Bitcoin (BTC) might see a new all-time high because of the growing US federal debt, which has exceeded $105,000 for each living person in the country.

The surging national debt of the world’s biggest economy, the United States, might help catalyze mass Bitcoin adoption, as explained by analysts.

On July 30, the US federal government’s national debt exceeded $35 trillion for the first time, raising fears about the economy’s health.

Nevertheless, the expanding US debt might enhance the adoption of Bitcoin and its status as a haven asset, according to the CEO of Turbofish, Matt Bell. He told reporters:

“The recent news of the US national debt reaching the record high of $35 trillion highlights growing concerns around the sustainability of traditional fiat currencies. This situation stresses the importance of Bitcoin as ‘hard money’ — a decentralized and deflationary asset that offers a hedge against currency devaluation.”

In periods of fiat currency devaluation, investors wisely seek out haven assets, like gold and Bitcoin, to help protect their purchasing power. Bitcoin’s price has previously increased in periods of distress in the legacy financial ecosystem.

Will US National Debt Catalyze Next Bitcoin All-Time High?

The ballooning US national debt might help push Bitcoin’s price to a new all-time high.

Bitcoin’s price will benefit significantly from government bonds becoming less attractive since a major part of the United States government’s spending is directed toward debt servicing, not toward productive industries, as explained by Bitfinex analysts.

The analysts said the US national debt of $35 trillion shows the importance of Bitcoin as ‘hard money’ and possibly operates as a catalyst for the next upside cycle in Bitcoin. They added:

“This may drive investors to seek alternative stores of value like Bitcoin, which is often perceived as a hedge against economic inefficiencies.”

The analysts also stated that the imminent debt crisis could be avoided if the US dollar was a ‘hard currency,’ which does not have an unlimited supply. The analysts highlighted:

“A lot of the current US national debt arises due to inflation, loss of value in the currency against other currencies, and the ease with which any government can print as much money as it wants.”

Bitcoin can ideally be called upon as one of the only true hard currencies since it is protected against inflation to a large degree, has a restricted supply, is durable because of its digital nature, and is majorly available.

Is Bitcoin’s Price Ready To Break Out In September?

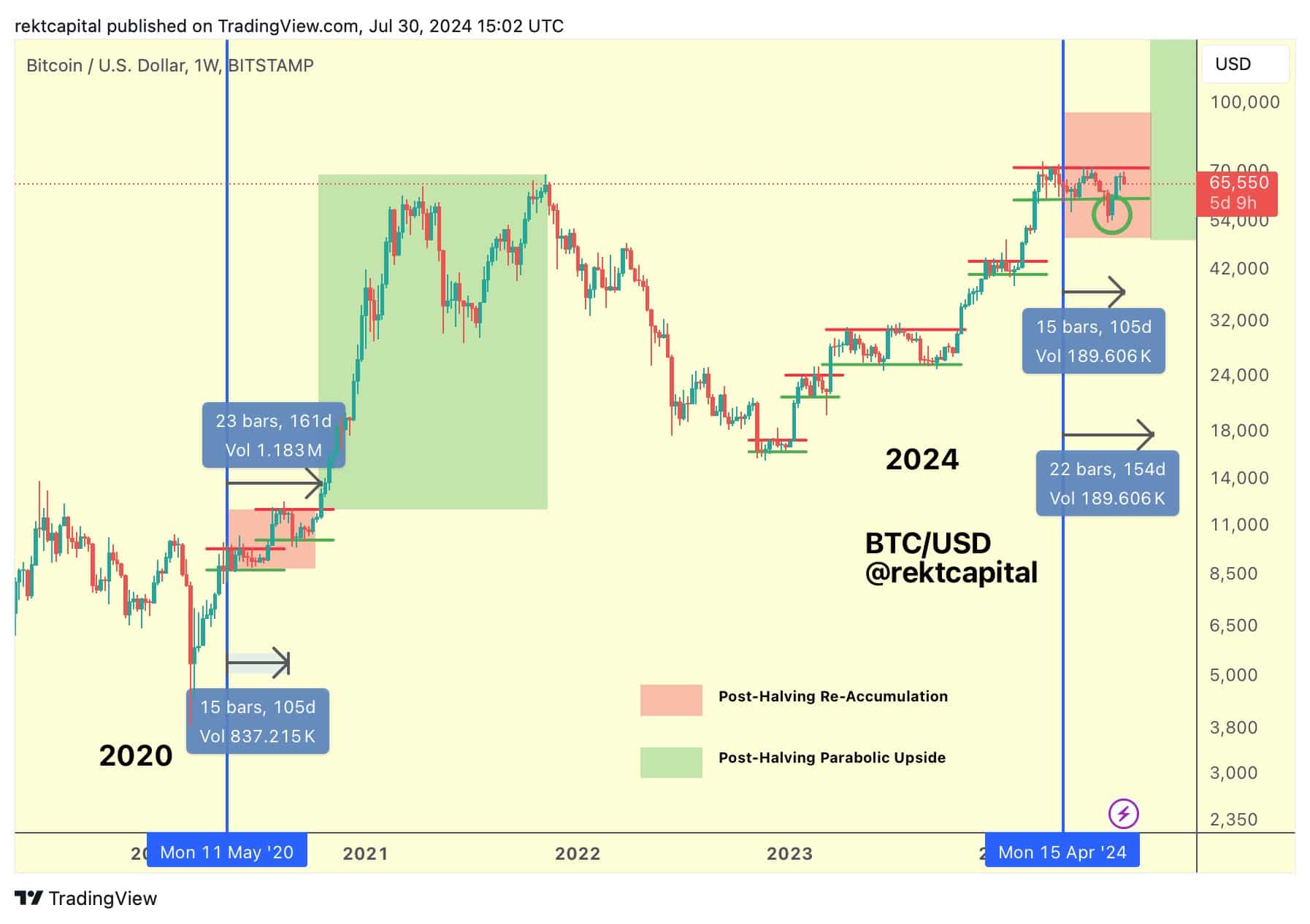

Bitcoin price might be on track to break out of its current range in September, as highlighted by popular crypto analyst Rekt Capital, who stated in a July 30 X post:

