Bullish Surge: Lido DAO, Injective, and Arbitrum Make Headlines with Impressive Price Rallies

Key Insights:

- Lido DAO (LDO) surges with positive investor sentiment.

- Injective (INJ) gains momentum with Polygon Labs integration.

- Arbitrum (ARB) sees bullish dominance with Circle’s USDC adoption.

According to CoinMarketCap, the top cryptocurrencies in the past 24 hours have been Lido DAO (LDO), injective (INJ), and Arbitrum (ARB).

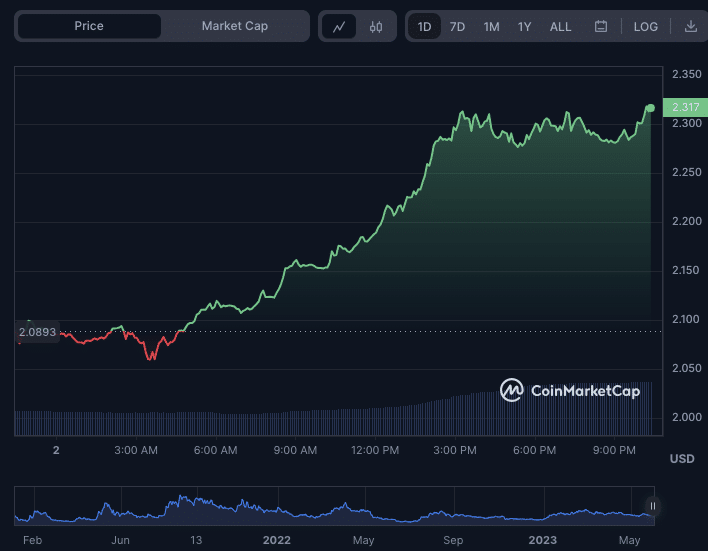

LDO/USD

The LDO price dropped to a 24-hour low of $2.06 after a bearish start, but the negative momentum was reversed as bulls drove the price to a new 7-day high of $2.3143. The bullish domination had maintained as of press time, with a 9.29% increase to $2.28.

LDO/USD 1-day price chart (source: CoinMarketCap)

If bullishness breaks over this new 7-day high, the next psychological threshold for traders might be $2.50. However, the $2.00 support level should be avoided if bearish pressure prevails.

During the bull run, market capitalization increased by 9.86% and 110.82%, reaching $2,010,742,147 and $77,613,236. This increase in market capitalization reflects the positive investor attitude regarding Lido DAO.

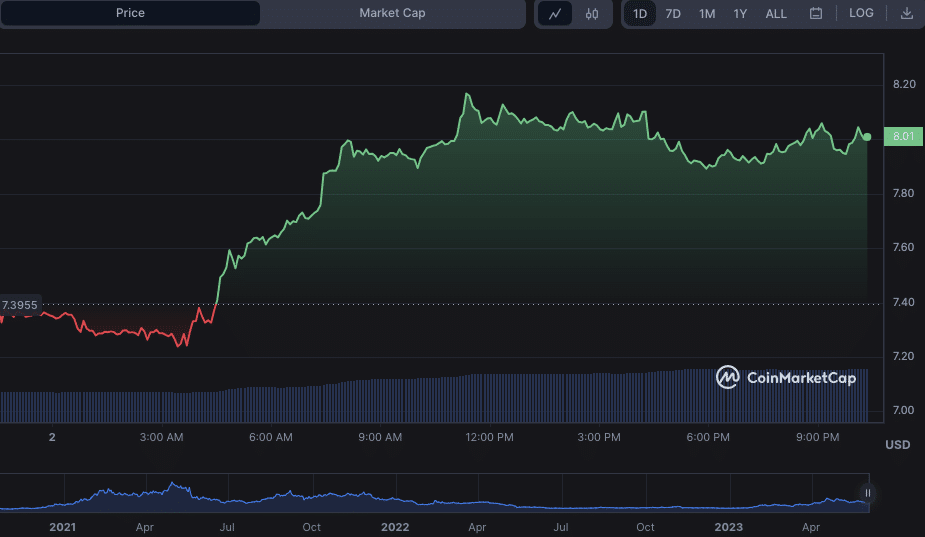

INJ/USD

After a difficult start under negative pressure, the Injective (INJ) market recovered spectacularly to close the day on a high note. INJ fell to a support level of $7.24 before rallying to an incredible 24-hour high of $8.17. Despite some resistance, INJ completed the day at $7.96, a significant 7.26% increase over its previous close.

