Dapper Labs sued for selling NBA Top Shot Moments NFTs as unregistered securities

A potential lawsuit has alleged Dapper Labs’ failure in allowing customers to earn from their NBA Top Shot moments in good time. Jeeun Friel from Virginia is litigating Dapper Labs (the creator of NBA Top Shots). NBA Top Shot is a blockchain platform for virtual collectibles that users can use to buy, sell and trade video highlights or moments as NFTs. This year sees a rapid rise in the demand for this product.

Hence, the company is seeking new funds despite being valued at almost $8 billion. Friel claims that the NFTs are securities and Dapper Labs puts her and other customers in harm’s way by not disclosing this fact with them or registering these NFTs as securities with the sec. Filed yesterday, Friel is seeking that a New York state court should declare that the company and Roham Gharegozlou, its CEO infringed on securities law and must pay her and other NFT buyers an undisclosed amount in damages.

Virginia Woman Files Case Against Dapper Labs

Top Shots was launched towards the end of last year but rose to prominence early this year when it sold about $3 million worth of the NBA moments in less than 40 minutes. Each moment has a nominally unique value as it is uniquely registered on the company’s blockchain (called a flow). There are other claims that Dapper Labs coaxed NBA Top Shot investors into pumping up the value of the collectibles platform by preventing these investors from withdrawing their funds for several months.

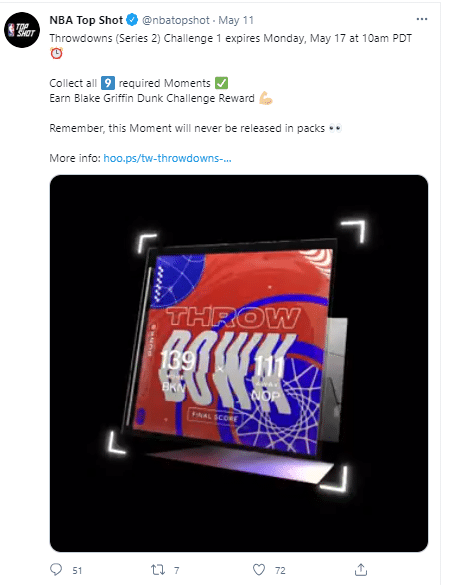

Below is a highlight of a Top Shot sample:

A complaint supporting the lawsuit against Dapper Labs further said, “NBA Top Shot truly sells moments (virtual assets) to customers in the United States and over half a billion dollars’ worth of these assets have been sold. However, the defendants didn’t allow money to leave the platform to hype the company’s market value as it disallowed investors from ‘cashing out’.” Before this lawsuit, no one else has alleged that NFTs must be considered as securities which makes the case a little fuzzy. Even several litigations to resolve the issue of whether digital cryptocurrencies are securities are yet to be resolved. Sadly, it is likely that this Dapper Labs lawsuit won’t be rolled over.

An Expert Crypto Lawyer Weighs in On the Issue

Experienced crypto lawyer, Stephen Palley remarked on Twitter that there are technical reasons why the case would be thrown out. He also opined that it is “idiotic” to suggest that an “investment contract” is any type of security that might experience some value appreciation.

He cited an example of buying himself nice shoes which though is an investment to his feet doesn’t make it a security investment under the law.

However, Palley admitted that Friel and his fellow claimants may have legitimate case provided it is true that Dapper Labs deprived investors of selling their NFTs. But he said that the case would now be filed under consumer protection laws instead of securities law.

When the media reached out to Dapper Labs for a response, the spokesperson replied saying, “it is the company’s standard procedure never to comment on public issues.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.