During COVID-19 Panic Period, Institutional Investors remained more Active than Retail Investors

As the Coronavirus pandemic has deep effects on traditional as well as digital markets, retail and Big players applied different strategies for Bitcoin.

The new research conducted by OKEx Insights and Catallact unveil that institutional investors behaved very differently from retail traders during the panic period of COVID-19.

On-Chain Data of BTC Transactions

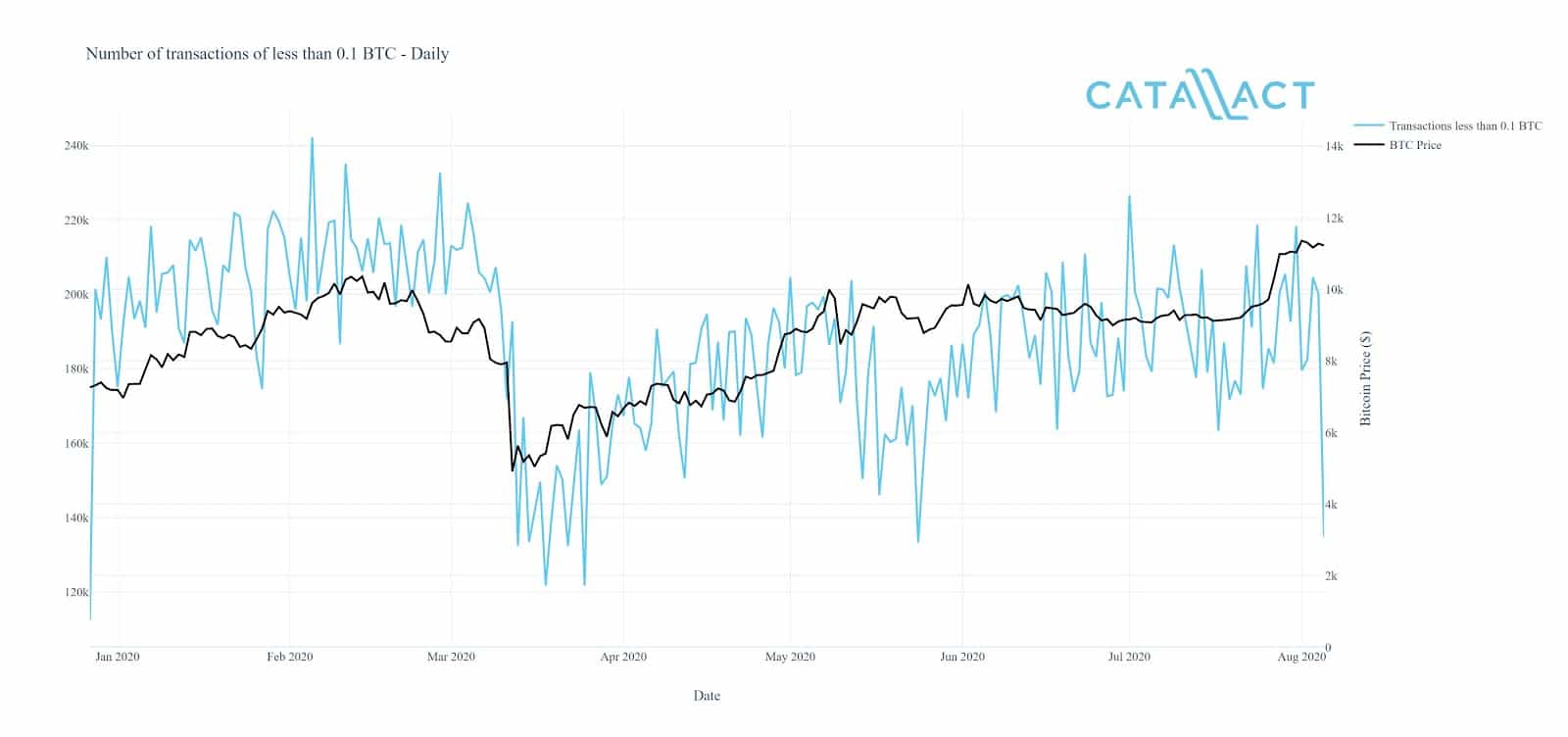

The research powered by Catallact finds out approaches adopted by retail and institutional investors after analyzing on-chain Bitcoin transactions from January to earlier August. Institutional investors adopted the HODLing strategy in anticipation of the price increase in the future. Retail investors, on the other hand, applied a wait and see strategy.

In May, when the price of the leading digital asset touched $10,000, small retail transactions plunged as retail players took a wait and see approach. Per the report, retail transactions “decreased and deviated away from the price’s trend—suggesting that retail investors took a wait-and-see approach as BTC a season-long, post-crash accumulation period” in May.

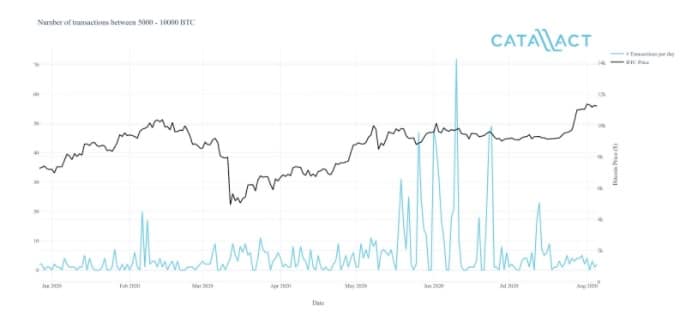

When the price was at $10,000, the transactions between 1,000 and 10,000 BTC started growing and the trend continued till June. According to OKEx’s report:

“This upward trend suggests the possibility that institutions and/or large players got busy accumulating BTC as economic stimulus measures from central banks spurred on the purchase of hard assets. However, because we cannot cleanly differentiate what actual activity took place from the number of transactions alone, this only remains a speculative possibility.”

Transactions comprising of 5,000 BTC also gained a push and it kept growing from mid-May to mid-July. Based on the data, researchers reached the conclusion that transactions of 5,000 BTC would be due to two reasons: Big players began accumulating top digital asset or cryptocurrency exchanges did this for some reasons such as security purpose.

Big players remained the most active over summer as they accumulated BTC in hope of price increase in the future. The report concluded:

“Finally, the largest players in the BTC space became most active during BTC’s price consolidation this summer. The data also highlights the possibility that they accumulated heavily with the expectation that BTC would increase in value in the long term.”

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.