Using the 100-day SMA on the four-hour chart, bulls must break above the marked resistance level or ChainLink could decline to $27 or more to even $23. If BTC keeps depreciating and declines to support levels close to $55,000, ChainLink might as well experience some decreased volatility. As of this writing, the king coin’s trading price is almost $58K after its futile attempt to surge past the $60,000 price target this past week.

Price Analysis for Chainlink

Bears might capitalize on any decrease in price below $28 and seek to revisit prices less than $27. Based on the 4-hour chart, the LINK/USD price decline is possible. The relative strength index has dipped beneath the equilibrium point and is at 42. Also, the LINK/USD pair is below the highly important 100 SMA ($30) – the price point that’s preventing an entry point for the bulls since the last twelve hours. Furthermore, the parabolic stop and reverse indicators are now higher than the current trading price which indicates that it is likely that the price will decline to $26. Once the pair declines further than $26, $23 will form the next support level.

LINK/USD 4-hour chart. Source: TradingView

Is A Breakout Possible?

Conversely, an instant breakout above the 100 SMA is possible but the price must remain higher than trend line. Currently, link trades at $29. Even though this crypto asset’s price has retrogressed by almost 2%, it still trends higher than the support level of a triangle with a symmetrical form. Bulls will likely build support higher than $30 once the price exceeds $29. When this happens, the bulls might retest a new resistance level (most likely $35). Then, a surge to a new ATH might follow – the current ATH is $36.86 set on the 20th of last month. When a new ATH is established, the bulls will be set to create another ATH at $50.

Chainlink Platform Activities: Why Is a Bullish Trend Possible?

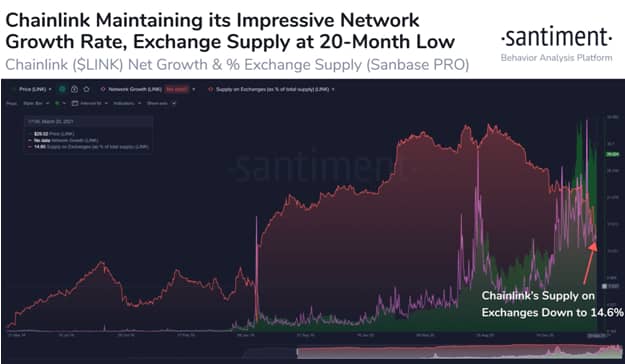

Recent activities on ChainLink hints at a higher rally and a possible rise beyond the $30 mark. Santiment (an on-chain analytics firm) reports that there has been a decline of about 15% on ChainLink’s on-exchange supply. The last time it was this low was two years ago, precisely, July. This indicates that most investors will prefer to hold for possible profits in the future. Also, activity logs on the platform shows an influx of new buyers. New addresses registering on the platform keeps increasing over the last 90 days. The awesome oscillator indicator shows that the link market has enough momentum to sustain its current phase. But trading on the coin could swing this crypto asset in any direction.

ChainLink’s on-exchange supply lows. The last of which was in July 2019. Source: Santiment

ChainLink’s market remains at the consolidation phase. While there has been lack of volatility in the coin, any abrupt price change could be signal a homerun for the bears or the bulls. Traders must focus on this market as it can change at the point in time even if the change will be for a short time.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.