Bitcoin after dipping down to $8,900 is now standing close to $9,150. The latest drop has raised concerns in the community whether a bearish trend has come. But analysts are not agreed with the narrative of a bearish trend but believe that a long-term bullish trend is ahead.

Recently, analyst Willy Woo came with a Bitcoin model which unveiled the fact that a bullish rally could start in a month.

Before the pandemic in February, the top digital asset was near to the breakout pattern. But the drop in equity markets, Bitcoin went to as low as $3,600 in March.

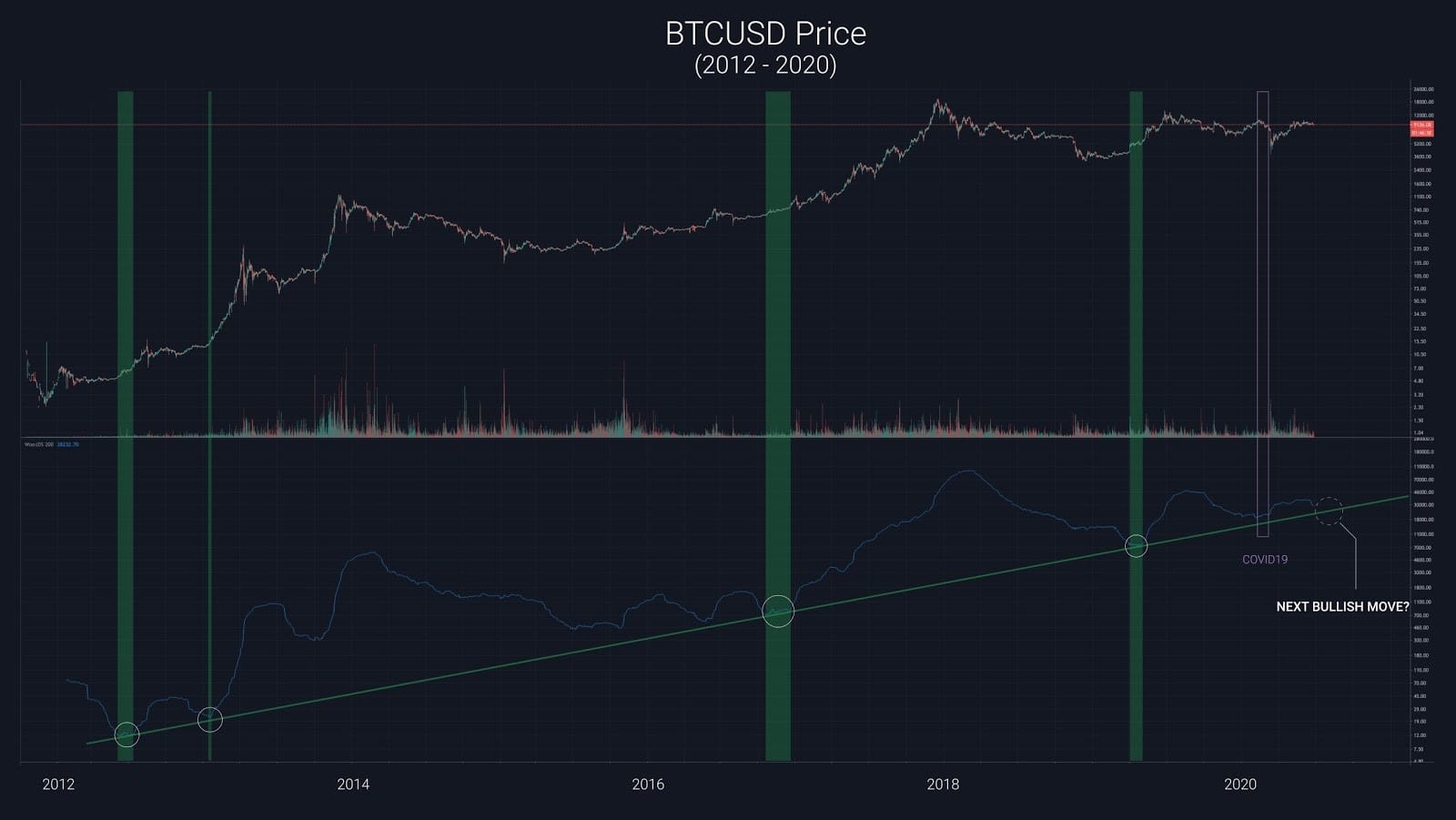

Bitcoin Model by Woo

Woo’s BTC model is based on the historical data which shows that it is preparing for a major breakout:

“This is a new model I’m working on, it picks the start of exponential bull runs. 1) Bitcoin was setting up for a bullish run until the COVID white swan killed the party. 2) This model suggests we are close to another bullish run. Maybe another month to go.”

Based on the data of the past few weeks, the volatility of the top digital asset remains very low that is the sign of strong consolidation:

“The longer this bull market takes to wind up, the higher the peak price (Top Cap model). A long sideways accumulation band is ultimately a good thing.”

Nunya Bizniz, the crypto trader, says that the Bitcoin is on the path of upward trend besides the happening of dips:

“The upward trend has morphed into more of a sideways pattern and has experienced some dips lately. However, market structure remains intact. The series of higher lows has not been broken. Does this pattern continue to hold?”

However, the contrary view is also present by some analysts. For instance, a crypto YouTuber says:

“Like I’ve been saying for months now, I have no reason to walk away from my prediction early in the year that Bitcoin is going to get stuck between $6,000 and $10,000 for the majority of this year.”

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.