3 Types of Costs for Ethereum 2.0 Validation Calculated by Jim McDonald

A researcher has attempted to foresee the expenses and costs for the validation of Ethereum (ETH) 2.0. He presents three kinds of costs for this validation.

Jim McDonald is a researcher from the Attestant staking service provider. He has tried to guess the costs and expenses that a validator will have to bear in the future during the Ethereum (ETH) 2.0 validation.

Three types of costs for ETH 2.0 Validation

After his calculation, he mentions three types of costs or expenses for future validation of Ethereum 2.0. These three types include expenses for setup, expenses for infrastructure and expenses for operation.

According to Jim McDonald, expenses for choosing the right hardware, the operating system, and software implementation are included in the first type of costs. The implementation of software is a difficult process as there are available around six implementations of the ETH network. Therefore, it will cost more.

The second type of cost is the infrastructure. McDonald says that in this kind of cost, a validator will have to bear depreciation expenses for hardware, electricity and network costs.

According to the calculation of Jim McDonald, the third kind of cost is related to the operation. Costs that will be spent during the software upgrades, maintenance of software, and during the re-evaluation of implementations are included in this kind.

Suggestion by Jim McDonald

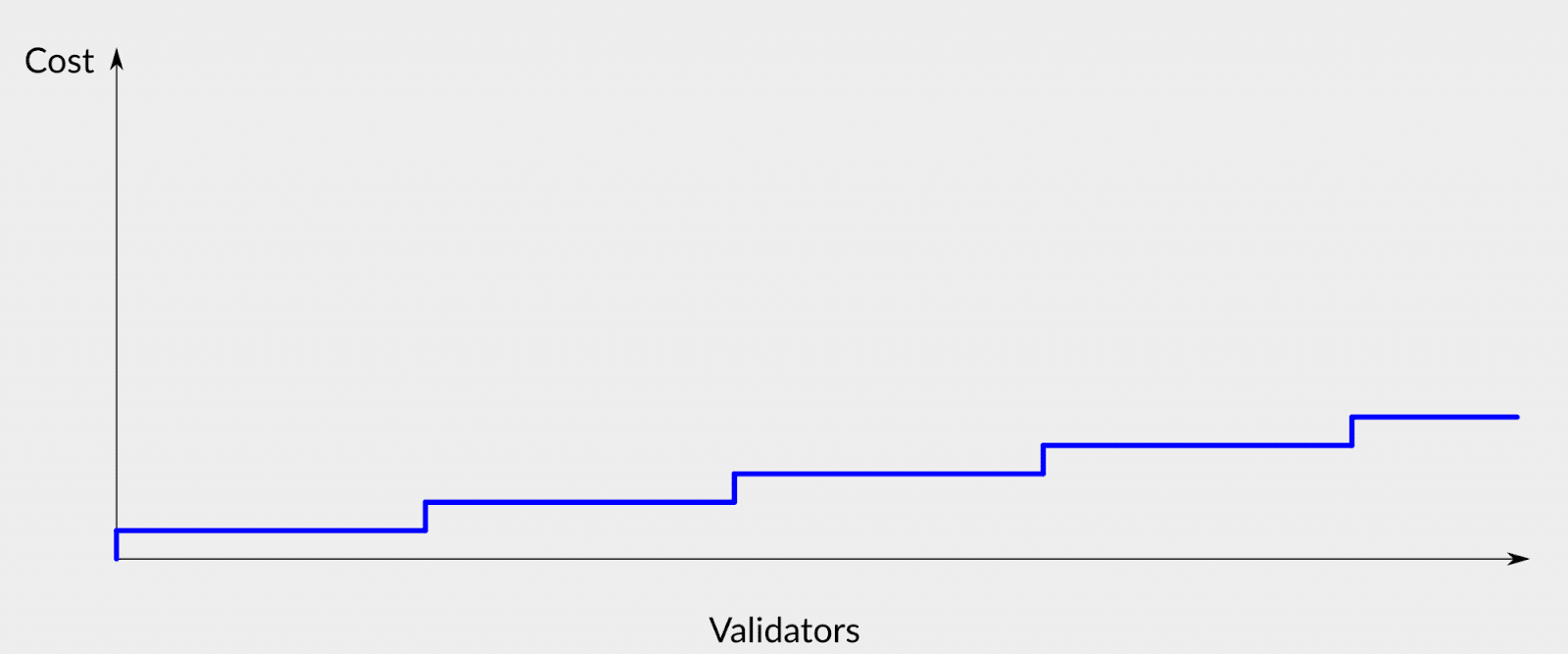

Jim McDonald, then, makes a suggestion for the expensive evaluation. He says that along with the progress of the phases of the Ethereum 2.0 network the expenses will also increase.

He shows the increase pattern for phase 1 and phase 2 in a chart.

There are only a few months left in the validation of Ethereum 2.0 from the mainnet launch. And we are seeing guesses and predictions about the costs and expenses of ETH 2.0 validation. Potential stakers are predicting whether it will be profitable to validate the ETH 2.0 transactions or not.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.