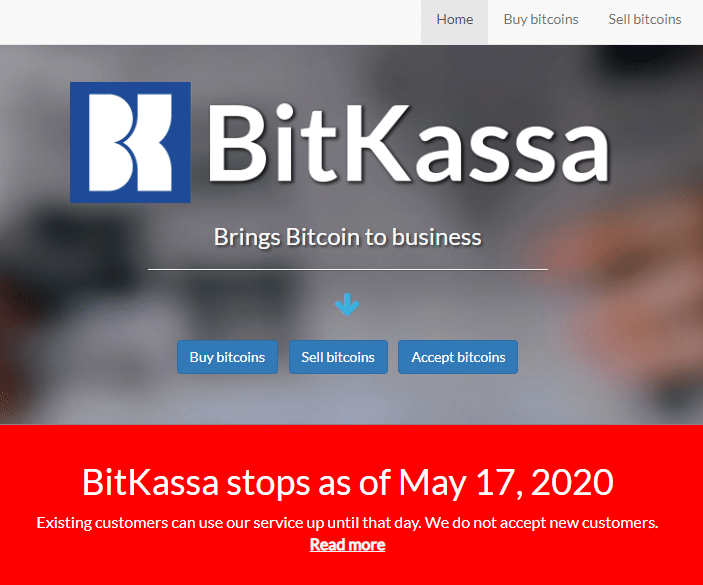

BitKassa Shutdown

BitKassa, one of the Leading crypto exchange platforms in the Netherlands, has announced that it will shut down its entire operation in the country in the coming days. According to the exchange, the recent development comes after the country’s central bank is set to enforce regulatory conditions, as stated by the EU. The Dutch central bank De Nederlandsche Bank has given all crypto business a May 18 ultimatum to register their business.

The DNB, in a statement issued, stated that the registration was compulsory with businesses that fail to register after the deadline risking a total shutdown. Meanwhile, BitKassa has announced that they will halt their operations in the country as a result of the directive of the Dutch central bank. Even though the EU’s regulation is a means to check fraud-related activities in the crypto sector, the exchange bosses say the fees required to complete the process is expensive. The digital exchange platform has announced that they will halt all their operations on May 17, a day before the deadline given by the DNB.

BitKassa has said in a statement that it won’t halt their operations in the country without showing displeasure to those in charge of the DNB. The statement further stressed on how outrageous the fees required for registration of respective businesses in the country are. According to the exchange firm, they were asked to pay a total of about $27,000 in fees and termed it “unreasonable.” The breakdown of the fees required for each firm to pay included $5,400 for registration and a further $21,600 in basic costs.

Reportedly, fees are compulsory and should be paid by all firms in the country upon registration of their business irrespective of the company size or income. BitKassa released a statement that said crypto firms were specifically asked to pay about a million dollars to get licenses in the country. The statement further stated that the directives enforced will see crypto firms pay up to $1.8 million for approval of around eight months. BitKassa frowned at the fact that they have to pay more than “trusts or credit cards companies” are asked to pay while saying the demands would kill small start-up exchanges in the country.

BitKassa has promised its client base that it would still deal in Bitcoin (BTC) in the future but would trade only in businesses that are not under the regulation of the central bank. The Netherlands boasts of about 75 key digital asset exchanges in the country, and the DNB stresses that most of the exchange might not meet up with the registration deadline. The DNB further stated that Crypto-fiat industries must register or face the consequences.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.