Bitcoin Price Retracts From $42,300 To $41,600 In Ten Hours

Bitcoin rose by almost 9% to surpass the $42,000 price yesterday evening, creating five successive green candles on the BTC/USDT chart on Kraken.

BTC Still Rising Despite Negative Amazon News

Coinmarketcap data shows that the leading cryptocurrency rose by 23% for the entire week. It is the first time it would do so since May 18. It also repeated the same on February 8, 2021. But BTC lost about 2.2% to now trade at about $41,450.

Bitcoin continues to defy the effect of amazon’s denial in accepting Bitcoin and cryptocurrency payments on its eCom site. Despite the little price correction, crypto analytics platforms, Glassnode and Intotheblock confirm that crypto whales continue to increase their Bitcoin portfolio.

BTC/USDT chart. Source: TradingView

Fear And Greed Index Now “Greed”

The fear and greed index, which indicates the audience’s perception of Bitcoin has risen. In the last few months, this index fluctuated slightly between 10 and 11 (an indication of extreme fear). But, in the last few days, the index has risen, and it’s now above 60—an indication of increasing greed among investors.

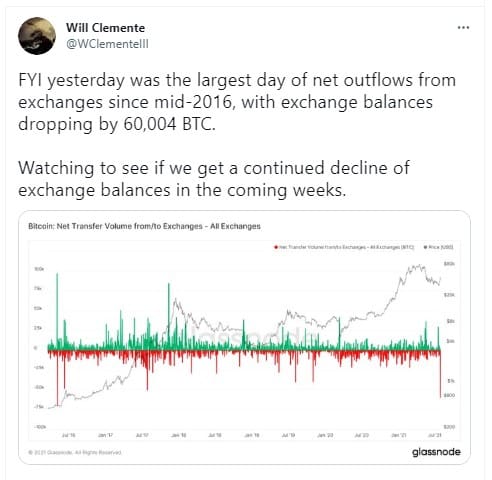

Outflows from exchanges are now at a multi-year peak. Top analysts such as William Clemente reveal that investors have moved about 60,000 BTC from exchanges plunging Bitcoin supplies at exchanges to a 5-year low.

Will Clemente Tweet. Source: Twitter

Also, this past week, there has been about a 30% rise in Bitcoin wallet activity. Crypto experts’ Bitcoin price prediction seems to be true now. They have been predicting that the bearish Bitcoin season is a phase that will soon pass, and now the rise in BTC appears to validate their point.

Bitcoin Undergoing Similar Gold Price Discovery

Fidelity Investment firm’s Jurrien Timmer says that Bitcoin and gold are like two players on the same team but have different ambitions even though investors commonly use both of them as a hedge against inflation.

Timmer further said that Bitcoin’s current price bounces are similar to gold in the ‘70s. But the gold price bounces at that were smaller than current Bitcoin price bubbles because the inflation rate at that time was a lot less than the present.

He also said the yearly volatility/monthly returns for both assets show that Bitcoin is the clear winner, offering more than 10 million more returns than gold. But it is the riskiest among them. Bitcoin also performs better than other assets. Its 3-day volatility scores when compared with oil, US stocks, and gold are 42.4, 16.9, 7.8, and 4.3, respectively.

Also, it has provided more risk-adjusted returns than any other asset (including us bonds and real estate) for almost a decade now. As of this writing, its risk-adjusted return is 2.40, while that of gold and US stocks are 1.45 and 1.75.

However, Bitcoin’s profitability over other assets (like the S&P 500 index and gold) on the daily returns index isn’t that clear. Timmer only remarked that this index isn’t a good measure of determining an asset’s profitability over another.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.