Bitcoin Investors Panic Amid Halving, Dump Up To $14 Billion In Investments

The digital currency market reportedly suffered a significant loss in one night in terms of investments and client after leading Crypto, Bitcoin (BTC) made a 6.5% reduction to move from $9,200 to $8,600. The price correction is happening as a result of the Bitcoin halving that will take place on the 12th of this month. The block reduction that happens once every four years will see Bitcoin reduce the rate at which blocks are rewarded by half when the halving takes place. Admittedly, the price of Bitcoin has fared well after halvings that took place in the past, but with little before and after price corrections.

Why The Crypto Market Is Suffering Investment Loss Before The Halving

The digital assets market has been known to always be on the front run of significant events that might generally have an effect on the price movement of cryptocurrencies in the crypto market. With the Bitcoin halving not too far away, the amount of the king Crypto might generally witness a surge judging by the previous happenings in the past halvings. Despite the previous price surge in the digital currency after the halving, as seen in the earlier cases, most crypto investors and traders have chosen to hold on to their assets, which made the market suffer a massive loss in investments. Interestingly, price correction for Bitcoin was imminent with many reasons to back it after it rose above $9,000, with the primary reason being the resistance the coin faced. The digital asset experienced the same resistance as 2017 with a price movement above $10,000, meaning that the Crypto made a new high not seen in three years.

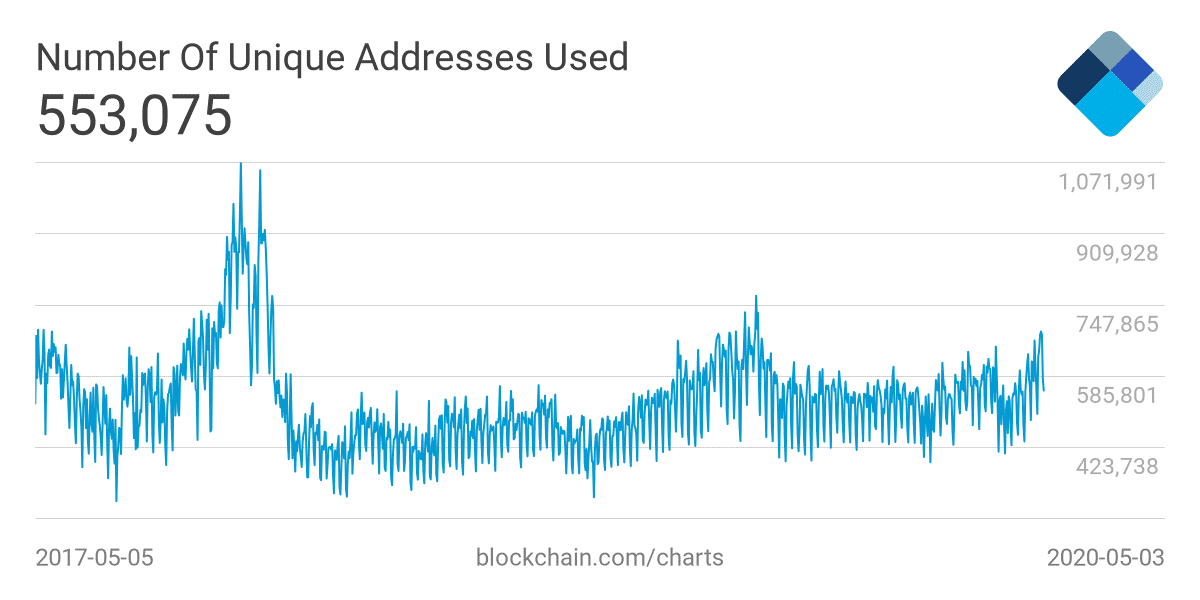

Take, for instance, the RSI of the coin stated that the coin is in an overbought region by small scale investors and clients, which points to the fact that a selloff would happen sooner or later. The disappointing aspect is that the Bitcoin network suffered low patronage in terms of user activity and new sign-ups with the low output blamed on the current situation of the economy. The number of new sign-ups totaled over a million in 2017 and has since suffered a decline with the new wallet sign-ups a little above 700,000.

As the halving nears, most analysts have pointed out that the Bitcoin surge in price trend might give way to a price reduction after the halving occurs. Admittedly, the crypto market is doing well in the weeks that are preceding the halving with analysts suggesting that if the price went as low as $5,000, miners wouldn’t have a choice other than to shut down when the halving takes place.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.