Yesterday, during the Cardano virtual conference, the company’s CEO, Charles Hoskinson announced that the Alonzo Testnet could be live next month. This Testnet will make smart contracts on the Cardano blockchain. He reiterated that “users will start writing smart contracts on Cardano and apply them on the platform. This is the first time this is happening on our platform.” however, he said that if for any reason, the Testnet isn’t live in April, it will be live in may unfailingly. Hoskinson further remarked that most crypto enthusiasts deride Cardano for not being smart contract enabled. But the platform as it is currently is overwhelmed with several partnerships.

Inputoutput Tweet. Source: Twitter

Based on this revelation, this upgrade is expected to happen this spring through a hard fork. The first phase of the rollout will only allow the use of smart contracts for testing purposes, while the complete mainnet is expected to commence in August.

Is Cardano Aiming for A Portion Of The Defi Cake?

If this smart contract possibility becomes a reality for Cardano, it will now make the proof-of-stake company a strong competition for Ethereum. From last summer till now, Ethereum’s decentralized finance community has been on an upward trend. Several kinds of decentralized applications (dApps) have been built on it and they’re all smart contracts-based.

With this Testnet, Cardano is set to have similar functionality. For example, the firm’s developers have provided a Cardano-built decentralized app through which users can substitute one token for another one. It is similar to Uniswap and other dope dApps from Ethereum.

Defipulse, an analytics hub for Defis, reports that the value of all dApps can be estimated to be almost $41 billion. However, most of the money makers are built on Ethereum’s smart contracts. Some of them are Aave, Compound, and MakerDAO.

Cardano will also be tapping into this multi-billion niche once its Alonzo is completely implemented. Earlier this month, Cardano made an upgrade, which it called mary. Mary, which aids anyone on the platform to develop personalized tokens, made the blockchain company almost like Ethereum.

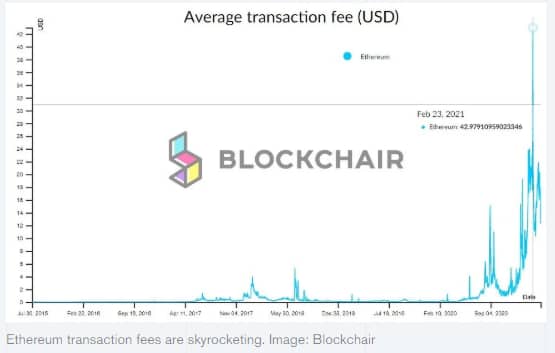

Hence, Cardano became a multi-asset platform suitable for various types of virtual assets. However, Cardano differs from Ethereum in that its token transactions are not based on smart contracts. It thus implies that trade fees could be less on Cardano than on Ethereum where trade fees continue to surge higher in each passing day.

Skyrocketing eth trade fees. Source: Blockchair

The Implication of Ethereum’s Competition Offering The Same Services As Them

Blockhair’s analytics showed that on February 23, 2021, average gas fees on Ethereum reached a new peak price of about $42. It rekindled the never-ending debate of whether it is now too expensive to use Ethereum. This debate will become more intense when competitors such as Cardano start offering smart contracts with lower trade fees. ADA (Cardano’s native crypto) is now among the top four crypto assets, it has a market capitalization of about $39 billion and currently trades at a little less than $1.30.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.