Bitcoin Whales Increase Their Holdings By Almost 171,000 Within Two Months

On-chain analytics firm, Santiment, has revealed that Bitcoin whales aren’t selling their holdings. Instead, they are acquiring more during this period when the price of the leading cryptocurrency is declining. These Bitcoin whales see the actions of short-term holders who continue to sell their Bitcoin holdings as the market’s way of shedding off weak holders.

Whales Buy 171K BTC

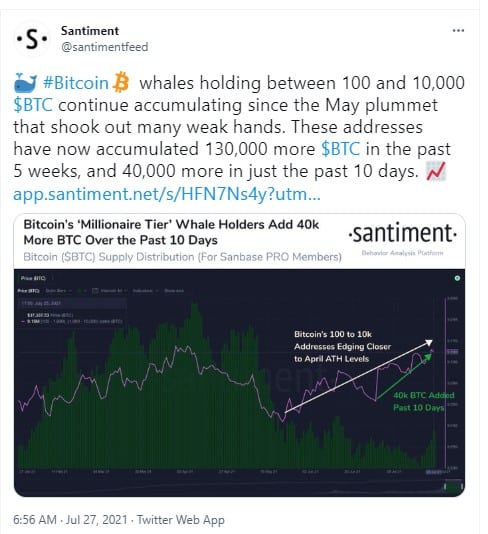

Santiment revealed on Twitter that Bitcoin wallets with 100 and 10,000 BTC (popularly called Bitcoin whales) continue to acquire more Bitcoin for almost two months now, a period that coincides with when the leading cryptocurrency started declining from its peak price of about $66k.

Within this period, they’ve increased their Bitcoin holdings by almost 171K BTC. They bought 130K BTC in five weeks while buying the additional 41K BTC in the last ten days. Using the current Bitcoin-USD value, that 171K is worth about $6,300,997,000.

Santiment’s Twitter revelation. Source: Twitter

Santiment’s data seemed true because CryptoQuant data (another crypto analytics firm) recently revealed that Bitcoin wallets with 1000 and 10,000 BTC have been increasing their Bitcoin holdings. When short-term holders and miners were selling their BTC, most of these Bitcoin whales were buying, and they now hold almost 58K Bitcoins. Recent Glassnode research was also in agreement with that of Santiment and Cryptoquant.

Bitcoin Price Rejects $40K

Yesterday, the leading cryptocurrency almost sustained a $40K price before Tesla released its Q2 earnings report. Thanks largely to rumors that Amazon is about to start allowing cryptocurrency payments on its platform, starting with Bitcoin.

Sadly, Amazon issued an official release to deny the rumors, and Tesla’s Q2 earnings weren’t favorable to the king coin. Hence, Bitcoin price went on a tailspin. However, top Dutch crypto analyst and trader, Micheal van de Poppe, has revealed that Bitcoin price action isn’t entirely new.

He opined that Bitcoin is only searching for a new higher low after reaching a new higher high. He further predicted that it might attain this higher low around the $33K to $36K range.

Outflows In Institutional Crypto Products

The latest Coinshares report shows that there are outflows in institutional crypto products for the third successive week. The outflows this past week is an increase of 175% to that of two weeks ago. The report also noted that the largest outflows were from Bitcoin-related funds.

Bitcoin-related outflows represent about 84% of the total outflows from all crypto products. Coinshares remarked that the possible reason for last week’s large Bitcoin outflows was the negative public sentiment surrounding the leading virtual asset. By contrast, the Coinshares report also noted that there had been inflows in crypto investments products, which has been happening since the start of this year.

For instance, Grayscale’s latest bulletin revealed that its total asset under management is now about $34 billion, representing an increase of almost $2.6 million. It is noteworthy that Coinshares’ report was released shortly before Bitcoin’s bullish run on Monday, where it rose by 16% within four hours.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.