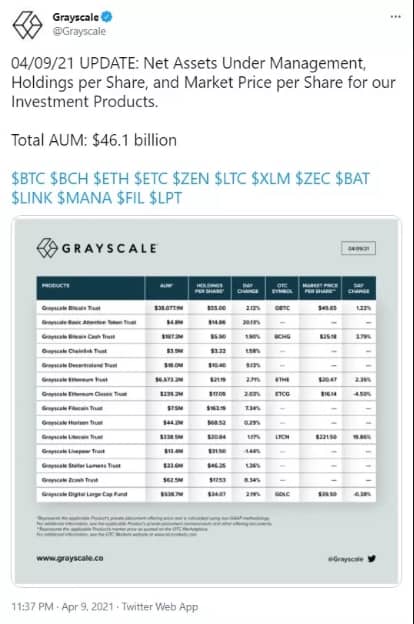

Serial bitcoin buyers, Grayscale have bought another round of BTC and other crypto assets. The company announced via its official Twitter handle that its BTC holdings are now $46.1 bn compared to the $45.1 bn it had the previous day.

Grayscale announcement. Source: Twitter

Grayscale Increases Its Portfolio of Altcoins

It would be recalled that the company recently bought huge amounts of altcoins to increase its digital asset portfolio. Among the most notable ones it bought are LPT, LINK, and BAT. Also, the firm has now created new trusts based on these new altcoins that they’ve bought. Meanwhile, it has increased its stake in ETC, LTC, and XLM.

The most exciting news coming from Grayscale during the week is it intends to become a bitcoin-based exchange-traded fund by making a switch from its current bitcoin-based trust. However, the regulators will have a crucial role to play before this can happen. Grayscale had previously attempted to convert its BTC trust to a bitcoin-based ETF some five years ago, but it withdrew its application due to regulatory bottlenecks.

Grayscale’s 4-Stage Approach to Become A Bitcoin-Based ETF

While Grayscale didn’t provide any timeline to its approach, it provided insight into how it intends to become a bitcoin ETF:

Stage 1. Launch a private equity investment. A fund initiative where only wealthy investors have the opportunity to buy the company’s shares and the issuing party controls these purchases.

Stage 2. Get a second market quote. The shares can be listed 6-12 months after the privately bought shares. If interested, those who bought at the private equity investment can sell their shares when the company goes public. At the moment, GBTC and its products are being traded on the OTCQ exchange. Those products include Grayscale’s composite large-scale fund, bitcoin cash among others.

Stage 3. Initiate the sec-report stage. During this stage, the company will have to adopt an SEC oversight and reporting prerequisites to ensure that there is transparency when it issues the private equity investment offers. A side benefit of this transparency is that the lock-up period before the firm’s shares can be traded publicly will reduce by as much as six months. Right now, ether and Grayscale bitcoin cash are the reporting firms.

Stage 4. Convert funds from the SEC record to virtual asset ETFs. At this stage, Grayscale issues ETF shares in return for the initial private equity investment shares.

Each of these stages requires serious discipline, especially the second stage which won’t happen automatically. While Grayscale claims that its GBTC is arguably the most liquid BTC investment products globally, its trading volume in recent times has been significantly way less than the firm’s current assets under management (AUM). Hence, it might be a struggle for them to list their assets because an important requirement for potential exchanges is to have significant trading volumes. One of the steps Grayscale is adopting to resolve this situation is to authorize its parent company to buy at least $250 million GBTC. Also, no new investors are allowed into GBTC for the main time; thus, no new shares will need to be issued.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.