Institutional Investors Invest More In Bitcoin As BTC Futures Contracts Surge

BTC Futures Contracts Surge

Bitcoin’s sudden surge to over $7,000 has reignited the interests of institutional investors and traders in the flagship cryptocurrency. As substantial investors are looking to put their monies where they would be guaranteed massive profits, most of them are looking on to none other than cryptos during this harsh economic condition.

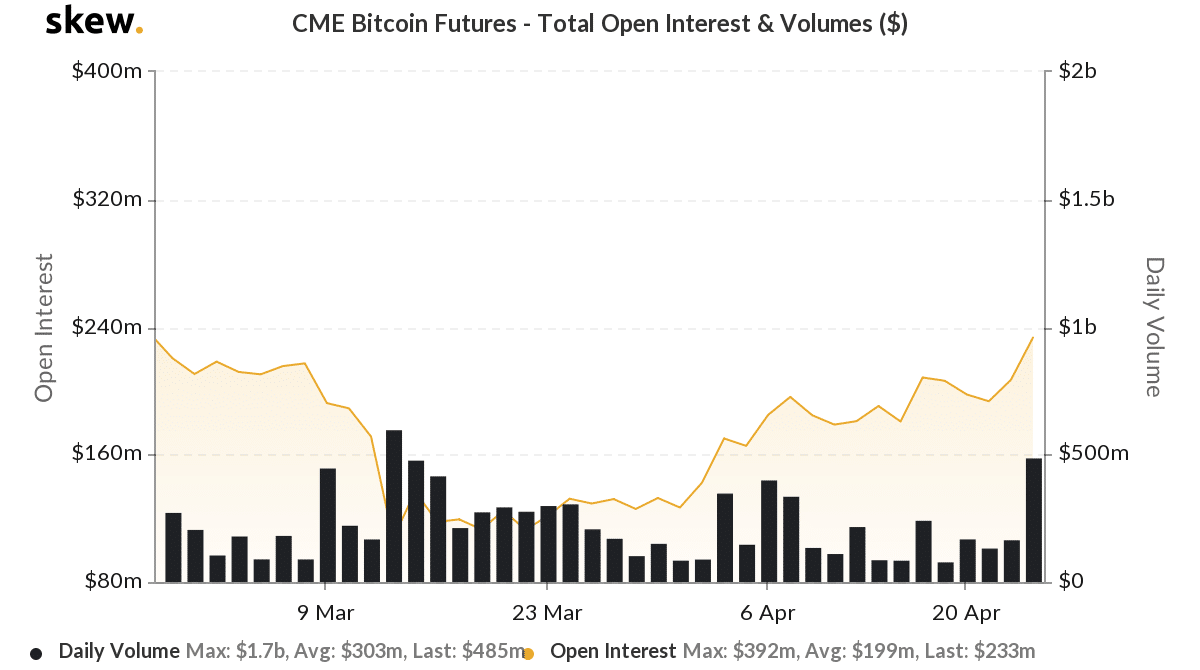

As major financial markets are suffering from the effects of the Coronavirus pandemic due to their recent plunge in assets, Bitcoin and other digital assets are the next point of call of investors. Bitcoin is currently moving between the safe and loss level due to its recent volatility in recent days. American institutional investors are taking full risks as they are looking to Bitcoin to make a massive surge and bring them massive profits in the coming weeks. Reports shos that data from data analyst Skew Markets shows that the investment in Bitcoin had risen to a level, not since the massive sell-off that the coin experienced on March 12 when it dropped by 40%.

While disregarding the current volatility in the market, Bitcoin traded over $7,500 to mark a historic one-day volume movement that has not been experienced since the middle of February in 2020.

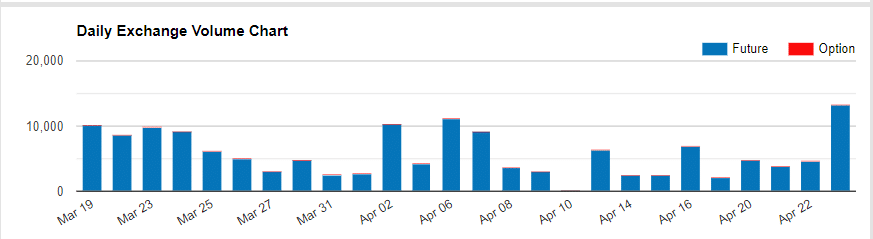

According to reports collated by Skew Markets on contracts, it showed that contracts worth 13,285 were traded with the total volume of all the assets put at $485 million. Realistically, a single-day record drop was recorded on March 12 with CME records noting BTC futures at $595 million while the most significant high that was recorded on February 18 recorded a trade over $1.1 billion.

The movement on the CME was important for investors that hold a contract only Bitcoin having more edge over investors that held physical cryptocurrency with the former enjoying a hedge only strategy. Institutional investors are looking to gain more as a result of the increase in their holding capacity of the digital asset amid growth in the stimulus packages offered by the US reserves.

Since Bitcoin is poised for halving towards the coming weeks, the digital asset is backed to make a surge in price when it eventually happens. The halving will see rewards from blocks reduce from 12.5 to 6.25 with the cost of the coin expected to provide support to the investors. If the Coronavirus pandemic ends, analysts have claimed that investors might need assets to put their funds in to help move out of the looming economic hardship and Bitcoin will prove to be the best bet when the time comes.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.