Blockchain technology has revolutionized finance by bringing cryptocurrencies into limelight. These have helped to improve payments and investment in many ways. However, every cryptocurrency has its own blockchain which it runs on.

For example ordinarily, you cannot use Bitcoin on the Ethereum network due to how the network is programmed. This places a huge barrier to decentralization, which is the core idea of blockchain technology – a decentralized network free from any form of central control.

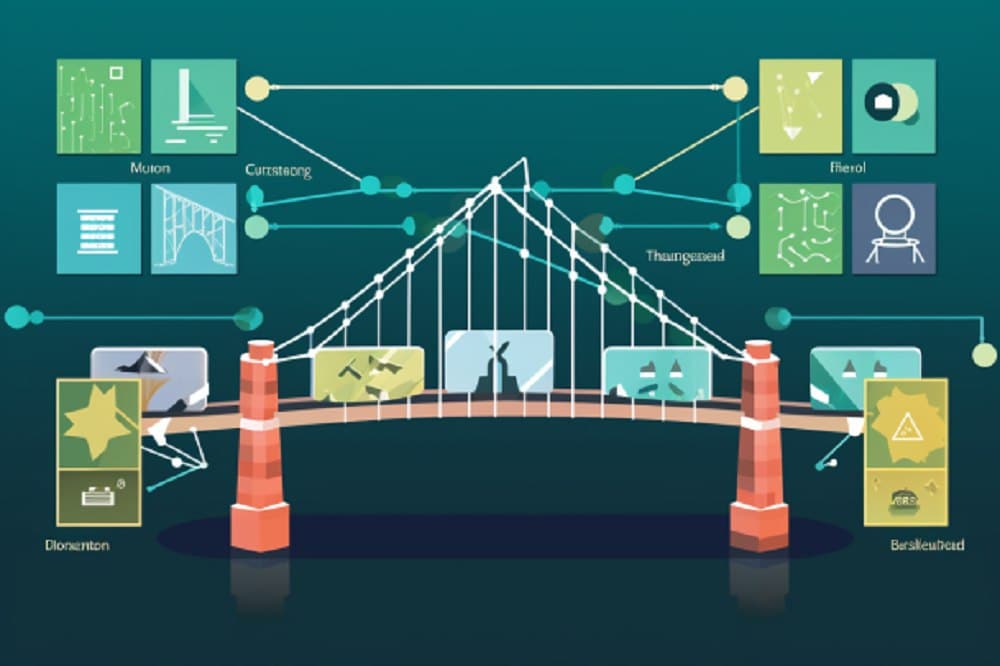

To attain full decentralization therefore, there’s a need to find a way of getting various blockchains to interact seamlessly with others. This gave birth to the idea of a blockchain bridge. Just like the name suggests, blockchain bridges serve as linkage between two or more blockchains, making it possible for the two to interoperate.

In this guide, we discuss blockchain bridges and the types, why they are important, their advantages and disadvantages.

What is a Blockchain Bridge?

Blockchain bridges connect two separate blockchains, bringing interoperability between the two. They are sometimes referred to as cross-chain bridges, and they work in different ways. You can use a bridge to facilitate free transfer of assets and information between layer 1 and layer 2 blockchains, as well as between different blockchain networks.

Because every blockchain project is programmed to function in a unique way, interoperability is impossible ordinarily. However with a blockchain bridge, seamless interaction between blockchains becomes possible. They can be trustless, trusted, bidirectional or unidirectional modes for transferring different transactions and data sets.

Types of Blockchain Bridges?

We could answer the question of how blockchain bridges work, but because there are different types and each functions differently, it is best to discuss the different types of bridges to help answer the question. Here are the different types of blockchain bridges.

Trusted Bridges

A trusted bridge uses a centralized approach towards facilitating interoperability. Under this system, users have to trust the integrity of the protocol and deposit funds on the bridge. Centralized bridges seem to have a simple user interface, making them attractive even to total crypto newbies.

Trustless Bridges

These are of course the opposite of trusted bridges. They leverage algorithms and smart contracts over a blockchain network instead of trusting in a centralized system. These types of bridges run almost completely on autopilot, with little to no human interference since smart contracts control the workings.

They also offer complete transparency by leveraging the advantages of mathematics, computer science, and cryptography for security of transactions. Users also have complete control of their assets since there’s no custodianship involved.

Unidirectional Bridges

Unidirectional bridges facilitate transactions in one direction only. It takes the direction of a transaction into account, and can only send transactions from blockchain A to blockchain B, but not the other way. Depending on your goals, you may find a unidirectional bridge is what you need.

Bidirectional Bridges

These are the opposite of unidirectional bridges. They ensure smooth transfer of assets between two networks in both directions.

Using the example above, this bridge can send transactions from blockchain A to blockchain B, and vice versa. Instead of using two unidirectional bridges for back and forth transactions, it may be more prudent to use a bidirectional bridge instead.

Risks of Blockchain Bridges

If you’ve been following happenings in the crypto industry, you must have read several stories about compromised blockchain bridges leading to the loss of millions of dollars in crypto assets.

While trusted bridges pose the concern of censorship by malicious bridge operators, trustless bridges are vulnerable to malware or bug risks in the smart contract code, as well as losses due to user error since users handle their own funds.

Because they are in their infancy, blockchain bridges have several vulnerabilities that criminals exploit to steal from investors. However with consistent improvement, it is hopeful that more secure blockchain bridges will evolve to facilitate better and safer interoperability between blockchains and networks.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.