Crypto Market Adds $75B as DeFi Tokens Post Strong Gains

The combined market cap of the cryptocurrency industry is now more than $1.5 trillion again because decentralized finance (DeFi) tokens are posting strong gains. The market cap rose by about 2.5% ($75 billion) between yesterday and now because the crypto market is slowly recovering from recent losses.

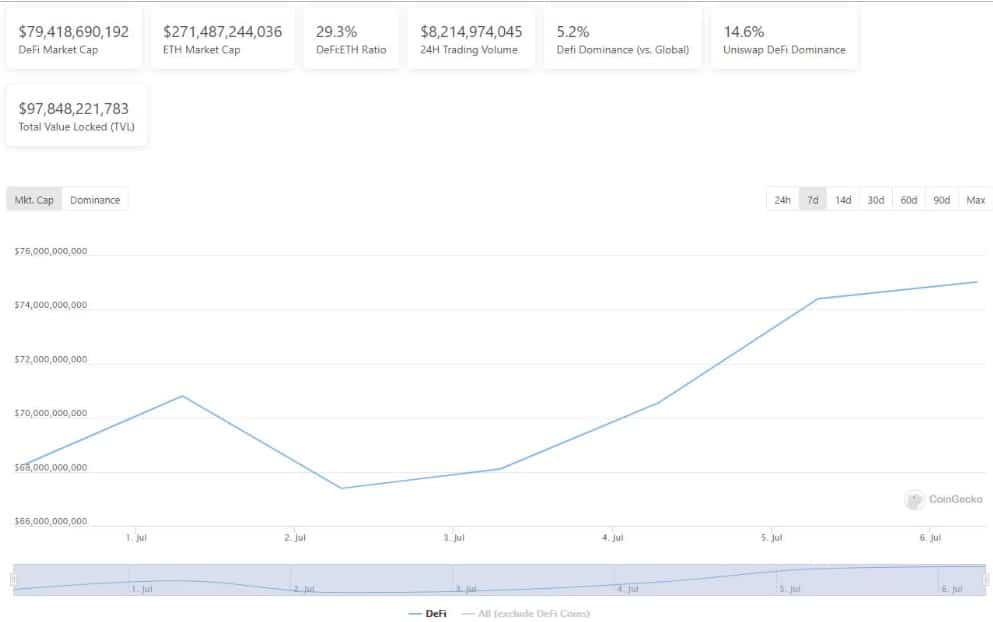

The combined market cap of the top 100 DeFi tokens listed on Coingecko is now about $80 billion, and that’s about 5.4% of the total market cap for the entire industry. However, this figure is now about 7.5% between yesterday and today, indicating that DeFi tokens are leading the market’s recovery right now.

DeFi market cap 7-day performance. Source: Coingecko

A Top-Performing DeFi Asset

The INST token (a newly launched token from InstaDapp) is the leading performer among the DeFi tokens. It has risen by over 63% between yesterday and today to now trade at $5.23. Another DeFi asset that rose significantly within this same period is the ALPHA token from Alpha Finance. It rose by over 55% to now trade at about $0.760.

Rounding up the top three increments during this period is the MLN token from enzyme finance. It rose by almost 40% within the last 24 hours because of two factors. Enzyme finance’s recent collaboration with Yearn Finance and the listing of the MLN token on Binance.

Other top-performing DeFi assets as of this writing (in no particular order) include COMP by Compound Finance, PERP by Perpetual Protocol, LINA by Linear, Aave’s AAVE, and Synthetix’s SNX. Dappradar reports that the total value locked (TVL) from all projects listed on its platform now stands at about $82 billion. However, Defilama reports that the figure is closer to $113 billion because more projects are listed on Defilama than DappRadar.

DappRadar also reports that Aave’s TVL of about $8.8 billion is the highest TVL among all DeFi assets. Uniswap ($8.4 million) and curve finance ($7.4 million) round up the top three DeFi assets with the highest TVL However, BSCProjects reports that the TVL of all projects listed on the Binance Smart Chain is close to $19 billion.

Here, PancakeSwap’s TVL of about $7.8 billion is the highest. All these TVL figures have been rising in the last two weeks, but they are still nowhere near their peaks that occurred mid-May 2021.

New DeFi Index

Meanwhile, Joe Weisenthal from Bloomberg TV posted some screenshots this morning, and there are indications of a newly added DeFi index on the Bloomberg terminal. The MVIS Cryptocompare DeFi 20 is the source of all indexes, including this new one. It usually lists the top 20 assets in the DeFi space according to their performance and market cap.

Other good-performing indexes are DeFipulse’s DPI and Indexcoop’s Metaverse for NFTs. While Metaverse for NFTs was only launched in April 2021 and hasn’t performed excellently, DPI’s price soared by 16% within the past 24 hours. So far this month, DeFi indexes have been performing far better than shit indexes. Historically, this situation has always been a boost for the crypto space.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.