Founder of the first China crypto exchange, Bobby Lee, opines that Chinese authorities might step up their disdain for cryptocurrency by making it illegal to own cryptocurrency. Lee made his views known during an interview with Bloomberg today.

Lee also opined that there is a 50% possibility that the country will ban Bitcoin ownership completely. He predicted that this might happen when the leading cryptocurrency starts trading around the $500K levels.

The crypto exchange pioneer is still firmly convinced that Bitcoin would still trade around $250K levels even though it has not fully recovered from its recent price correction. However, he expects Bitcoin to decline by almost 65% next year because Bitcoin’s bull cycle usually happens every three to four years.

Lee: “Beijing Not Interested In The Crypto Market”N

Lee further said that even though the Chinese government is pushing for a digital Renminbi, it doesn’t mean they are interested in the virtual asset space. He based his assumption on the outright ban of crypto miners in the country without considering whether these miners were using clean energy or coal energy for their mining operations.

He also affirmed that the crypto space wouldn’t suffer because China isn’t in support because there is no relationship between the digital Yuan and Bitcoin. Lee is convinced that if Elon Musk’s tesla continues to support Bitcoin, it is only a matter of time before most fortune 500 companies increase their Bitcoin and cryptocurrency investments.

Crypto platforms are now taking active steps to ensure they aren’t disobeying China’s crypto regulations. For example, FTX, a top crypto exchange in China, has reduced its maximum trading leverage for its users from 100 to 20.

The Catalysts Behind Bitcoin’s Sharp Rise

Yesterday, city A.M., a British business tabloid, revealed that eCom giants, Amazon, are developing plans to accept Bitcoin on their platform and that the plans are already at advanced stages. The rumor coincided with the fact that Amazon recently announced the vacancy for a blockchain and cryptocurrency expert.

Even though Amazon is yet to confirm or deny the news, the Bitcoin price is already reacting to it positively. Another reason for Bitcoin’s recent price surge is Elon Musk‘s remarks at the “B-word conference.” the electric car CEO and billionaire confirmed that his company isn’t planning to short its Bitcoin positions. He was also full of praise for the leading cryptocurrency.

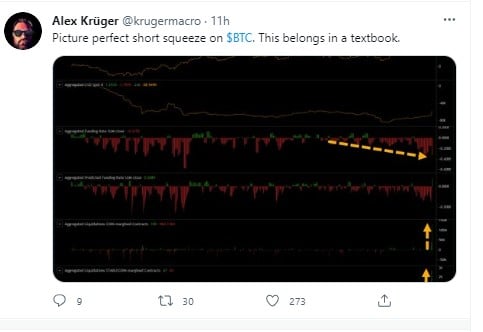

He even hinted that his electric car company might sooner than later start accepting Bitcoin payments again. The third catalyst behind Bitcoin’s recent price surge is what ace crypto analyst, Alex Kruger, has termed a “picture-perfect short squeeze.”

Alex Kruger Tweet. Source: Twitter

While it is rare, short squeezes occur when an asset surges suddenly in the opposite direction to bets against it. Hence, short-term sellers would be forced to repurchase more of such assets to protect their pushes. These actions even push the asset’s price higher. ByBt reports that the value of short positions liquidated in the last 24 hours is almost $935 million.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.