Chinese Real Estate Market Blamed For The Global Crypto Market Decline

Veteran China-based crypto journalist, Collins Wu, has revealed via Twitter that Hong Kong’s top stock exchange, the Hang Seng index, today reached a 1-year low following a 7% loss. Before this decline, the index’s previous most significant decline was 18%.

Collins Wu Tweet. Source: Twitter

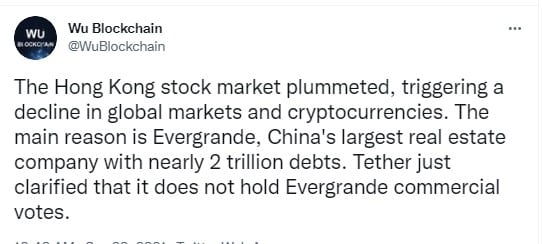

He further disclosed that an 11% loss of the shares of the famous real estate firm resulted in a sharp decrease in the digital asset market. In terms of sales volume, this group ranks second across the whole of South Asia. In terms of profit, this group ranks number 122 globally.

Henderson’s real estate firm is also suffering the same experience. Wu further revealed that Evergrande’s debts are estimated to be around $2 tr. The rising debt issues facing this company are having a ripple effect on the share prices of other sectors.

News Affects The Digital Asset Industry

As widely reported, BTC lost 8.5% of its value following a drop in price from $48.8K to $44.44K. The king coin lost about $313m within an hour. Over 50% of the BTC positions (valued at $154m) were exited on the ByBit exchange. Various analytics from several exchanges indicate that the selling pressure is still on.

Hence, BTC’s price may still experience more losses and sunk below its $45K support level. As of this writing, BTC trades at almost $44.8K. According to a Bloomberg crypto news report, news of the share price decline of China’s Evergrande group is also affecting the crypto market, particularly the altcoins.

Bloomberg Crypto News Report. Source: Twitter

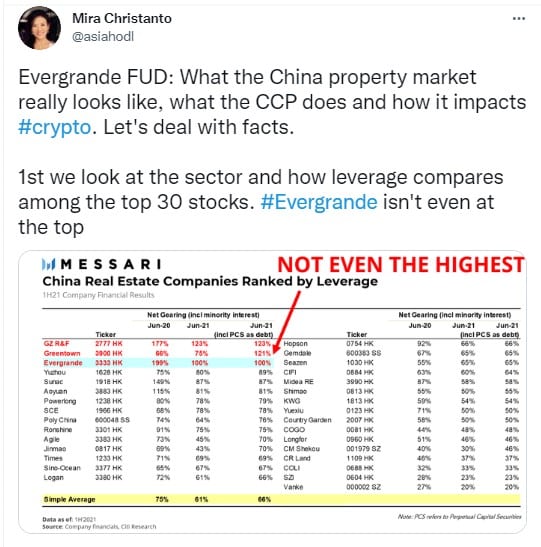

It is estimated that the whole digital asset market’s loss today is over $205B. Some analysts opined that Evergrande’s issues would have spiral effects beyond china. However, Mira Christanto, a top-level executive with a top china-based analytics firm, claimed that the situation is widely exaggerated. She supported her claims with a screenshot on Twitter which revealed that the real estate giant’s debts woes aren’t the highest.

Mira Christanto Tweet. Source: Twitter

El Salvador Increases BTC Holdings Again

Nayib Bukele has revealed via Twitter that his country’s holdings are now 700 BTC following the acquisition of another 150 BTC. Bukele claimed that more than 1.2m Salvadorans now have the Chivo crypto wallet on their mobile devices.

As of the time Bukele tweeted, BTC traded for $45.7K, but it has since declined to $43.3K. El Salvador continues to face various issues regarding her adoption of BTC as an official currency. Many Salvadorans have expressed their displeasure regarding the authorities’ BTC legal adoption.

They expressed their displeasure by staging a demonstration during the country’s independence day celebration last week. Part of the demonstration turned awry as some newly installed BTC ATMs were destroyed during the protest. However, various reports claim that El Salvador’s number of BTC ATMs is more than 250. That of America and Canada only surpasses their ATMs.

Top BTC traders have identified a fractal on the BTC long-term chart. They predict that BTC price could rally to the $300K range before the year ends if this fractal repeats itself. So, Bukele’s BTC buying efforts may well be worth it in the end.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.