dell, the CEO of Dell Technologies, and his interest in Bitcoin is believed to have the power to enforce its adoption in the United State technology industry. According to the interview with Larry Fink, the Blackrock CEO on CNBC, BlackRock is in charge of $10.5 trillion and is optimistic about a possible Bitcoin economy. Fink also called Bitcoin the digital gold and a viable alternative to economic stability.

Recent market data has shown that the United States spot BTC ETF on Monday, had $300.90 million worth of inflow. This development has been described as a sign of an increased investor’s interest and also represents a temporary increase in the price of Bitcoin. The cumulative Bitcoin reserve by the eleven United States BTC ETFs has been summed up to $51.22 billion.

Price of Bitcoin Breaks Above Low Point, Rally 6.5%

Data from a chart published by Coinglass Bitcoin Total Liquidations has it that $71.02 million kept in short positions were liquidated on June 15, compared to its former $9.94 million kept in a long-term position. The pressure in the upward trend on the price of these assets motivated by short coverings indicates increasing volatility and a future shift in market sentiment, hence, targets towards a bullish outlook.

On Sunday, the price of Bitcoin broke above its low point to rally 6.5% on Monday. Bitcoin, as of press time, has entered another resistance level to trade at $62,641 after losing 3% of its initial value. Sideline traders are looking to leverage the opportunities at $57,800 and $59,200 price levels.

Market watchers are forecasting a 10% rally in the price level, believing its daily price resistance could reach $64,913. The daily Relative Strength Index (RSI) has it that the BTC has rallied above 50, which is the neutral level. The Awesome Oscillator (AO) is moving towards its neutral position, maintaining its different positions above the medium line, waiting for the bullish position to be maintained.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.