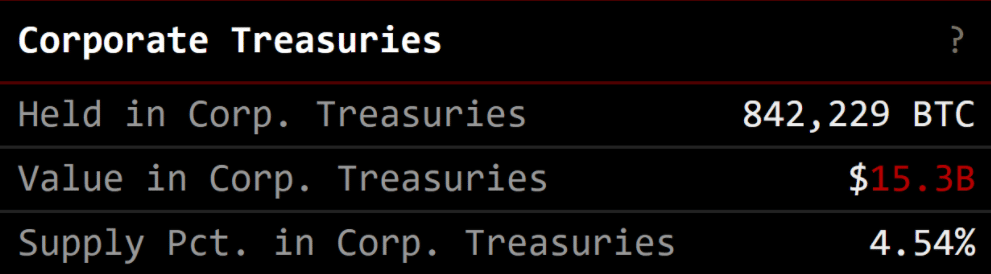

Corporate Treasuries Now Hold 842,229 Bitcoin (BTC)

Institutions and companies from across the whole world seem to have been acquiring more and more Bitcoin over recent times as they now contain 842,229 Bitcoin (BTC) as per the new data shared by Clark Moody. This amount is worth approximately $15.7 billion at the coin’s present price value of $18,700.

As per the data by Clark Moody, around 4.54 percent of today’s circulating supply of Bitcoin (that revolves around 18.5 million) is now held by corporate treasuries.

Source: Clark Moody

Financial institutions’ interest in Bitcoin arose significantly after the famous business intelligence firm MicroStrategy made an investment in Bitcoin and purchased $425 million worth of BTC.

The main reason for which these financial institutions and firms seem to have developed their interest in Bitcoin is that they have started acknowledging the world’s largest cryptocurrency as a better store of value. And this fact has led them to acquire as much Bitcoin as they can. If corporations and institutions continue to acknowledge Bitcoin as a perfect store of value, the leading digital currency will continue to witness a great deal of interest from them.

While talking about the worth of Bitcoin as a store of value, the Chief Executive Officer (CEO) of MicroStrategy Michael Saylor said that the top-ranked digital currency should neither be regarded as a currency nor a payment network rather it is a store of value. As he said in a statement:

“Bitcoin should be neither a currency, nor a payment network. The principles of humility & harmony dictate that we should allow technology partners to provide for payments, & defer to governments on matters of currency. $BTC is a purely engineered Store of Value.”

These companies also believe that apart from serving as a better store of value, the major cryptocurrency can also play a significant role as a hedge asset as well. Some firms especially MicroStrategy have even regarded Bitcoin as their primary treasury reserve asset.

Meanwhile, the dominant digital asset has come pretty close to retest its all-time high value. Bitcoin is currently trading at around $18,700 with a change rate of 3.65 percent in the last 24 hours. Bitcoin is clearly eyeing the $19,000 breakout now.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.