ETH’s Inflows On CEXs Reaches $383M In One Week

This past week saw a surge in deposits to centralized exchanges (CEX) for Ethereum (ETH), its highest in two months. This increased activity suggests that the price of ETH might decline.

According to CoinGecko data, the second-largest cryptocurrency experienced a slight price decline, losing 2.5% of its value over the past seven days.

ETH Sees Highest Inflows in Two Months

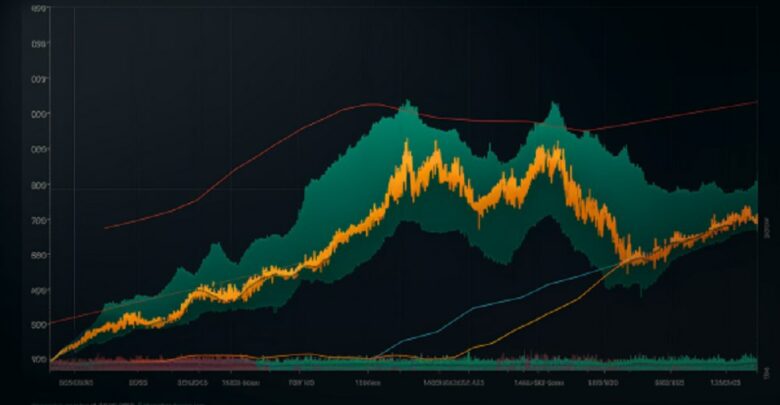

As revealed by IntoTheBlock data, Ethereum experienced an unprecedented surge of inflows into centralized exchanges over the last few months. The crypto analytics platform stated the ETH deposits on crypto exchanges reached new peak levels this past week after ETH transaction volume on CEXs rose to $384 million.

The IntoTheBlock report also revealed the primary origin of a significant portion of the CEX’s ETH inflows. It traced a large transaction volume to a single wallet address which holds nearly 61,220 ETH following the token’s ICO many years ago.

The ETH held in this wallet hadn’t been active for eight years, with the ETH valued at over $116 million at current market prices. However, this address became active earlier this week, with its entire ETH tokens transferred to another address linked to the renowned Kraken exchange.

Additional data from Whale Alert (a popular crypto transaction tracker platform) revealed an intriguing trend of significant Ether token transfers to various accounts. The massive influx of ETH volumes pouring into centralized exchanges suggests potential market selling pressure and a drop in the asset’s price.

While such occurrences have historically been associated with bearish sentiment, it is critical to remember that not every large transfer to an exchange leads to a drop in the price of an asset. It is important to consider the motives behind the whales’ actions.

Nevertheless, experts believe that the whales’ motivations for large-volume transfers can be complex. While some large token holders may be preparing to sell their holdings to maximize their profits, others may adopt an accumulation stance during periods of price corrections.

Staked ETH Hits All-time High

Furthermore, the Ethereum network has recorded a remarkable increase in the total amount of ETH staked on its blockchain. This figure reached about $52.4 billion, according to recent data by IntoTheBlock.

Beyond the substantial monetary value, this milestone is important as it helps boost the security of the Ethereum blockchain. With increased ETH being staked, the network’s resilience against potential centralization threats is significantly improved.

It reduces the possibility of any entity gaining the network’s control, resulting in a more robust and decentralized ecosystem. The increased volume of staking by the Ethereum community reflects their active involvement in the platform’s evolution, governance and security.

Members contribute to the network’s operations and consensus mechanisms by staking their ETH, which is critical in transaction validation and confirmation. Meanwhile, analysts opined that the recent increase in staking activity is a direct consequence of the successful implementation of the network’s Shapella upgrade.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.