Bitcoin Price Will Surge by More Than 4,000% by 2030 Due to BTC Adoption: Crypto Research Report

The Crypto research group rolls out its new prediction for Bitcoin and other altcoins in its latest report for Jun 2020. According to the report, the Bitcoin adoption is still at its early level.

In the next ten years, the top digital asset by market cap will reach nearly $400,000, while the other coins will also follow the trend. The report primarily mentions the performance of the coins, including Ethereum, Litecoin, Bitcoin Cash, and Stellar.

Source: Crypto Research Report

The report has speculated the price values of BTC, ETH, LTC, BCH, and XLM for the year, 2020, 2025, 2030, 2033, respectively. By 2025, Bitcoin will touch $341,000 in 2015 while it can again the figure of $397,727 by 2030, close to $400,000.

The report says:

“The price of $7,200 at the end of 2019 suggests that Bitcoin has penetrated less than 0.44% of its total addressable markets [worth $212 trillion]. If this penetration manages to reach 10%, its non-discounted utility price should reach nearly $400,000.”

According to researchers of crypto report, BTC, ETH, LTC, BCH, and XLM would surge by 4,000%, 1,600%, 5,000%, 5,400%, and 11,000% respectively by 2030.

The researchers have used the target addressable market (TAM) metric for price speculations. There are various things which are included in the TAMs for crypto coins such as tax evasion, store of value, remittance, offshore accounts, crypto trading, micropayments, online transactions, online gambling, reserve currency, consumer loans, gaming, and others.

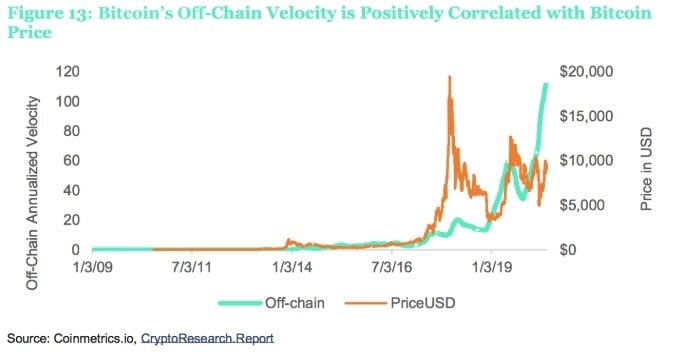

They have also found the increasing value for “off-chain velocity” and deceasing value for “on-chain velocity”. The transactions on blockchain are measured by the on-chain velocity, while the off-chain velocity is based on the crypto activity in the exchanges.

“If cryptocurrencies gain adoption for long-term hoarding purposes or for short-term spending on speculation or coffees, the price of crypto assets will go up…High velocity on-chain and low velocity off-chain suggests that crypto assets are becoming increasingly used for speculation and not for store of value.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.