The world’s second-ranked digital asset Ethereum has been trading in the bearish zone but it has the potential to fuel a trillion-dollar finance market.

Ethereum condition was the same in the year 2017 and the price value of the coin lifted up after the ICO bubble came and Ethereum demand increased. As a result, the Ethereum price jumped high to $1400.

Ethereum is still in the two-year bear market. With this bearish performance does it have the ability to fuel the trillion-dollar finance market?

Demand for Ethereum’s money protocol

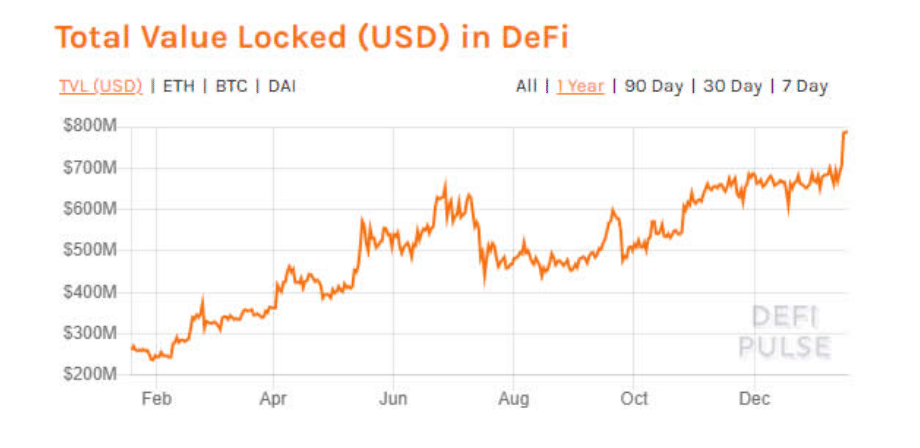

Ethereum’s money protocol still has demand. Defi markets have been growing well since the previous year. In terms of total USD value locked in DeFi, the sector developed by 140% in the year 2019.

This sector can hit a billion-dollar milestone in the first half of this year as it is currently standing at $788 million according to the report of defipulse.com. There is $3.1 billion locked away in terms of Ethereum that is equal to 2.85% of the total supply.

Ryan Sean Adam says in the newsletter known as bankless that Ethereum’s projects such as MakerDAO and Compound provide leverage to the financial infrastructure of Ethereum to develop the global finance paradigm. He talks about the role of Ether and says:

Ether is trustless value supplying economic bandwidth for Ethereum’s permissionless money protocols.

Ethereum’s money protocols are using Ethereum economic bandwidth. Etereum amount will continue to increase despite the fall in the price value of Ether.

DeFi Projects have developed rapidly since the mid 2019

DeFi projects grew rapidly in the year 2019 and have developed very rapidly since then. Along with DeFi projects, lending protocol, decentralized exchanges, and derivatives are too growing well and contribute with almost a third of the total value.

Synthetix is another synthetic asset issuance money protocol that is built on Ethereum. It has added almost $160 million in the total Ethereum value locked in DeFi.

So, demand for Ethereum money protocol shows that Ethereum have the potential to fuel the trillion-dollar finance market.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.