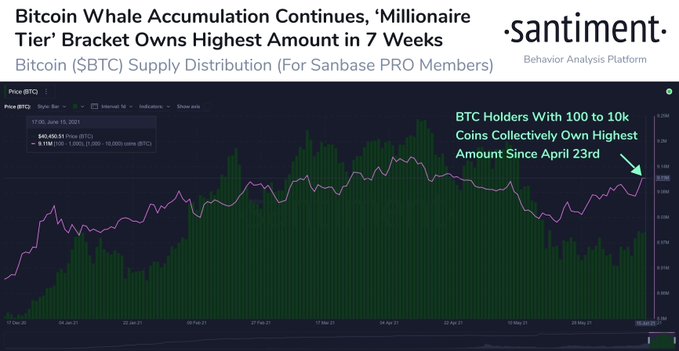

Reports emerging from data analytics firm, Santiment, shows that whales are not resting on their oars as they have just acquired 90,000 Bitcoin more. The report indicated that wallets that were already holding 100 – 1000 Bitcoin have topped up on their holdings. The accumulation of 90,000 BTC has now spanned 90 days. Following this latest announcement, the whales are now in custody of half of the total supply of the foremost crypto asset.

Santiment tweeted the update on its official Twitter page with a link provided to the actual report. These whale wallets holding 100-1000 BTC have now accumulated a total of 9.11m BTC summing up to $366.89 Billion and also 48.7% of the cumulative supply of Bitcoin. Total supply of Bitcoin is 21 million and miners have only mined a little over 18 million. The 90,000 BTC acquired over the past three months by the whales also sums up to a whopping total of $3,606,867,900.

Bitcoin accumulation chart; Source

Bitcoin accumulation both by individual and institutional investors has been on the increase lately. In fact, a week ago, Tokenhell had reported that MicroStrategy requested for $400m in senior secured notes to double down on its Bitcoin holdings. Furthermore, Tokenhell reported a day ago that MicroStrategy was also looking to sell $1billion of its stocks to purchase more Bitcoin. According to reports, the firm has made over $1billion profit on its bitcoin investment following the bull run that occurred during the first quarter of the year.

22,500 BTC Moved Off Exchanges Recently

Santiment also reported on Monday that the largest amount of Bitcoin was moved off crypto exchanges to cold storage wallets- a total of 22,500 BTC was moved off these exchanges. Another report emerged from the same source that whales were buying the Bitcoin dip with confidence. This was before the ride of Bitcoin to the $40,000 threshold on Tuesday. The report also indicated that whales were unwilling to part with the Ethereum they bought towards the end of last year. According to Santiment, the number of whale wallets holding ETH since last year have not reduced even while the price of Ethereum took a dump from the $4,200 threshold to below $2,500.

Bitcoin Miners Outflow Index Plunges

Glassnode released data that showed miners have also been holding onto the reward-issued bitcoin just like the whales. Charts revealed that sales of mined Bitcoins by miners have reduced and the amount of Bitcoin sold by them currently stands at $1,725,244.41. Miners outflow index plunged to a massive low. Bitcoin miners are rewarded with newly mined Bitcoins after getting the hashes right and adding blocks to the blockchain. This is what is known as the Proof-of-Work consensus algorithm.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.