While they are unconfirmed, rumors suggest that the US SEC has knocked back at least two BTC ETF applications. Thus, indicating that the financial watchdog doesn’t have any plans to approve any BTC futures products soon. This is happening a couple of days after Direxion and Valkyrie submitted proposals for a bitcoin futures product with the SEC.

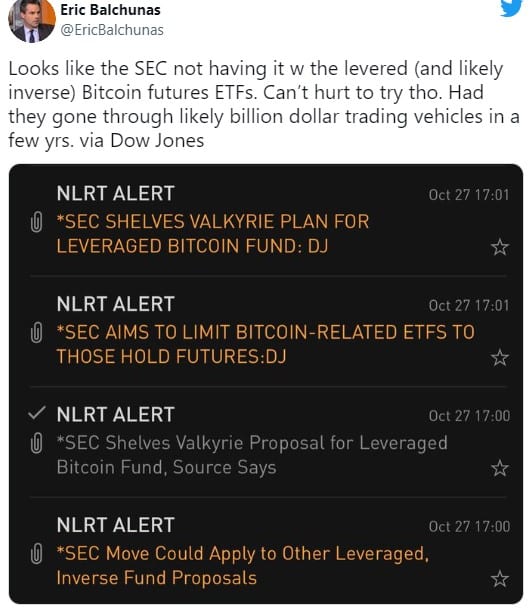

This morning, Eric Balchunas (a top analyst with Bloomberg) suggested that the SEC has knocked down Valkyrie’s ETF application citing a Dow Jones alert as reference. He also indicated that Direxion’s inverse fund application would also be given a similar treatment.

Eric Balchunas Tweet. Source: Twitter

If approved, Direxion’s BTC ETF would have helped investors buy futures during a bearish BTC price action. However, Valkyrie’s ETF would have given speculators a 1.25X exposure to BTC. While Valkyrie’s futures product involves options, futures, forwards, and swaps, Direxion’s proposal is strictly futures.

Dow Jones Alert In Perspective

A contrary Dow Jones indicator suggests that the SEC’s current focus is strictly on direct futures products, mainly contracts purchased from the CME (Chicago mercantile exchange). The financial watchdog isn’t ready to approve any other products different from this one.

Balchunas further supported this notion saying, “it would be fascinating should they approve this one because it was strictly futures-based. However, Valkyrie’s application was clearly diverse.” Nate Geraci (ETF store’s president) revealed that AXS investments also submitted two additional ETF proposals.

A separate Dow Jones alert indicates that Grayscale is convinced that the SEC will likely approve a spot BTC ETF by the middle of next year. Ten days ago, Grayscale submitted a proposal with the SEC to switch its famous futures-backed GBTC to a self-asset-backed spot fund. However, Geraci wasn’t quite sure that the spot crypto market wouldn’t be regulated by that time.

In other news, VanEck’s BTC ETF launch is close to happening. Its trade ticker is suggested to be XBTF, and Balchunas opined that there is almost a 100% possibility that trading could happen on Thursday or at most by Friday.

Indian Crypto Law Scheduled For February 2022

Business today (an Indian news media) has revealed that the authorities plan to release a crypto policy early next year. It is likely to be presented at the same time as the budget to the parliament. The news agency further stated that the policy suggests similar regulation for digital assets as it’s currently applicable to commodities.

A few months ago, Indian authorities clarified the category to which digital assets belong and stated that the country’s financial watchdog would be responsible for enforcing regulations for that sector. Despite the country’s apex bank’s concerns about the digital asset industry, the finance ministry continues to work with the apex bank to define the crypto regulations for the country clearly.

India’s recent actions and reports indicate that the government is no longer looking to ban digital assets outrightly, as has been the case for the past two years. Instead, it intends to use it as a revenue generator for the country’s economy.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.