Grayscale Investments’ holdings of cryptocurrency surged by $1 billion in the last 11 days. The rise in the institutional capital shows in the cryptocurrency markets as Bitcoin jumped to $11,000, the highest position since the start of the year.

In its latest tweet, Grayscale informs that it has $5.1 billion worth of Assets Under Management (AUM). In less than two weeks, the funds of the fund manager increased by $1 billion from $4.1 billion to $5.1 billion.

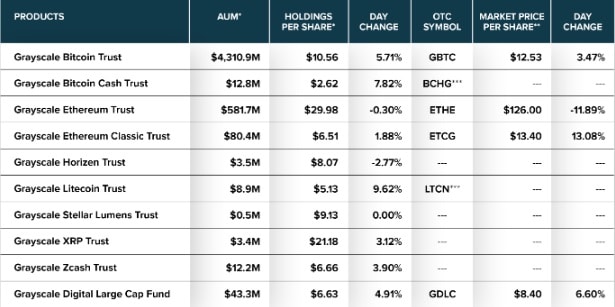

Besides the growth in BTC and Eth Trusts, other cryptocurrencies- including Bitcoin Cash, Ethereum Classic, Horizen, Litecoin, Stellar Lumens, XRP, and Zcash- have also seen a rise in holdings.

$782 Million Funds Added to Bitcoin Trust

Almost $782 million injected into Grayscale’s Bitcoin Trust in the previous eleven days. Similarly, Eth Trust also witnessed an injection of $174 million since July 17.

On June 19, it was reported that Grayscale has purchased 19,879 BTC, but after that, the fund manager has not purchased a single Bitcoin. In the second quarter, the firm has bought more BTC than the current supply of newly mined BTC.

“After Bitcoin’s halving in May, 2Q20 inflows into Grayscale Bitcoin Trust surpassed the number of newly-mined Bitcoin over the same period. With so much inflow to Grayscale Bitcoin Trust relative to newly-mined Bitcoin, there is a significant reduction in supply-side pressure, which may be a positive sign for Bitcoin price appreciation.”

Grayscale is adding more cryptocurrency in AUM. Last time, it has added trusts of Bitcoin Cash (BCH) and Litecoin (LTC) after getting approval from the US Financial Industry Regulatory Authority (FINRA).

According to Grayscale, Trusts “are open-ended trusts sponsored by Grayscale and are intended to enable exposure to the price movement of the Trusts’ underlying assets through a traditional investment vehicle, avoiding the challenges of buying, storing, and safekeeping digital Bitcoin Cash or Litecoin directly.”

The addition of $1 billion in AUM of Grayscale tells us that institutional investors, which are disappointed by the Fed’s response to Coronavirus by printing more money, are turning towards more safe-haven assets.

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.