INJ/USD 1-day price chart (source: CoinMarketCap)

With this increase, INJ’s market capitalization increased by 7.42% to $637,150,157. The rising 24-hour trade volume, which increased by 76.07% to $91,451,232, was also remarkable. This increase reflects a growing interest in INJ among investors and traders, with current market dynamics creating a good picture.

This bullishness results from Injective making waves in the developing world with bold moves. On May 31st, a significant statement was made outlining its relationship with Polygon Labs, a move that is expected to expand the frontiers of DeFi composability. Users will be able to access native assets from both Injective and Polygon in a variety of cross-chain use scenarios thanks to this integration.

Furthermore, The Avalon Mainnet Upgrade was successfully implemented on the platform. This update brings the most high-performing Injective infrastructure to the table to optimize the user experience and expand the platform’s possibilities. This demonstrates Injective’s dedication to pushing the boundaries and being at the forefront of the fast-paced and ever-changing DeFi market.

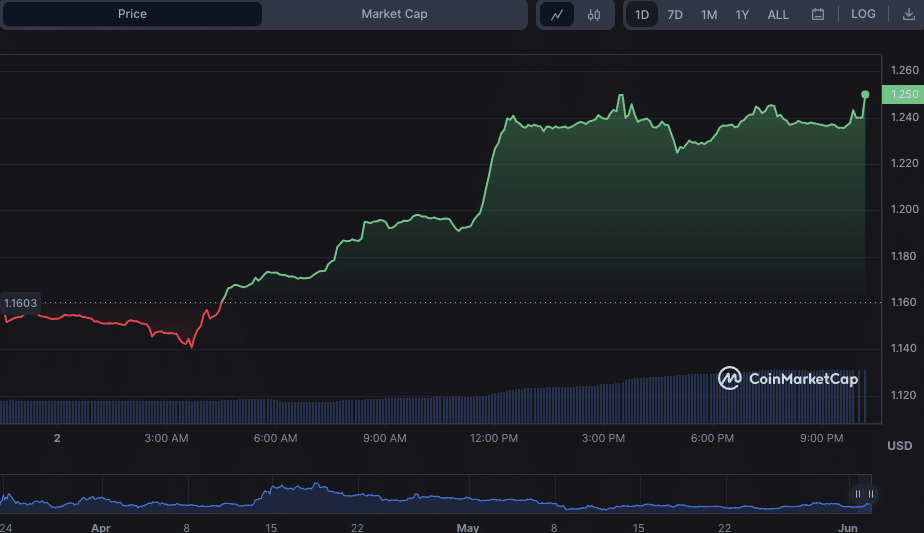

ARB/USD

In a dramatic turn of events, the market’s negative momentum was quickly neutralized as support established below the intra-day low of $1.14. The bulls took charge and drove the price to $1.25 before running into strong resistance. Nonetheless, bullish domination prevailed, resulting in a 7.05% increase to $1.24 at press time.

ARB/USD 1-day price chart (source: CoinMarketCap)

This enthusiastic reaction increased market capitalization and 24-hour trading volume by 7.20% and 134.97%, respectively, to $1,582,803,038 and $342,213,299. Circle, the inventor of the USDC stablecoin, encouraged such enthusiasm by announcing intentions to launch a native version of their currency on the Arbitrum network.

Circle outlined its intention to replace the existing Ethereum-based bridging version of USD Coin to improve transaction speeds and increase interoperability across the blockchain ecosystem. The future Arbitrum native coin will serve as the official USDC inside this ecosystem, eventually replacing the bridging version.

Circle’s adoption of the Arbitrum network ushers in using cross-chain transfer protocols (CCTPs) to enable frictionless asset transfers across blockchains, hence fostering liquidity unification. Circle predicts faster transfer speeds and the removal of withdrawal delays by facilitating native USDC movement between Ethereum and other supported chains.

In conclusion, Lido DAO, Injective, and Arbitrum have shown impressive growth and investor interest, paving the way for a promising future in the ever-evolving world of cryptocurrencies.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.