TRUST FUND Review

TRUST FUND claims to be a leading global technology-enabled liquidity provider in financial products.

Basically, it offers online trading services for customers all around the world who want to either buy or sell CFDs based on popular instruments.

The brand seems to be established, as the information available on its website suggests it was founded in 2003. Anyways, to make sure the company can be trusted we are putting forward this updated TRUST FUND review.

CFD list

In terms of asset coverage, the broker does seem to hold an edge. Support for tens of crypto coins is more than welcome due to increased demand for such CFDs. Also, traders can use leverage, so even people with small accounts can get involved.

Alongside crypto, the list includes other popular markets like Forex, futures, commodities and stocks. We did not find any information regarding margin requirements on the website, but very likely max leverage is capped based on what you want to trade and the account type you choose. The point is that with so many instruments available, it should be convenient for traders to find the right CFDs to trade every day.

Accounts

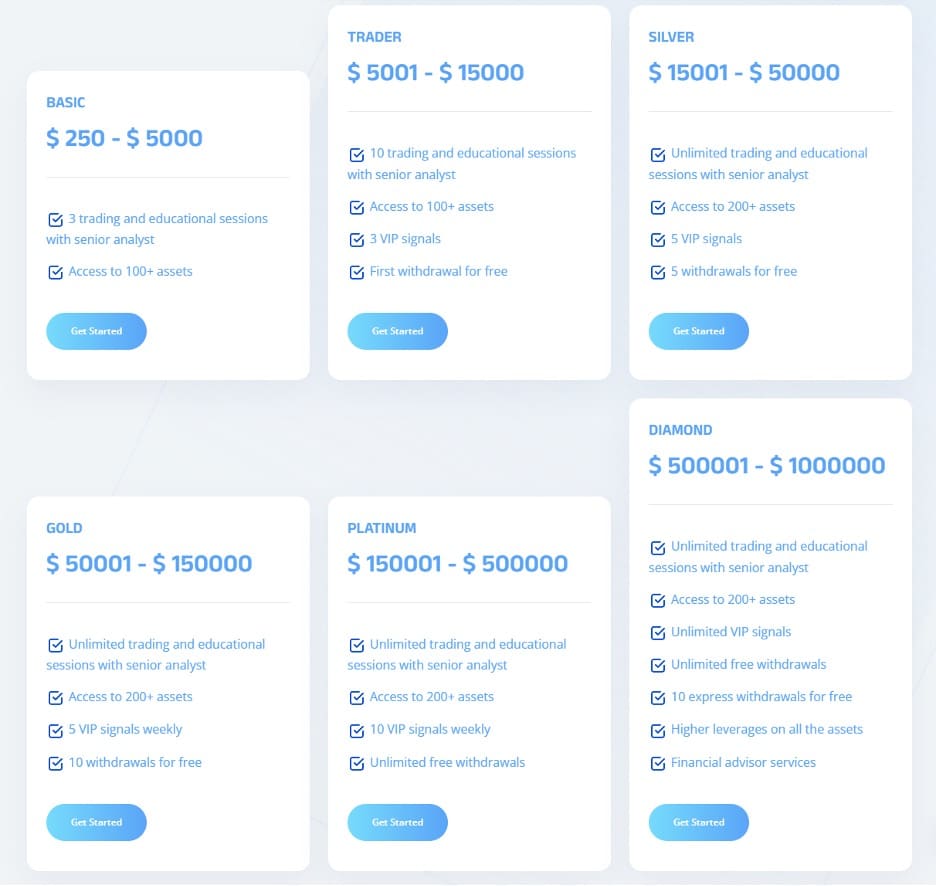

Let’s switch to account types, where TRUST FUND stands out again in terms of diversification. Traders can choose between 6 accounts (Basic, Trader, Silver, Gold, Platinum and Diamond). When looking at Basic, the low deposit requirement stands out. You only need $250 to get started and even at this point you still receive several educational sessions and access to 100+ instruments.

When moving to larger accounts, the broker demands larger deposits and in exchange for that, it provides better trading terms. Each user is free to choose which one suits them best, but the ultimate factor will be how much you are comfortable allocating to CFD trading.

Market resources

Efficient trading requires a specific list of tools and resources. Moreover, people wanting to learn how to buy CFDs should have access to the appropriate guidance. TRUST FUND sticks to the script and provides all its users with updated market resources.

At the Basic level, traders receive 3 trading and educational sessions with senior analysts. That number grows as we move up to Diamond accounts. Starting with the Trader account, the broker also offers VIP trading signals. These could be useful when you have no clue of what might happen next in the market.

Seeing what other traders think could provide a better perspective. Be aware that profits are never guaranteed, so simply copying trades without understanding the market is not the right trading approach.

Summary

To conclude, TRUST FUND is an appealing CFD broker where traders can choose between hundreds of assets. There are also 6 account types available, enough to satisfy a very large audience. The company stands out in terms of market resources, offering educational sessions to every client. Feel free to visit trust-fund.co if you need further information.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.