Celsius Network Faces A US Federal Investigation

According to a new report by Bloomberg on Wednesday, bankrupt crypto lender, Celsius Network, is currently under the scrutiny of the US financial watchdog as it faces a federal investigation over allegations of irregularities in its operations.

The counsel of creditors admitted that “the amount and level of investigations of the debtors by governmental entities are important. Celsius is also subject to enforcement proceedings or investigations in at least 40 states apart from investigations by the federal government.” The cryptocurrency lending company is also undergoing investigations by many state regulators. One such state regulator is the Texas Securities Board which issued an official statement on September 7.

A Failed Crypto Firm

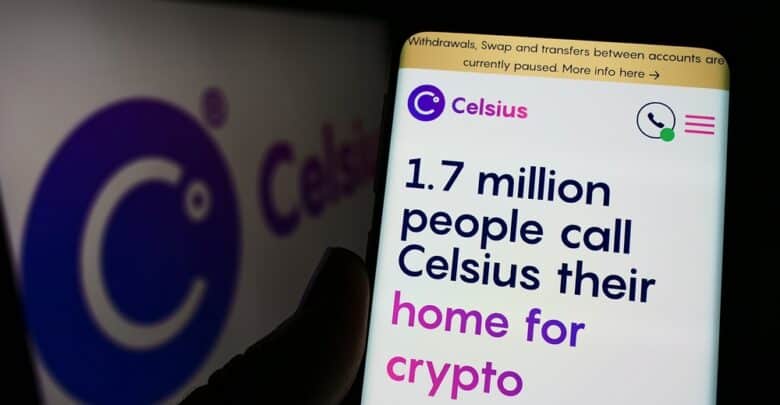

Celsius Network became popular in the crypto industry when it started giving interest for cryptocurrency deposits. However, while many in the crypto space saw it as a very profitable business, the platform failed when the crypto market experienced a decline at the start of the year.

The first sign of a problem was Celsius’s decision to freeze client withdrawals on the platform in June, admitting that it was because of the current market volatility. However, the company filed for bankruptcy in New York the next month. The withdrawal suspension was later justified by members of the special committee of the company’s Board of Directors.

“Without the temporal suspension, some users who acted early enough would have received their funds fully while users might need to wait. They would need to wait for Celsius Network to gain value from its illiquid or long-term asset investment before they recover their funds,” the board said in a statement. This new development puts clients who made deposits into the platform to become unsecured creditors of the crypto lending company.

Before this new investigation, the crypto lending company has gotten inquiries in the US from the Commodity Futures Trading Commission (CFTC), Federal Trade Commission (FTC), and Securities and Exchange Commission (SEC). In addition, a federal grand jury in the New York district court placed Celsius Network on suspension.

This has also kept other crypto lending companies under the scrutiny of US federal regulators for a while. Earlier this year, the SEC carried out an investigation against Voyager Digital, Gemini Trust, and Celsius Network. But the agency did not lay any charges against these crypto-lending companies.

The current bankruptcy of Celsius Network is partly due to the current bear season in the crypto market, a bearishness that has refused to subside since the beginning of the year. However, a spike in crypto prices might be a positive development for the crypto lending company.

T. Schneider / Shutterstock.com

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.