“Bitcoin is still on track for a September breakout. History suggests that a breakout from the ReAccumulation Range mere ~100 days after the Halving was always going to be unlikely.”

This breakout might be catalyzed by the increasing concerns in the legacy fiscal ecosystem, based on the statement by Turbofish CEO Bell, who added:

“As more individuals and institutions recognize the limitations of the current financial system, we could see increased adoption of Bitcoin and other cryptocurrencies […] This growing awareness and adoption could indeed act as a catalyst for the next leg up in Bitcoin’s cycle, driving its value higher as it becomes a more integral part of the global financial landscape.”

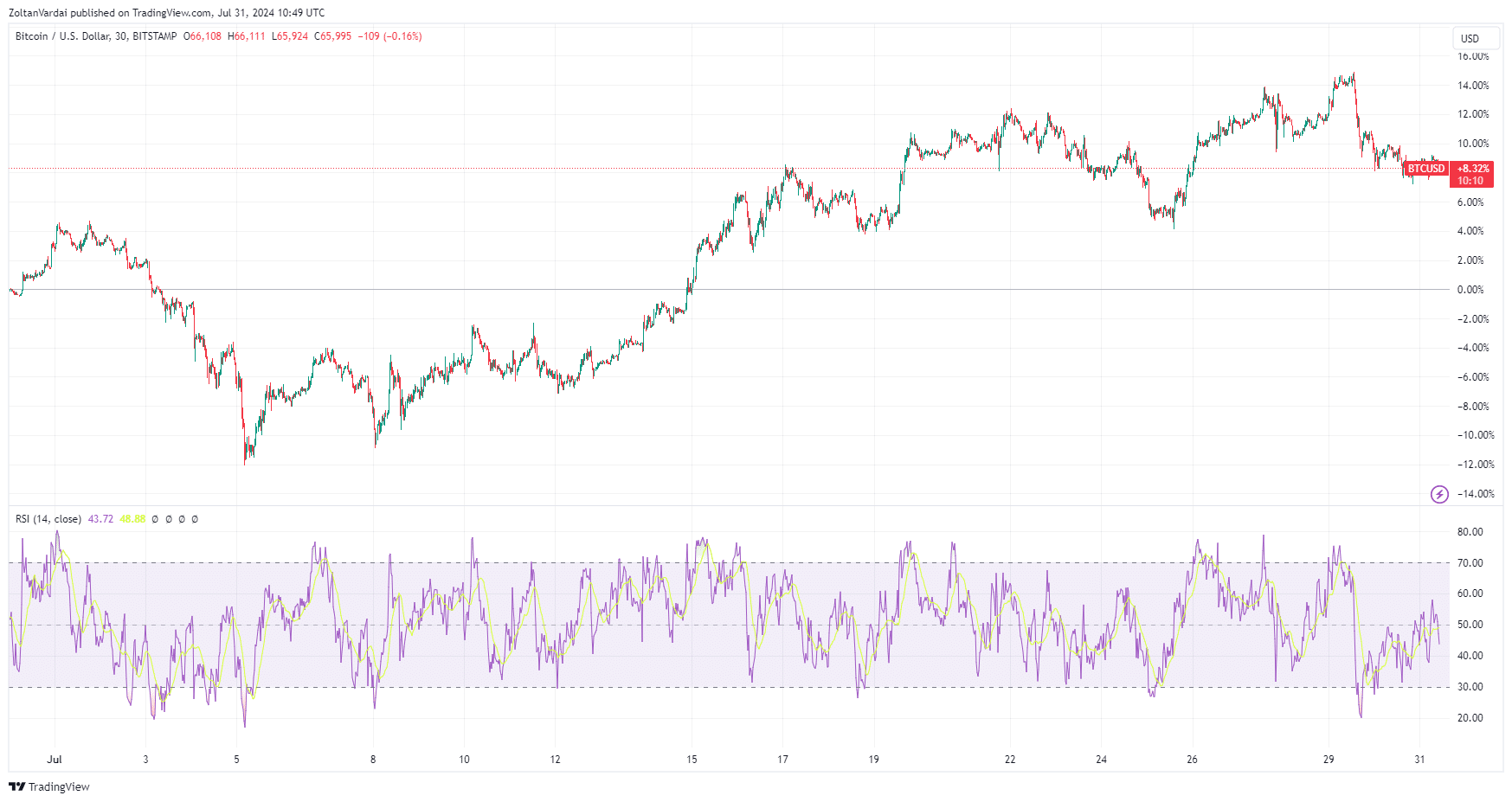

The price of Bitcoin is up over 8.3% in the past month, ending July above the $66,000 mark, according to Bitstamp data.

Although it has since dropped to around $64,000, analysts believe it is now consolidating before moving up in the coming weeks to retest its all-time high of $73,750.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.