Bitcoin Slumped to $10,500 from $12,000 and then Jumped to $11,300 in a Matter of Hours

After claiming $12,000, the leading digital asset crashed in a matter of minutes and the reason behinds it is still unknown.

In less than an hour, Bitcoin stopped at $10,500 after losing $1,500 and witnessed a 12% loss. However, it then jumped again to $11,300 with the help of bulls who are not willing to push the price downward.

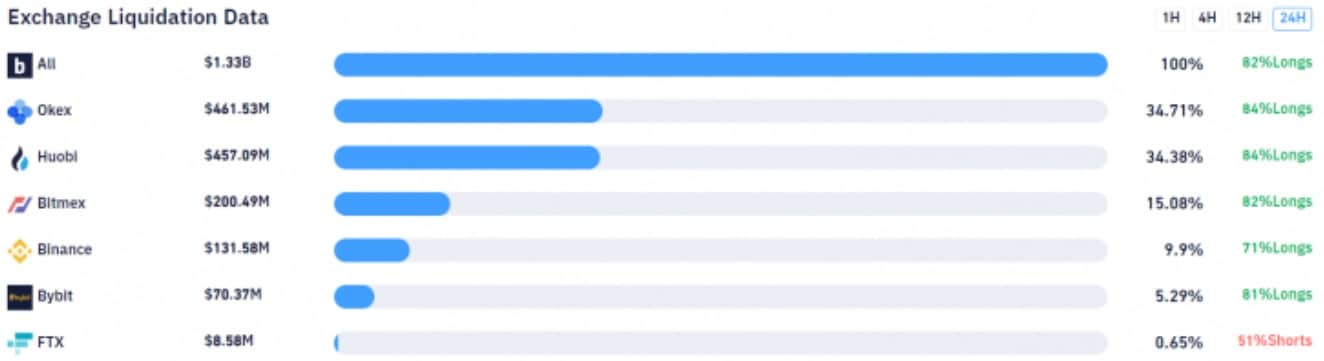

Liquidation of BTC Positions

The liquidation of Bitcoin positions worth $1 billion over different cryptocurrency exchanges may be another reason behind the price fall. Crypto data firm Bybt said,” In the past 24 hours, 72,422 people were liquidated. The largest single liquidation order occurred on Bitmex-BTC value $10M”

Since last week, Bitcoin has made significant progress and rallied above the year’s high position. According to the data shown by trading platforms, the trading volume also surged exponentially which means retail traders also attracted to top digital currency due to its increasing price value.

Flash Crash

However, the reason for the flash crash is not known yet. But it seems that whales are responsible for the BTC crash as they always manipulate BTC markets according to their will. In a matter of minutes, almost $20 billion minuses from the entire market cap per the CoinMarketCap.

“Bitcoin is the most ruthless asset in the world. Hits $12,000 and then drops $1,500 in minutes. Not for the faint of heart,” crypto trader and analyst Anthony Pompliano said.

Some analysts believe that Bitcoin’s rally happened because investors are finding safe-haven assets, including bitcoin and gold. Famous trader Micah Erstling said,” Bitcoin’s push has been fueled by the drive towards safe-haven assets.”

“Markets are being driven by ongoing coronavirus concerns, as well as U.S.-China trade tensions, which also helps to explain gold’s meteoric rise. Even then, gold is still up 28% for the year, compared to Bitcoin’s 50%. Perhaps Bitcoin is fulfilling the narrative of becoming an all-encompassing, risk-on, safe-haven, deflationary asset.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.