The current downturn in the crypto market has made the bank for international settlement (BIS) more skeptical about the crypto space. However, the bank has put aside its skepticism and lent a helping hand to the struggling crypto inddustry.

Today, the BIS announced that banks could hold at least 1% of their reserves in bitcoin and other crypto-assets. The BIS made the proposal known following the suggestion of the bank’s Basel Committee on banking supervision (BCBS). The BCBS released a report of its submissions on Thursday, June 30.

A Classification Of Digital Assets

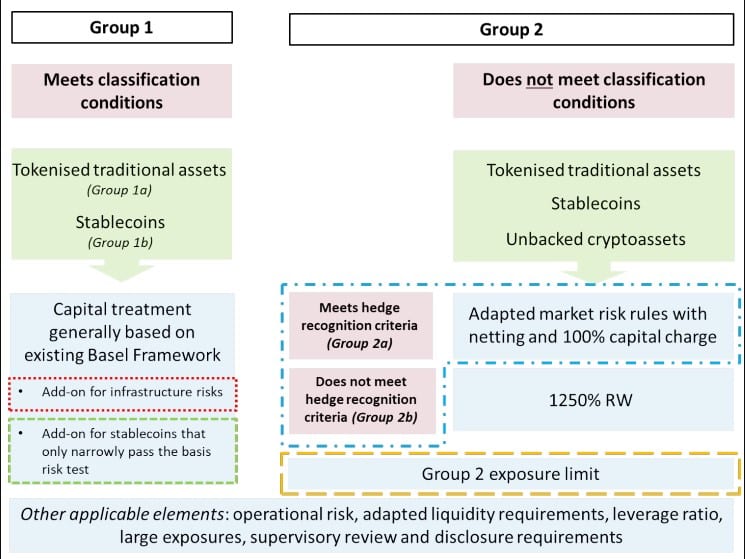

According to the BCBS, digital assets have two categories. Some have to fulfill certain conditions, and some don’t fulfill these conditions. However, the committee didn’t reveal those conditions. Those that met its set conditions are classified into category one, while the others are classified into category 2.

Category of crypto assets. Source: BIS

According to the BIS, there should be a limit to which banks are exposed to category two digital assets. The BIS clarified that this limit is the total of their crypto exposures, not their exposure to different cryptos.

The report also stated that this exposure includes all the banks’ direct and indirect crypto holdings. The BIS stated that it would classify cash and derivatives as direct holdings.

However, ETF/ETN and investment funds are examples of indirect holdings. According to the BCBS report, a bank’s exposure to cryptos must not exceed 1% of its major capital. BIS states that this demand is one of the standards of the BCBS policies according to the Basel framework.

However, the Basel policy doesn’t include regulations on large exposures. What it covers is exposure to individuals or groups of counterparties. Hence, a bank with a counterparty such as BTC can have huge exposure limits to digital assets. That’s why the BCBS introduced the exposure limit rules, which aren’t covered by the large exposure rules.

The BIS notes that it will regularly modify this 1% rule as it isn’t set in stone. Many industry participants believe the BIS decision is a positive step for crypto. They believe it will help the broader audience to have more trust in the crypto market.

BIS Still Has Its Doubts About Digital Assets

As previously reported, the BIS has said the current downturn in the crypto market further validates its doubts about the digital asset space. It also believes that its prediction about DeFi space’s risks will soon be fulfilled.

Last month, the BIS released a document explaining why cryptos can’t replace or be considered legal tender. Some of the reasons cited in the report include a lack of regulatory clarity, network fees, and network congestion.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.